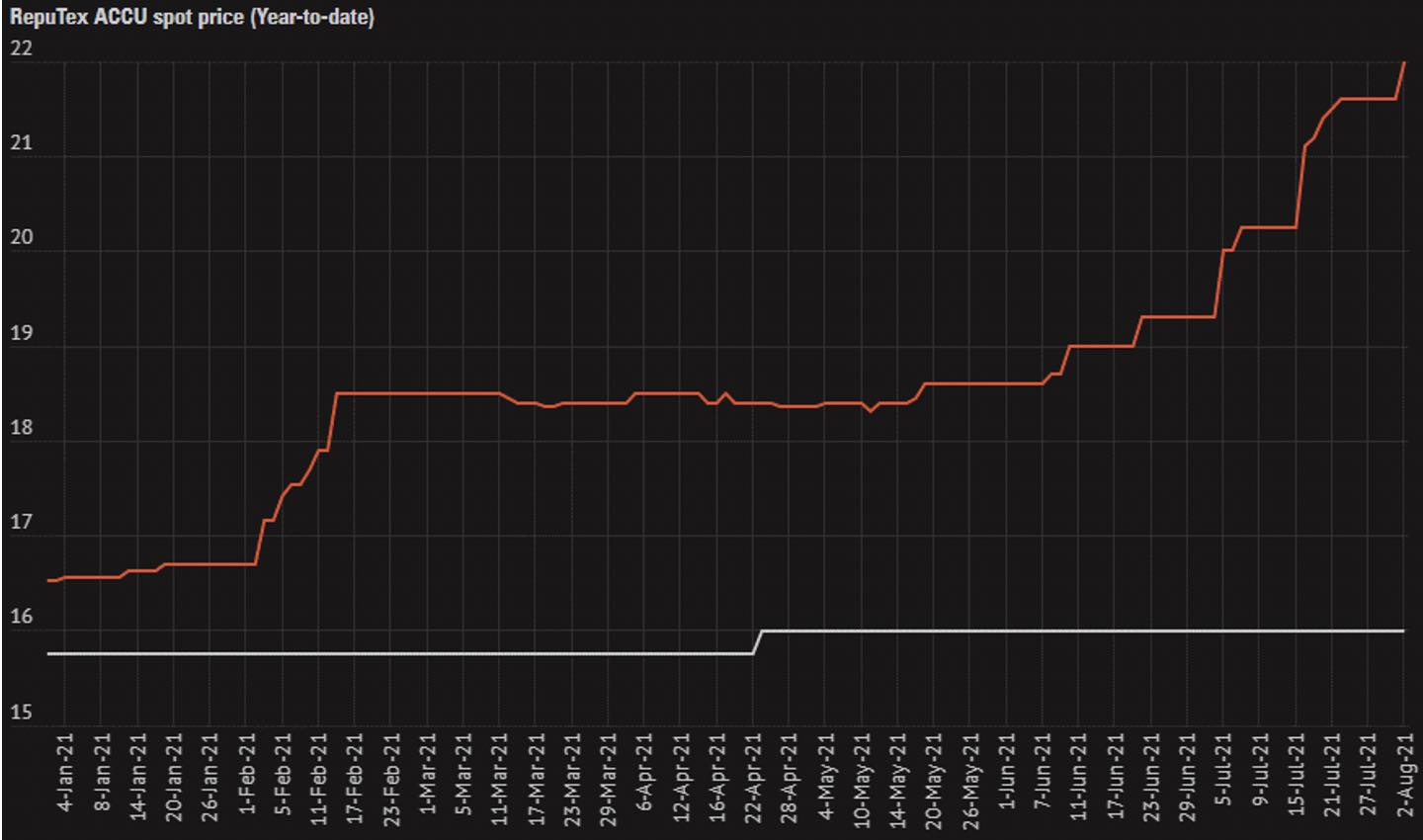

ACCU spot market action

RepuTex’s ACCU spot price assessment grew 4% to $22/t over the fortnight, a new record high, behind increasing corporate and investor activity.

While prices continue to trade at record levels, some short-term heat has come out of the market, with traded volumes slowing over the past week and parcel sizes falling to between 5,000-10,000.

RepuTex’s daily price assessment captures full day transactions for spot market ACCUs, derived from polling of market participants and public information to discover price data over the trading day.

Data is collected from a cross section of the Australian market, with our daily price assessment reflecting the average of all traded values for each day.

As we head toward the end of the calendar year we continue to anticipate increasing compliance demand ahead of the February 28 deadline for covered emitters to surrender ACCUs under the safeguard mechanism.

While compliance buying remains nominal, at less than 5% of the total market, the completion of multi-year baselines is likely to lead to a slight uptick in demand as companies begin to true-up offsets against their multi-year baselines.

To some degree, compliance activity has already begun to impact the market, with higher spot price dynamics incentivising some buyers to fix their compliance costs and protect themselves from rapidly escalating prices by entering into forward contracts.

Three forward transactions were recorded over the period, for delivery of 10,000 ACCUs in Feb-22 at $22.30, and delivery of 10,000 ACCUs in Feb-23 at $23.30 (Jarden).

A put option was also recorded (for delivery of 100,000 ACCUs in Feb-23 at $18/t (TFS Green), providing a floor price to protect against a potential fall in ACCU prices. Six forward transactions have now been recorded since Apr-21, for delivery between Feb-21 and Feb-23 at $18-25/t.

ACCU issuance and project registrations

Zero new projects were registered over the period, with total registrations remaining flat at 998. 838,184 ACCUs were issued to just over 40 projects, a 31% decrease from our last update.

Total ACCU issuance has now grown to 98.2 million (since 31 December 2012), with a record 16.45 million issued in FY21, a 6% increase on FY20.

Just over 1 million ACCUs have been newly issued in FY22. As noted in earlier updates, the majority of this issuance is contracted under Fixed Delivery Contracts to the Emissions Reduction Fund, with under 10 million ACCUs therefore estimated to be currently available to the market, yet loosening toward the end of the calendar year.

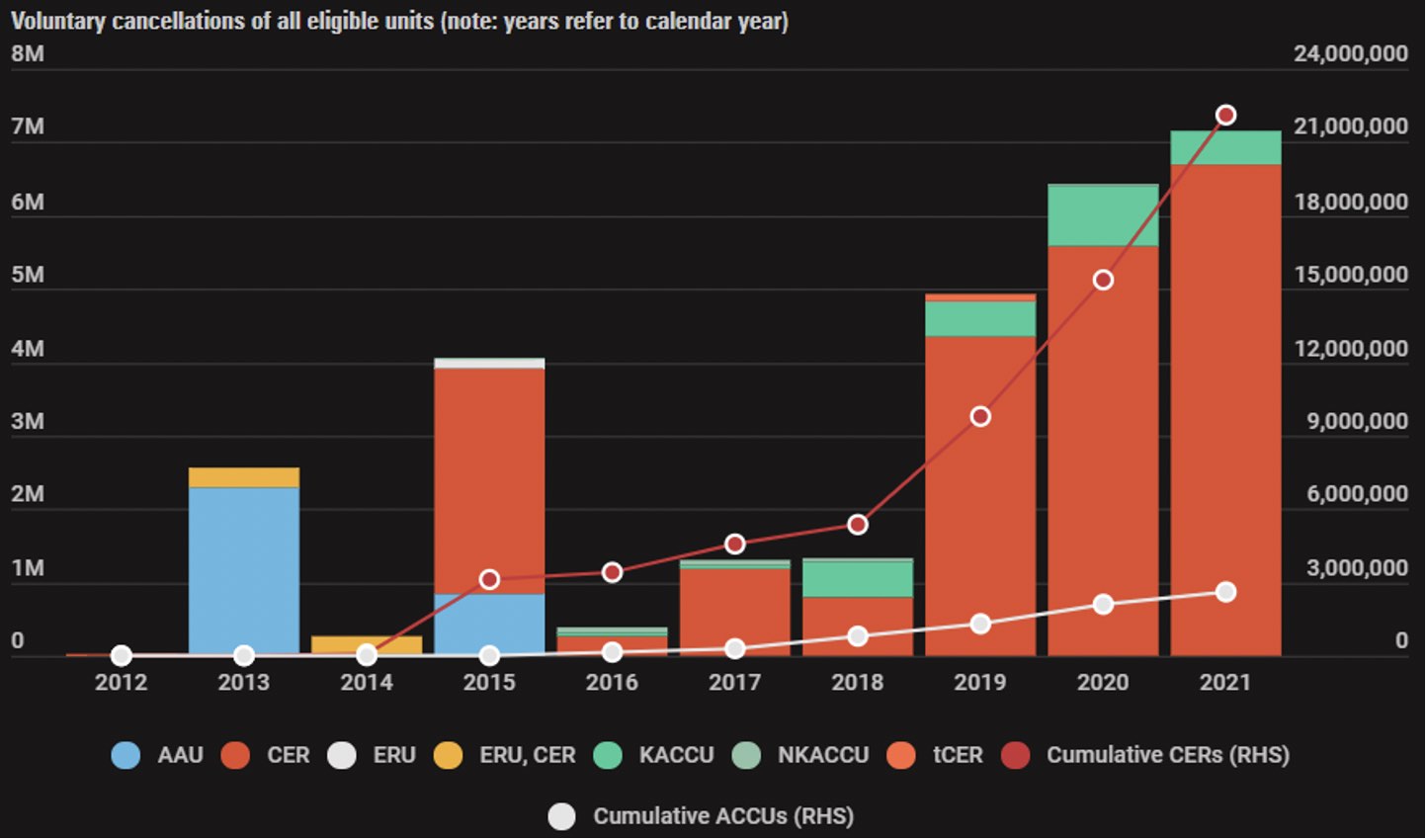

Voluntary cancellations continue to surge

Around 360,000 offsets were voluntarily cancelled over the period, almost double recent fortnightly cancellation rates. In line with recent trends, international Certified Emissions Reductions (CERs) continue to make up the majority of activity, at over 90% of all voluntary cancellations over the period.

Over 7 million offsets have now been cancelled over CY21, already over 10% ahead of (total) CY20 levels, as cancellations continue to occur at a record pace.

Around 95% of all voluntary cancellations are in the form of CERs, reflecting the ongoing trend for voluntary actors to utilise cheaper international CERs (while they can under the Kyoto Protocol) to meet immediate voluntary targets, primarily under the Climate Active carbon neutral scheme.

As noted in our recent research note, uncertainty over the future use of CERs may trigger changes to Australia’s voluntary framework, governed by the Climate Active carbon neutral standard, to ensure that voluntary activity contributes to Australia’s NDC under the Paris Agreement, and/or supports domestic emissions reductions.

Article 6 negotiations at COP26 therefore remain a key watch, with discussions likely to re-define what voluntary offsets that may or may not count towards Australia’s NDC, with more expensive ‘Article 6-approved’ offsets likely to supersede CERs under the Climate Active scheme.