In 2009, when I first interviewed Geoff Evison, the founder of the Arkx clean investment fund, he was at pains to point out the benefits of being ahead of the pack – and the dangers of being too far out in front.

In the last few weeks, Evison and co-founder Tim Buckley have learned the cost of being too far ahead of the times when Westpac’s Ascalon Capital Managers pulled its support for the fund. Its Global Listed Clean Energy Fund is being wound down after 7 years of investing.

Arkx, the first Australian wholesale fund to invest in global clean energy equities, foundered because it was unable to attract enough funds managers to support its product, its founders say.

“Westpac ran out of patience waiting for investors to take action,” Buckley said this week. “At the end of the day, we were unable to convince the Australian superannuation industry that there are real opportunities as well as threats arising from the move to a low carbon future, and that the issues of energy security and climate change are real.”

As it is, if the Coalition has its way, and wins the election tomorrow, Australia is probably not going to make a transition to a low carbon future anytime soon. Certainly, the policy environment in Australia was so poor, uncertain and volatile over the past few years that Arkx didn’t make any investments in its home market.

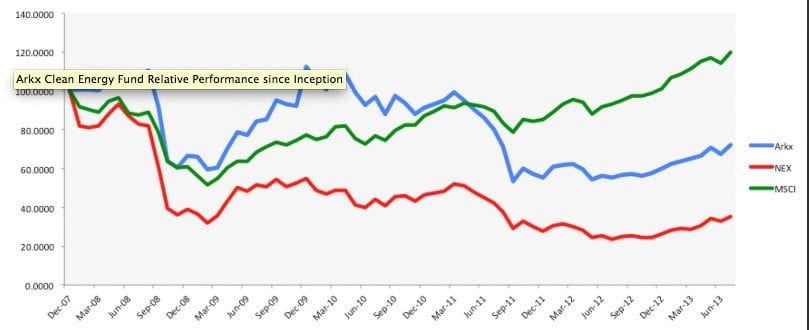

The investments it did make enjoyed a roller-coaster ride. But in its last 12 month period – to the end of July – it showed a 31 per cent return (net of fees, and $A hedged). The more volatile Bloomberg NEX recorded a gain of 51.8 per cent over the same period, while the MSCI World Index delivered a 28.9 per cent gain.

The investments it did make enjoyed a roller-coaster ride. But in its last 12 month period – to the end of July – it showed a 31 per cent return (net of fees, and $A hedged). The more volatile Bloomberg NEX recorded a gain of 51.8 per cent over the same period, while the MSCI World Index delivered a 28.9 per cent gain.

The fund peaked at $11 million, but funds managers will tell you they need around $50 million just to break even once custodian, administration, information and other expenses are taken into account.

The decision by Ascalon to pull support has a certain irony, because it comes just six months after Westpac made a big deal about its commitment to spend $8 blllion to invest in what the Australian banking giant described as “the most pressing issues in society and the environment today.”

Buckley is not critical of Westpac, but he is critical of the “herd mentality” of funds managers. “They don’t want to be the first to act. And Australian fossil fuel companies have a very visible lobby saying it is too early and expensive to act, and politicians buy this despite the obvious self-interest.

“This seems to resonate here because Australia doesn’t have a major energy security problem as yet (despite some of the highest retail electricity prices in the world), and has wedded itself huge investments in coal and natural gas exports.”

This is despite numerous reports that warn of the dangers of stranded assets, a theme that might be common if the Coalition continues with its Direct Action lip service to climate change issues.

He cited Climate Institute’s Carbon Tracker report, and AODP, 350.org, the World Bank and the IGCC, who all talk extensively about the need for action to avoid wasted capital and stranded assets, and prepare for the inevitable change to energy policy globally.

Buckley says that Australian cleantech equities have by and large been decimated by constant rule changes over the last decade. “Overseas there is somewhat more policy certainty, but the change required involves massive capital investment that is significantly harder to come by post the GFC, resulting in significant volatility in the clean energy stocks globally.”

Buckley likens the move to a low carbon energy sector to the trends seen in the telecommunications and internet sectors – lots of initial hype and promise on the back of rapid technology change, followed by disappointment as the time to maturity hits home and the scale of capital investment is realised.

“But investors in any of Microsoft, Apple, Google, FaceBook or eBay would know that the survivors of this sector transformation have gone on to become the leading firms of the world. The same will happen in cleantech, which is why firms like Schneider, Siemens, GE, First Solar, EDPR and ABB have all bet the company on this move to clean energy.”

He says it is heartening to see some super funds are willing to act bravely and “accept their fiduciary duty.” He cites Local Government Super for being the leading super investor in Australia in terms of its numerous moves to protect its members from the risks associated with climate change, taking initiatives in their bond, listed equities and property asset allocations.

“Most other major superfunds are talking about the issues, but yet to act in any meaningful way. Some of the biggest have taken a token stake in an offshore wind farm or two, but beyond this, actions are very limited.

“The underlying excuse is that they don’t want to take technology risk – but we would argue they have huge technology risk in their portfolios by default – they are backing fossil fuel technologies to continue to externalise their cost of doing business. Australia is overweight the stranded assets of the future.” And stranded governments too.