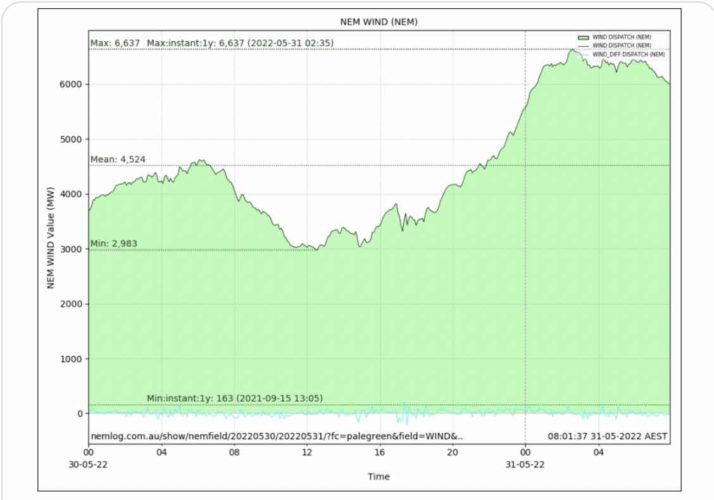

Australia set a new record high for wind energy output early on Tuesday morning, reaching 6,639MW at around 2.30am and bringing temporary relief from the absurdly high electricity prices, at least in the southern states of Victoria, South Australia and Tasmania.

The record output, spotted by Geoff Eldridge from NEMLog, beat the previous record of 6,427MW set in July, 2021, and comes as a big front crosses the continent, delivering windy and cold conditions, and much rain in some regions.

The wind output was mostly concentrated in the southern states, Victoria reaching around 2,400MW and South Australia 1,700MW.

These states enjoyed negative (minus $20/MWh in Victoria) and zero prices (in South Australia) wholesale power at the time and for several hours before and after, before gas and coal fired power stations resumed their pricing control and took prices back up to around $300/MWh, where they have sat for most states for most of the past month.

NSW was also producing a lot of wind at the time, around 1,840MW, and importing another 1,200MW from Victoria, but in these strange times that is not enough to wrest pricing dominance away from the state’s fossil fuel generators, and the wholesale prices stayed around $300/MWh for most of the night.

The fall in prices in the southern states accentuated the growing “north-side” divide identified by AEMO, with consistently high prices in the coal dependent states of Queensland and NSW, and more variability, and lower average prices, in the renewable rich states further south.

Wholesale electricity prices in all states, however, are spending most of their time at around $300/MWh – except during periods of exceptionally high wind or solar output. Many in the industry lament a “broken” and “crazy” market.

This, traders say, is the result of external geopolitical forces (Russia’s invasion of Ukraine), high coal and gas costs, coal plant outages, and the widespread use of series of complicated derivative trades on the market using instruments such as caps and swaps.

The higher prices have already caused the collapse of at least two small energy retailers, with more expected to be under intense pressure. The regulator also approved big bill hikes for homes and businesses in a decision that was deliberately delayed until after the federal election.

AEMO intervened in the market late Monday after the cumulative gas price reached its maximum allowable, and the Queensland regulator approved retail electricity price hikes of up to 10 per cent, and business hikes of up to 17 per cent.

There had been hope in the market that Queensland, unique in the mainland gird in that it owns the networks and most of the main generators, could step into the market as it did in 2017 to order the state’s generation companies to change their bidding patterns.

That directive was effective, resulting in the lowest wholesale prices in Australia. But this time round the situation is different: Queensland is the most captive of all states to coal, it has less than 20 per cent renewable generation share, and it has been hit by the soaring cost of coal and gas, and coal outages.

Traders speak of a broken market. Cap prices had traditionally been set at around $300/MWh, because that was the marginal cost of the most expensive generation, diesel. But that now barely covers the cost of coal, and doesn’t cover the cost of gas, leading to some extraordinary bidding and generating decisions.

We are now seeing a situation where on generator, Snowy Hydro, is running diesel as “baseload”, and others are switching on diesel in South Australia to export to other states.

Of course, the loser is the customer, as it always is. And even the Australian Industry Group, the business lobby that went out of its way to oppose Labor’s carbon price a decade ago and loudly applauded when Tony Abbott killed it, is now complaining that Australia remains hooked on fossil fuels.

Hmmm. Maybe should have thought about that before now.

Others say this is an inevitable, if temporary, consequdnce of the energy transition, as legacy generators try to maximise their profits on their way out of the market.

“The generators have bought less fuel as they are uncertain of their energy output and not spending money on maintenance as their longevity is being reduced,” one trader observed.

“This is all caused by the disruption of renewables, and due to poor regulatory policy, AEMO failure and the government’s inability to smooth the transition.

“The result is they sell less energy and more caps as they need less fuel to defend a cap and don’t need to be as reliable. It all started with the penetration of renewables. You can’t expect to cannibalise an incumbent and not get a response.”