Australian biomass-to-hydrogen venture Verdant Earth has progressed plans to undertake a public listing in the United States, kick-starting a process to raise almost $100 million to fund the recommissioning of a New South Wales power station using biomass.

Verdant Earth has been developing plans to use the now decommissioned Redbank power station, in Warkworth, with the ultimate goal of producing hydrogen, which it says could be certified as renewable through the use of biomass.

In seeking a public listing, Verdant is looking to secure investor support to reactivate the 150MW Redbank power station, located in the NSW Hunter Region, and which has previously been fuelled with coal.

The plant was shuttered in 2014, after just 13 years of operation and after its previous owner was put into administration after accruing substantial debts.

Verdant acquired the inactive power station in 2018, with ambitions of restarting the plant.

Earlier this month, Verdant filed registration documentation ahead of a planned listing on the Nasdaq Capital Market. Through the proposed listing, Verdant hopes to raise around $US70 million ($A97 million) to fund the recommissioning of Redbank.

In a prospectus included with the filing, Verdant said that it could commence early hydrogen production later in 2022, with a goal to ramp up production using the Redbank power station from 2023 onwards.

“Upon the completion of the Redbank Recommission Project, we believe we will be well positioned to take advantage of the market opportunity created by the drive in Australia and neighbouring markets towards net zero emissions,” the prospectus says.

The prospectus details that the company has yet to secure consent from NSW planning authorities to operate the power station using biomass fuels and that it expects to receive a decision on the proposed amendments to the planning approvals by April.

The lack of secured planning approvals represents a significant risk to the project – particularly given already outspoken opposition to the prospect of a biomass-fuelled power station.

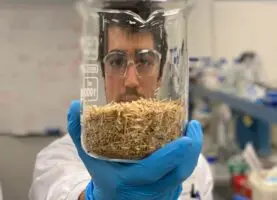

According to the filing, the company will seek to run the Redbank power station using biomass and wood waste supplies – to secure entitlements to Large-scale Generation Certificates under the federal renewable energy target – before using those electricity supplies to produce hydrogen.

The prospectus suggests that electricity generation will serve as the primary revenue stream for the project, with the prospect of hydrogen production being added to the facility at a later date.

The company also expects to generate revenues from ‘tipping fees’ by receiving and processing waste streams of biomass that would otherwise need to be sent to landfill operations.

The prospectus suggests the hydrogen production component of the venture could ultimately produce up to 20,000 tonnes of hydrogen per annum at a marginal cost of $A3.70 per kilogram. The company says that it hopes to sell compressed hydrogen at a price of $A6.50 per kilogram, but may continue to sell electricity into the grid if the option provides better financial returns.

The company adds that it considers the location of the plant, situated near Newcastle, as being advantageous for its ultimate plans to export hydrogen.

“Once completed, our Verdant HV Hydrogen Plant will be strategically positioned with access to both large local markets on the east coast of Australia, as well as to Asian markets via ports,” the company’s prospectus says.

“The planned site for the Verdant HV Hydrogen Plant will be well situated, via major highways, to the Port of Newcastle, Australia’s third largest port by volume, and to Sydney, Australia’s largest city. It will also be adjacent to a major railway with direct access to the east coast rail network and the Port of Newcastle.”

Last year, Verdant indicated that it had signed an offtake agreement with Sweetman Biomass to purchase a supply of biomass from sawmill operations to fuel the power station.

Such projects have been met with some scepticism, particularly from environmental groups wary of the potential biodiversity impacts of bioenergy projects, as well as the potential for output from the project to be labelled ‘renewable hydrogen’.

Local environment groups have also expressed fears that the project could ultimately lead to increased logging of native forests.

Roth Capital Partners is assisting the company in undertaking the public listing on the Nasdaq.