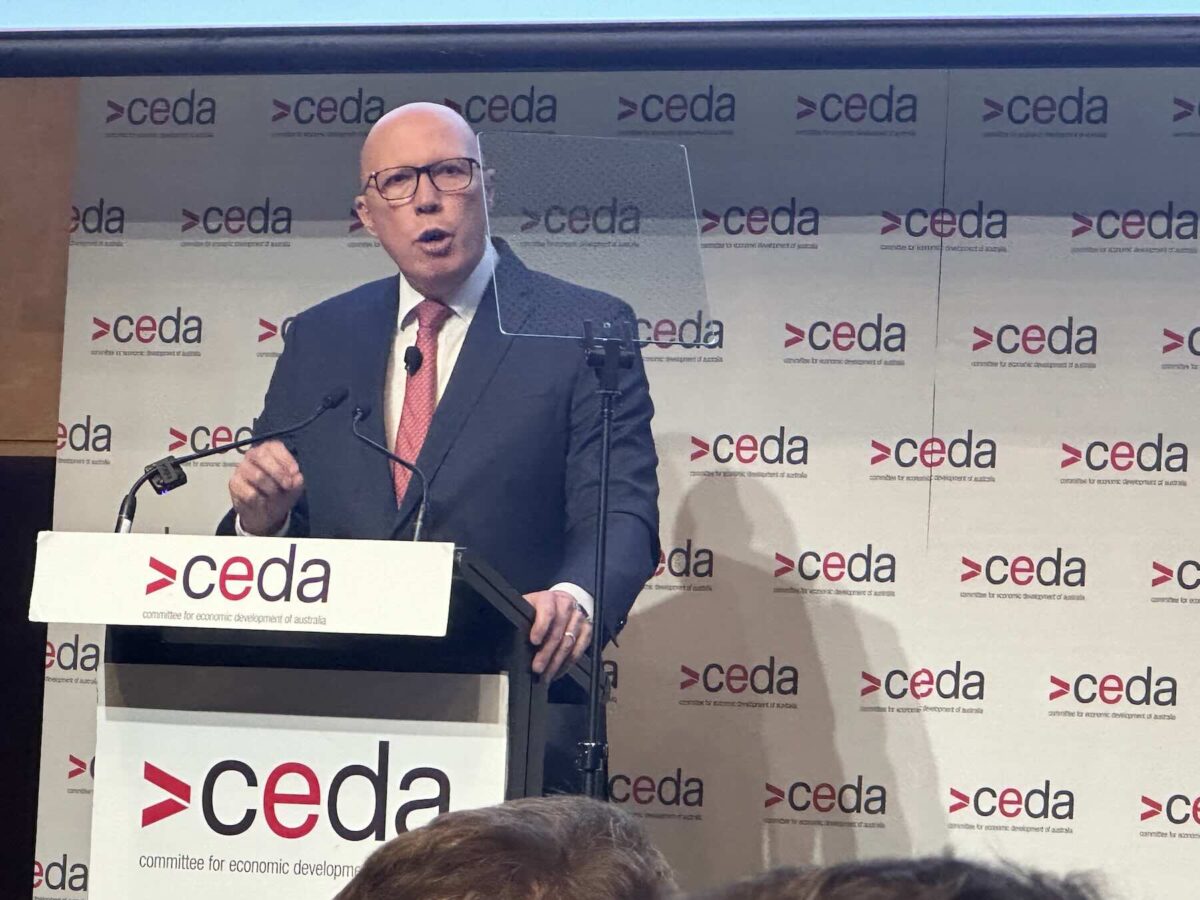

Any day now, we should be provided with an estimate from the Liberal-National Coalition and/or Frontier Economics on what Peter Dutton’s plan for nuclear power will cost us.

Keep in mind we already have plenty of sources of information for what nuclear power costs based on real-world experience.

The chart below, based on analysis by myself and Johanna Bowyer, shows the power price required for nuclear power plants to be commercially viable compared to current wholesale energy costs passed on to residential power consumers.

These power prices are based on the cost of actual power plants which have either been committed to construction or which provided tender construction contract offers over the past 20 years across Europe and North America.

Our research indicates that conventional nuclear power stations cost anywhere between $14.9 to $27.5 million per megawatt to construct. They also accumulate significant finance interest costs over a lengthy construction period ranging between 9 to 18 years.

While yet to be commercialised small modular reactors are promised to achieve shorter build times, they don’t exist, except on the drawing board.

The only one that has progressed to a construction contract in the developed world would have cost $28.9 million per megawatt. These are the range of costs and build times that the Coalition and/or Frontier Economics should be using if they want to be realistic.

This would lead to the uncomfortable conclusion that household power bills would need to rise by around $665 per year for nuclear power plants to recover their costs from the electricity market.

Oddly, Ted O’Brien and Angus Taylor didn’t think real world experience with nuclear projects was a valid basis for assessing the cost of their plan. That, of course, makes one wonder what they might have in mind.

Here are four ways they might instead approach their costing:

1) Apply the shoulda, coulda, woulda approach to costing nuclear power plants also known as a “nth of a kind” costing;

2) Assume all transmission upgrade costs can be avoided with nuclear even though the prior Liberal-National Government approved and supported these transmission projects when in government;

3) Assume coal power plants never grow old;

4) Assume the damage from emissions released prior to 2050 don’t matter

We look at those claims in detail.

1) Look out for ‘NOAK’ or the shoulda, coulda, woulda approach to costing

Advocates for nuclear power aren’t terribly fond of using costs based on real-world experience. Instead they like to apply the shoulda, coulda, woulda approach to power plant costing.

This is where they assume away all the things that almost always go wrong with nuclear power plant construction, and imagine what should, could, or would happen if the real world would just stop being so damn unco-operative.

This typically requires that:

1. Construction companies and component suppliers stop making mistakes and stop seeking to claim contract variations;

2. Members of the community and politicians welcome nuclear projects with open arms and stop seeking to obstruct and delay them;

3. Nuclear plant designers get their designs perfect right from the start, avoiding the need to make adjustments on the fly as construction unfolds;

4. Financiers stop worrying about risk;

5. The community and politicians loosen-up about the small risk of radioactive meltdowns and apply less onerous safety requirements;

6. Construction staff aren’t tempted away to non-nuclear projects with offers of better pay or a more reliable stream of work;

7. Safety regulators work co-operatively and flexibly (compliantly?) with industry; and

8. Power companies en masse commit to ordering lots of reactors from a single supplier well in advance of when needed to enable the supply chain of nuclear equipment suppliers to achieve mass economies of scale and learning.

You generally know that these types of assumptions have been made in a nuclear costing because that costing will be described as a “nth of a kind” or NOAK cost.

The idea here is that incredibly high costs that were incurred in building all the prior nuclear power plants were an anomaly because they involved a whole bunch of mistakes and inefficiencies that the industry will learn from.

So, after they build several more and get progressively better, they’ll eventually reach the “Nth” number of plants, and all the problems that made prior plants so expensive will be ironed out.

At exactly what number plant do we reach N?

Well that’s usually a bit rubbery.

Under pressure from the nuclear lobby, you’ll find this NOAK costing approach is commonly adopted by the International Energy Agency, the US Department of Energy and even Australia’s CSIRO adopted a nuclear NOAK costing for its GenCost publication.

Unfortunately, while these agencies are generally good sources of information, the Nth power plant seems to always be a few more nuclear power plants away from being realised.

In reality the cost of building nuclear reactors has historically got worse rather than better over time in the western world.

The chart below illustrates the construction cost experience for pressurised water reactors in the US (in blue) and France (in red). Note this was based on a 2011 paper and omits the more recent and even worse cost experience detailed in the report by Bowyer and myself.

Bent Flyvberg – a professor in construction management at Oxford University and author of the bestselling book, How Big Things Get Done, has helpfully compiled a huge database of how major construction projects across the globe have performed against their original budgets.

This database reveals just how unreliable are the costings provided by the nuclear industry and its proponents. As the chart below published by Flyvberg reveals, the mean cost overrun of nuclear power projects stands at 120%, with only Olympic Games and Nuclear Waste Storage Facilities managing worse cost over-runs.

Meanwhile look at what types of projects perform well – notice anything?

For the journalists reading this article your task is simple – when the Coalition or Frontier Economics release their nuclear plan costing you need to ask them the following:

Can you please provide us with a written assurance from the CEO of an experienced nuclear technology provider, like Westinghouse, EDF or Korea Hydro and Nuclear Power, confirming they are willing to enter into a fixed price contract to build a nuclear power plant in Australia for the cost and timeframe used in your costing?

If instead they cite to you the experience of the Barakah Plant in the United Arab Emirates let’s say, then you can always ask them:

So, like the United Arab Emirates, will you be:

– allowing the mass importation of construction labour from developing countries;

– removing the right of workers to collectively organise and bargain;

– exempting nuclear construction projects from paying Australian award wages; and

– banning the right to peacefully protest?

2) All transmission expansion costs are the fault of Labor and can be avoided with nuclear power

It should be acknowledged that transmission network expansion projects in this country are also being hit by large budget blow outs which involve multi-billion dollar costs. We need to do a far better and more judicious job in the roll out of transmission projects in this country.

It’s also true that several of these projects are critical to supporting ongoing expansion of wind and solar power. Ted O’Brien and David Littleproud have been highly critical of these new transmission projects and claimed extra transmission costs can be avoided by rolling out nuclear.

Given this, their forthcoming costing will probably suggest all of these new transmission costs can be sheeted home to Labor’s Renewable Energy Policies.

But this would also indicate that O’Brien and Littleproud suffer from amnesia. That’s because the major transmission expansions which are incurring the largest costs were actively pushed by the former Coalition Government which both of them served in.

The prior government “welcomed” and helped underwrite the new 900 kilometre transmission interconnector between SA and NSW.

In the lead up to the 2019 election, they vowed to build a second electricity interconnector between Tasmanian and the mainland.

In January 2020 the Federal Coalition entered into a funding deal with the NSW Government to upgrade transmission lines across north, central and southern NSW.

As part of the 2020 budget, Angus Taylor and a range of National Party MPs announced funding support for an 840km transmission line across inland Queensland which they declared was a “commitment to regional jobs, industry development and affordable reliable power.”

Then, leading into the 2022 election, they announced they would underwrite construction works on a major new transmission line between NSW and Victoria.

Then Energy Minister Angus Taylor’s press release at the time spoke glowingly about the benefits of new transmission, stating:

“Our investment in this project will support reliable electricity supply, deliver substantial cost savings and help keep the lights on for Australian families, businesses and industries.

This builds on the Morrison government’s record of judicious investment of over $800 million in priority transmission projects recommended by AEMO’s Integrated System Plan – projects that stack up for consumers.”

3) Relying on coal power plants that never grow old

It is almost guaranteed that the Coalition’s costing model will assume we can rely on the existing coal power stations to keep powering on for another decade or two with no deterioration in their reliability, before they then switch to nuclear power.

This is a very handy assumption to make because it allows you to avoid or delay significant costs involved in building the new, replacement power stations before the nuclear plants miraculously come to the rescue.

Yet while it might be a handy modelling assumption, it probably isn’t a realistic one.

To keep coal power plants reliable, especially when they are several decades old, requires ongoing significant expenditure on maintenance and replacement parts. Plus, even with this expenditure there can reach a point where a plant is so old it will continue to suffer serious reliability problems.

A good example of the risks and limitations of refurbishment is the case of the attempt to refurbish Western Australia’s Muja A and B coal generating units of 240 megawatts.

In 2007 these units, which were approaching 50 years of age, were mothballed. But by 2009 the WA Government announced they would be recommissioned due to a gas shortage that had afflicted the state. At the time the cost was estimated to be $100m.

The cost of refurbishment subsequently blew out to $290 million and in 2012 one of the units suffered an explosion due to corroded piping, injuring a worker.

A subsequent investigation highlighted a range of technical problems with the plant that made refurbishment challenging, but in 2013 the government chose to press on and sink a further $45 million into the project, claiming it would have a lifetime of 15 years and ultimately recover its costs.

However, even after refurbishment was completed it was reported by the West Australian newspaper the generating units were “plagued by operational and reliability problems, generating electricity just 20 per cent of the time. By 2018 the WA Government decided to cut their losses and shut Muja A and B permanently.

AGL’s Liddell Power Station is another case in point. AGL argued that a ten year life extension would cost $900m, and decided it wasn’t worth it. A government taskforce which sought to second guess AGL on the closure noted,

“a Liddell extension meets the maximum power output requirement.

This means it could provide sufficient capacity to maintain current levels of reliability in NSW as long as it is actually available during peak demand conditions. However, the increasing risk of outages as the plant ages gives rise to an increasing possibility those outages would lead to supply shortfalls.

Liddell already has a high outage rate compared with other NSW coal generators…. There is a risk that upgrades to make the plant compliant with safety and other regulation would not alter its upward trajectory of faults and unplanned outages.”

The other issue is that owners of power plants are likely to face considerable difficulty raising finance to undertake such refurbishment.

Delta Electricity, the owner of the Vales Point B coal power station, revealed in a rule change request to the AEMC that it was facing significant difficulty accessing bank finance stating, “A significant number of financial institutions…are no longer providing financing facilities to fossil fuel generators”.

The rule change request asked that Delta be able to provide cash, rather than a bank guarantee to AEMO to meet prudential requirements for trading purposes.

It explained that the bank providing its current guarantee was unwilling to continue with this arrangement because lending to a coal generator was in breach of environmental policies governing its financing practices.

In a search to find another lender Delta found, “during the refinancing process that 13 of the 15 lenders declined due to ESG [Environment, Social and Governance] constraints, which included the Big-4 Australian banks.

“Both of the remaining financial institutions were prepared to offer a bank guarantee facility to provide credit support related only to requirements for mining rehabilitation obligations and renewable Power Purchase Agreements.”

Some conservative politicians might like to pass this off as some short-term, woke fashion that will pass once they reach power. But it won’t pass, because bankers don’t like to lend money to risky commercial ventures.

Some conservative politicians might think global warming is an idea promoted by a mass conspiracy of meteorological science agencies across the globe to impose a socialist, world-wide government. However, most people think that’s a bit far-fetched.

Conservative politicians that think climate change is a hoax aren’t always in power, so bankers recognise there is a significant risk coal generators will be subject to emission control policies that will undermine their commercial viability.

This isn’t a distant risk, because such policies (which often are targeted towards supporting growth of renewable energy) have already been implemented.

4) The damage caused by power plant emissions in the years prior to 2050 don’t matter

Carbon dioxide and a range of other greenhouse gas emissions released by fossil fuel extraction and combustion last many decades once released into the atmosphere. Consequently, the extent of global warming is a function of the accumulated stock of greenhouse gas emissions in the atmosphere built up over time.

It isn’t a function solely of emissions in the single year of 2050. If we manage to achieve net zero emissions in 2050, but have polluted the hell out of the atmosphere in the preceding years then global warming will be very bad indeed.

A tonne of CO2 emitted this year and each of the years preceding 2050 will cause damage to society that is worth something to avoid. Any economist worthy of calling themselves an economist knows that the value of this avoided damage needs to be taken into account in any attempt to properly cost alternative options for our electricity system.

The Australian Energy Regulator provides one such option for valuing this in its paper – Valuing emissions reductions.

It should be noted the AER’s attaches significantly lower value to avoiding emissions than the United States Environmental Protection Agency recommends in the years prior to 2050, and very far below values used by the UK Government.

If the Liberal-National Party’s policy leads to slower emission reductions (even if they ultimately deliver net zero by 2050) this carries a serious penalty for our children and future children.

If it is ignored from their economic analysis, can we come to any other conclusion than the Liberal-National Party think climate change is so unimportant its impacts can be ignored?

Tristan Edis is director of analysis and advisory at Green Energy Markets. Green Energy Markets provides data and analysis on energy and carbon abatement certificate markets to assist clients make informed investment, trading and policy decisions.