The Australian Competition and Consumer Commission says it will investigate bidding behaviour by generators under last week’s price cap for any breaches of rules that prohibit market misconduct.

The statement was released by the ACCC in a special update of its latest report on the conduct of electricity markets. It was included in a special addendum following the dramatic events of the last week, when the Australian Energy Market Operator imposed a price cap following runaway wholesale market prices.

However, AEMO then had to suspend the entire market – for the first time ever – because of mass withdrawals of capacity and because it became “impossible” to manage and gaurantee supply. Consumers were asked to moderate their energy usage.

The withdrawal sparked allegations that some generators were “gaming the market”, and particularly the two competing compensation schemes that are designed to ensure generators do not operate at a loss.

A warning by the regulator against illegal behaviour was followed by clarification of the price cap compensation regime by another key body, before AEMO decided it needed to suspend the market to ensure the lights stayed on.

“The ACCC notes generators may have been motivated to withdraw capacity due to differences in the compensation regimes under the administered price cap and the AEMO directions process,” the ACCC writes in its report.

“The Australian Energy Regulator has responsibility for enforcing the National Electricity Rules, which set rules around generator behaviour. The ACCC will also be monitoring generator bidding behaviour for potential breaches of the Prohibiting Energy Market Misconduct spot market prohibition.”

Generators and their lobby group have defended their actions, insisting they had little choice but to withdraw capacity given the structure of the market, its bidding system, and fuel shortages. Some note that storage facilities were effectively trapped by the lack of arbitrage opportunities and other factors.

Others though, from the prime minister down, have been concerned that the system may have been gamed. Consumer groups have warned of a “breach of trust”.

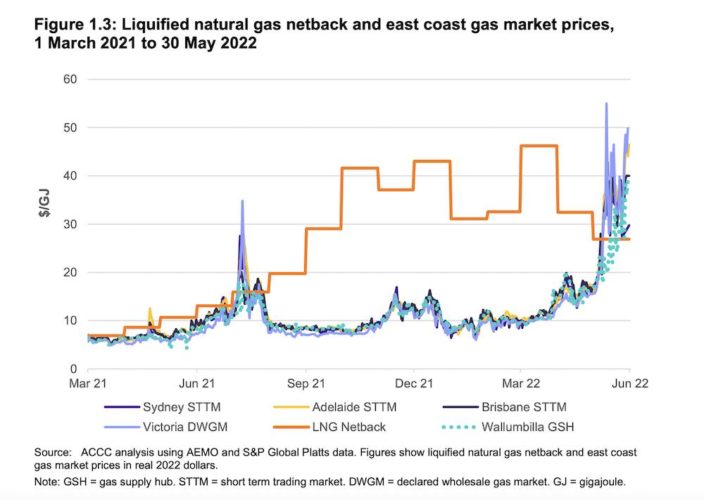

The ACCC notes that the primary cause of the spike in wholesale prices has been the “unprecedented” spike in gas prices. Domestic spot prices had jumped up to five times higher than they were in March and were well above international prices.

“The difference likely reflects a range of domestic conditions including significant cold weather along the east coast of Australia, generator outages, high coal prices influenced by volatile global commodity markets and the impact of renewables in the National Electricity Market,” it says.

It didn’t explain what impact renewables had, although the states with the highest share of renewables have enjoyed lower prices than those almost totally dependent on coal and gas, such as Queensland and NSW.

This so-called “north-side” divide between the coal-dependent states in the north, and the more renewable focused state grids in the south, first emerged at the start of 2021, according to AEMO.

Meanwhile, the Australian Energy Market Commission has reminded generators that did incur costs under the administered price cap – before the market was suspended – that they have until the close of business on Wednesday to notify it and AEMO of their intent to make a claim.