The Australian Energy Market Operator (AEMO) released its fourth quarter of 2022 (4Q2022) Quarterly Energy Dynamics report today.

It is a stark and welcome reminder that the green energy transition in Australia is well established and accelerating beyond expectations.

While rampant hyperinflation of all things fossil fuels caused mass disruption in 2022, the underlying trends are clear – and the burgeoning of renewables and decline of coal and gas in the grid ultimately spell permanent price relief.

Notably, fossil fuels sank to their lowest-ever levels across Australia’s east-coast electricity mix in the final three months of 2022. Renewable energy overtook black coal for the first time in the history of the grid, driven by unreliability, unaffordability and unavailability of coal (particularly in Queensland) and lower demand.

Renewable energy generation hit a record high, providing on average 40.4% of the grid’s supply during 4Q2022. This beat the previous record of 35% set in the fourth quarter of 2021. Renewables in the east coast grid peaked at close to 69% on 28 October, exceeding the previous record of 64% set only the previous quarter.

The 4Q2022 also saw the highest wind generation for any quarter on record, with output from wind and grid-scale solar growing strongly as new facilities were connected and commissioned. Across the 3 months, utility wind and solar comprised 20% of total generation, not including rooftop solar.

The quarter was marked by an unprecedented, historic intervention in the electricity market.

In December, the Albanese government passed emergency laws to protect against the ongoing catastrophic market failure underpinning the hyperinflation of fossil fuel costs smashing Australia’s households and businesses alike, introducing a 12-month price cap for CY2023 on local purchases of coal and gas.

This was entirely appropriate, and made some progress toward bringing to heel the international gas cartel raking in unprecedentedly massive war profits from our sovereign public assets as they price gouge everyone else, in many cases paying next to no tax, and destroying the planet in the process.

The markets responded with a ringing, preemptive endorsement.

showing the success of the dramatic government intervention.

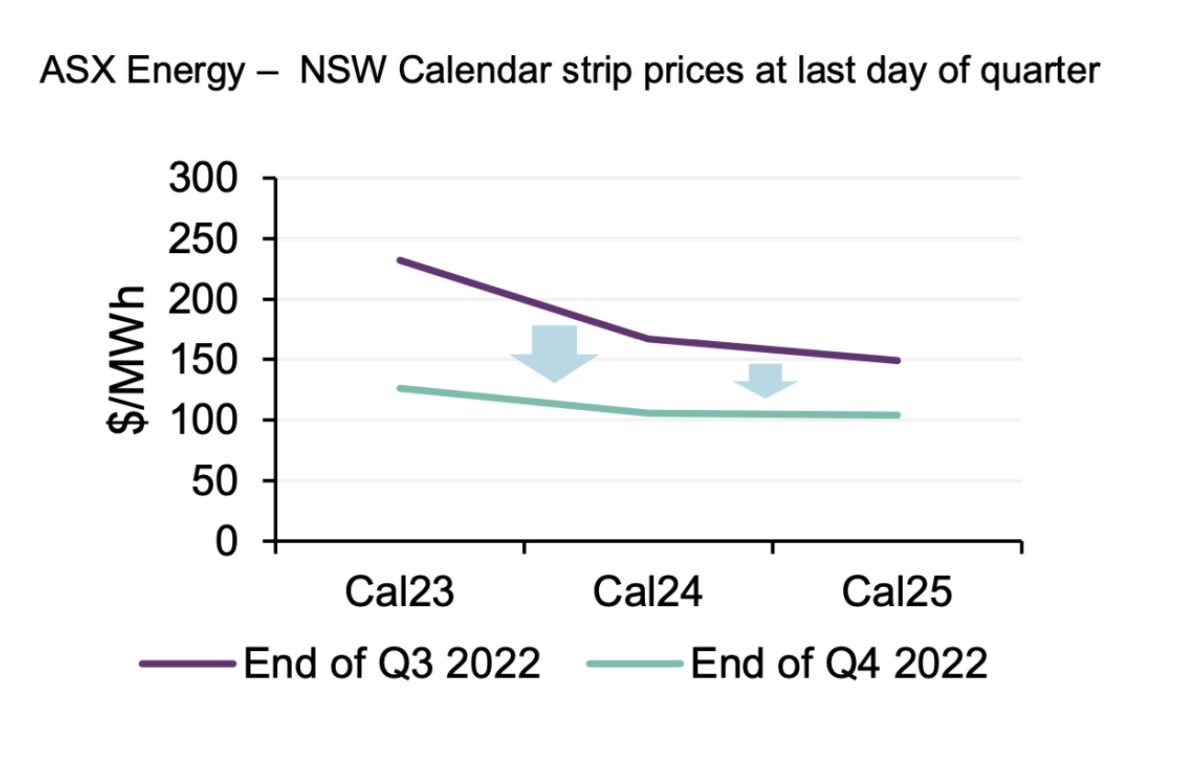

Prices in the electricity futures market eased in mid-October and November in anticipation of the Federal government action, and dropped significantly after confirmation of the details of wholesale domestic gas and coal temporary price caps, more than halving in the final three months of 2022, as renewables set new records (Figure 2).

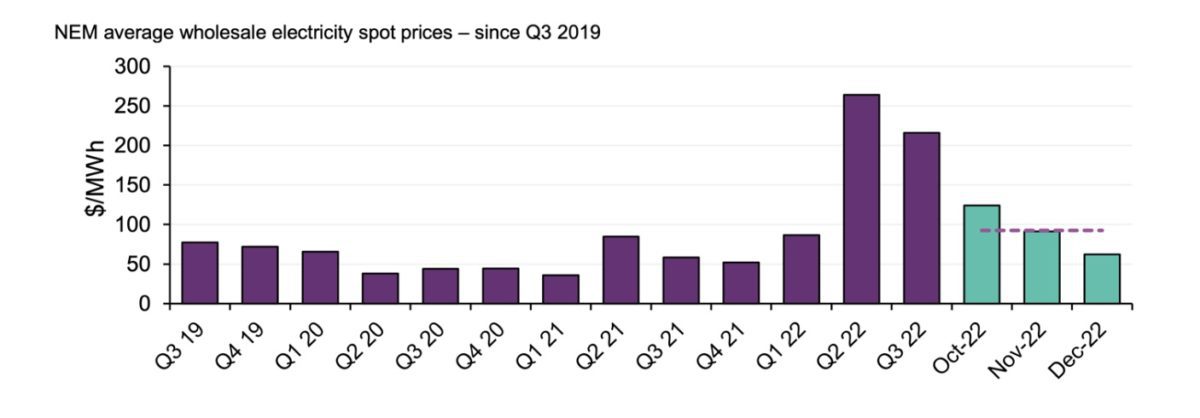

Wholesale spot prices averaged $93 a megawatt hour across all National Energy Market (NEM) regions (the eastern states and South Australia), a price reduction that was helped by record low demand. Demand was down 2% from the previous year, driven by the continued expansion of and record high rooftop solar (Figure 1).

As for gas, east coast wholesale gas prices declined from the record highs seen in June and July, to an average of close to $18 per gigajoule (GJ). However, this remained 70% above the $11 for the final quarter of 2021, and double the average of 2021. Gas demand decreased by 7% in the quarter compared to the same quarter in 2021, driven by a large decrease in Queensland LNG exports.

In Western Australia, the quarter saw the all-time lowest quarterly average coal-fired generation, down 42% from the same quarter last year. Concurrently, renewables reached an all-time record quarterly share of nearly 43%, up 3% y-o-y from 4Q2021.

While South Australia had a major grid interconnect outage, notwithstanding all the fear-mongering by fossil fuel proponents and climate science deniers, the state managed in isolation even as renewable generation peaking at 91.5% on 19 November 2022.

Australians have been held hostage to our historical fossil fuel dependence and failure to regulate to ensure local energy needs are supplied first, before the balance is exported, entrenched by a lost decade of policy chaos under the coalition government.

The events of the last 12 months are a copybook illustration of the need for, and speed of, transition.

Fortunately, it is likely the worst is now behind us: coal and gas are in a long structural terminal decline, renewables are booming and pushing expensive, unreliable, polluting coal and gas out, and market expectations for 2023-2025 wholesale prices have moved decisively down in the last quarter (Figure 3).

While relief will not be instant, this transformation will inevitably flow through to lower energy bills beyond FY2023, meaning massive, permanent energy price deflation over time for Australians.

The end of coal and gas as we electrify everything, and deploy firmed renewables and EVs at unprecedented speed, will consign fossil fuel energy bill shock to the dustbin of history.

An orderly, managed accelerated transition of our energy system and economy is the only solution, and with the Albanese government now working in concert with the states to develop and implement transformative climate and energy policies, we are moving in the right direction, as is evidenced in the AEMO report.