Western Australia-based Frontier Energy had two things to boast about last week – the appointment of former state premier Mark McGowan as chairman of the board, and news that it has been assigned capacity credits that will help pay for its Waroona solar and battery project.

The news is significant for two reasons. Firstly, because it confirms that without the energy industry, former ministers and premier might have nothing to do and nowhere to go after quitting politics.

Secondly, the release on the Waroona project reveals some fascinating insights into the costings and revenues of one of Australia’s first true solar and battery hybrid projects.

The Waroona project, to be located around 120 kms south of Perth, will combine 120 MW (dc) of solar and an 80 MW, 360 MWh DC-coupled battery storage system.

The capacity credits have not yet been locked in – that decision will be made in September – but Frontier has crunched the numbers on what it might mean for the project.

The top line figure is $27 million of revenue a year, for at least five years – paid to ensure a certain amount of capacity is available in the demand peaks – which will be around one third of its anticipated annual revenues. More money will be earned in the merchant market, buying and selling on the grid according to price volatility.

CEO Adam Kiley says the capacity credits alone will cover interest, debt repayments and some operating costs, making it easier and cheaper to finance the project, and leaving it free to tap into the merchant market without having to enter any fixed price power purchase agreement.

“Reserve capacity is unique to WA and a key reason why the economics of our Project stand out significantly compared to other renewable energy opportunities throughout Australia,” he said in a statement.

Frontier expects to receive reserve capacity credits equating to 87 MW for the Waroona project from the 2026/27 year, when it will be complete. (The contracts normally run from October 1 each year).

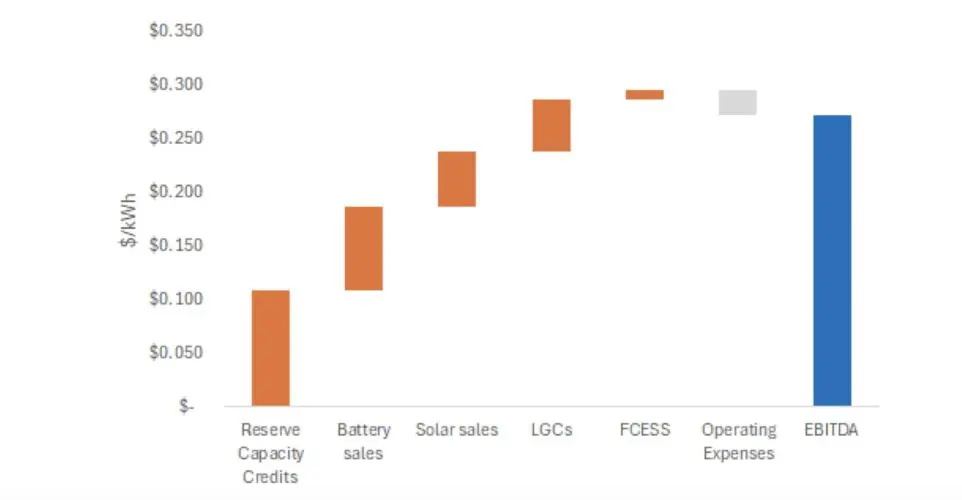

All told, it expects around $67 million in annual revenues, with $24.8 million coming from the reserve capacity credits for the battery, and another $2.4 million for capacity credits for the solar facility.

Another $16.9 million will be earned from arbitrage from the battery, and $8.9 million from solar production, $12.6 million from LGCs, and another $2.4 million from the frequency services market. The average revenue over 5 years would be around $74 million.

In a presentation earlier this year – made on the assumption that it would be assigned the reserve capacity credits – operating costs were put at around $5 million per year, with the project delivering annual EBITDA of around $68 million over the first five years, or 27c/kWh.

Frontier says the revenue forecasts and profitability will deliver a payback period on the investment of 5.8 years, and a post-tax internal rate of return of 14.8 per cent. A higher debt level would deliver an even strong post tax IRR of 21.6 per cent.

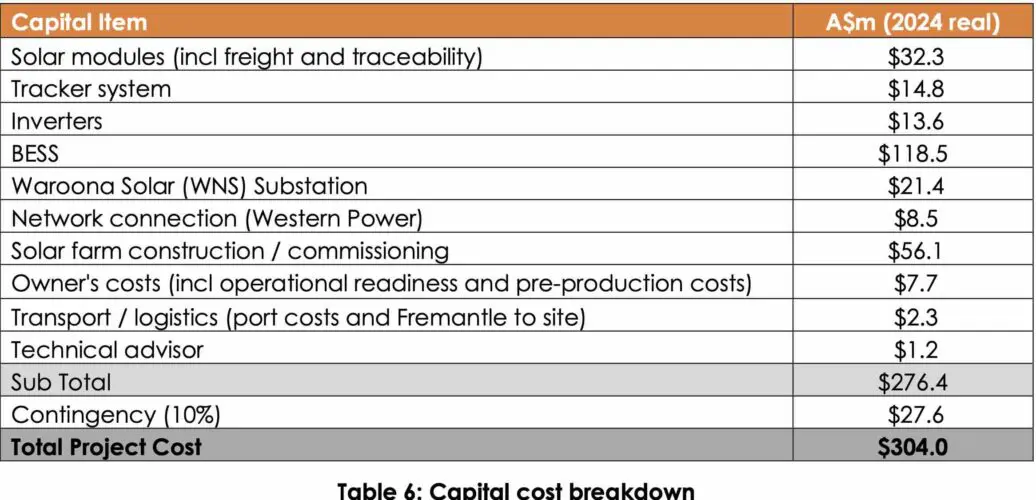

The presentation also included some interesting insights into project costs, the sort of detail that is rarely revealed in the Australian sector, largely because people treat it as commercial in confidence, and because most developers are no longer listed on the stock market.

Frontier says it chose the DC-coupled system because it means no additional inverters, and will have a lower capacity cost and greater efficiency than a traditional AC-coupled system. And it will deliver the strongest financial returns with the lowest risk.

Its statistics on battery degradation are also interesting, noting that an LFP battery will have degradation of around 16 per cent over the initial 10 years and around 26 per cent over the first 20 years of battery life. The batteries carry a 20-year warranty on degradation.

The solar modules will cost just $32.3 million for a 120 MW system, with another $28 million for trackers and inverters. The battery will cost $118.5 million for 360 MWh, while the balance of costs goes too substations, network connections, construction and commissioning, advisors and transport and logistics.

In all, the total is put at around $304 million.

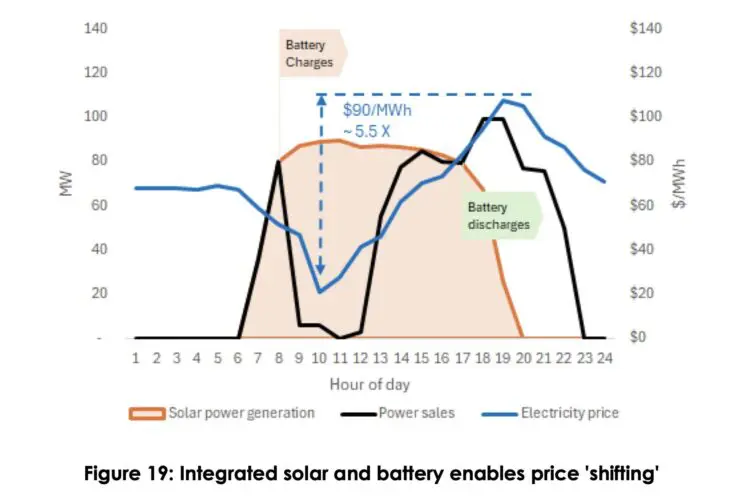

The battery will enable the owner to benefit from high peak prices in the morning and evening by storing the output of the solar farm when prices are usually low in the middle of the day.

“Average typical solar production energy prices have increased 63% in the last two years to $68/MWh in 2023, while peak energy trading interval prices have increased 81% to average around 143/MWh in 2023,” the report says.