The Clean Energy Regulator has announced that the fourth Emissions Reduction Fund (ERF) auction will be held on November 16 and 17.

The Regulator has also announced new auction purchasing rules and the establishment of a consultation process on the proposed purchasing of Australian Carbon Credit Units (ACCUs) outside of the auction process.

Below, we summarise the announcements made by the Regulator and re-state our price and supply expectations for auction four.

Date for ERF auction four announced

The fourth ERF auction will be held on November 16-17, 2016, maintaining the Regulator’s semi-annual auction schedule. New projects must be registered by October 4, 2016. Auction results will be published on Thursday November 24.

Change to ‘variable volume rule’ may lower clearing threshold

New auction guidelines published by the Regulator provide additional flexibility for the Regulator to select the volume of abatement it will accept at each auction. At Auction three, the “variable volume rule” enabled the Regulator to purchase between 50 and 100 per cent of eligible abatement, contracting in line with best value based on price and volume.

New changes to the clearing rule will now see bid(s) that “straddle” the 50 per cent of eligible volume able to be selected at the discretion of the Regulator. This would have the effect of enabling the Regulator to contract less than half of the ACCUs offered in the event that the project straddling 50 per cent of volume offered is not selected.

Depending on the number of ACCUs with bids that straddle 50 per cent of eligible volume, the impact of the rule may vary. For example, if a very large project straddles the 50 per cent volume point, the minimum clearing rule would be set below 50 per cent, potentially leading to less abatement being purchased at a lower clearance price. Conversely, a small project straddling the 50 per cent volume threshold would have little impact on the end result of the auction.

For proponents participating at auction four, this reinforces the importance of understanding project supply volumes prior to bidding, with supply and project size directly influencing the operation of auction clearing rules and the height of the auction price curve – i.e. the highest clearing price and the safe bidding range.

Consultation on off-market purchase of ACCUs outside ERF

In addition to the update to the Auction Guidelines, the Regulator has also released a consultation process (referred to as a market sounding paper) on the proposed purchase of abatement from large projects outside of the auction process.

The Regulator will publish the results of its consultation process after the fourth auction has concluded, meaning the mechanism will not be considered before ERF four, but may become available to contract ERF funds that remain after the fourth auction.

The key mechanics of the direct abatement offer are:

- Only large projects would be eligible to make a direct abatement offer, e.g. projects delivering 250,000 ACCUs per year (on average), or at least 1.25m ACCUs in total.

- It must be demonstrated that participating in an ERF auction is “inhibitive”. The definition of inhibitive remains unclear but may reflect commercial barriers such as the cost of bidding, timing and expediency of bidding or commercial sensitivity.

- The Regulator would set a “benchmark price” against which offers would be assessed based on past auction information. It is unclear if the benchmark price would apply as a form of market price across all direct abatement offers (similar to the ERF) or would be set in line with different project types (i.e. price banding).

- Should the direct abatement offer not be accepted, the participant would be given an additional opportunity to re-offer.

- Should the second price exceed the benchmark price, the offer would be deemed unsuccessful and would be excluded from the ERF for 12 months.

- Details of the contract price would not be made public.

The proposed new rules appear to be a direct response to the lack of industry interest in the ERF process, with potential for the contracting of large volumes of abatement outside the auction process to create more certainty for project developers and simplify the bidding process. In addition, the design of off-market abatement contracts may remove large projects from the ERF auction bid-stack, removing major distortions on the shape of the supply curve, as seen at the third ERF auction.

Notably, the removal of large projects from the ERF may reduce competition within the reverse auction mechanism and lead to an increase in the average price of abatement for ERF auction participants. Without the influence of large projects, moderate sized projects may be able to exert more influence on the shape of the bid stack and extract more favourable contract prices.

Subsequently, the proposed addition of off-market contracting would enable eligible proponents to choose the most favourable pricing source for funding their project, be it via the benchmarking of contract prices to establish likely off-market pricing, or through bidding into the existing reverse auction mechanism, where larger projects are able to exert greater influence on market shape and pricing outcomes.

Price upside may return at fourth auction

There are currently 283 projects eligible to participate in the fourth ERF auction, with 17 new projects registered since the last auction. Notably, a substantial overhang of projects (266) remains in the registry from earlier auctions, with these projects either failing to win, not participating in earlier auction rounds, or having registered shell projects that are unlikely to participate in remaining auctions.

The third ERF auction saw the average price of abatement fall to $10.23, from $12.25, dragged down by Terra Carbon’s ‘mega project’ developed by the Queensland government under its Catchment Conservation Alliance. To this end, the weighted average price was heavily influenced by the bid price of one large project, and is not reflective of the wider value of contracted emissions reductions. Nor does the average contract price reflect the current value of ACCUs – and in this way, should not be mistaken for a market-derived “carbon price”.

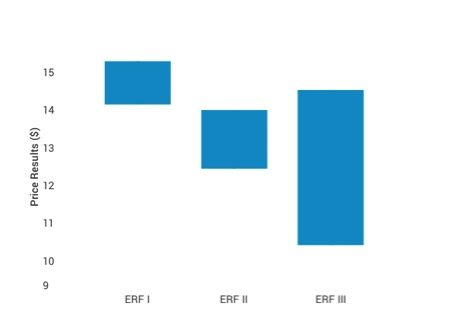

As shown in Figure 1, RepuTex modelling indicates the ‘highest clearing price’ for ACCUs grew to around $14 at the third ERF auction – a 40 per cent premium on the average price of abatement ($10.23) published by the Regulator. This reaffirms that the weighted average price is not representative of broader abatement value being contracted, with informed bidders continuing to extract full value from the ERF in line with supply fundamentals and a more accurate understanding of auction clearing.

As noted in our earlier updates, we continue to anticipate that average ACCU contract prices will push higher at ERF IV, driven by lower participation and reduced competition, particularly should the participation of mega projects recede.

In this context, many marginal projects remaining in the ERF project registry may have an opportunity to exert greater influence on the shape of the bid-stack (free from the influence of mega projects). This may push prices higher, and enable firms to access more favourable contract prices, subject to the operation of the variable clearing threshold.

Bullish pricing sentiment is also likely to be supported by the size of the remaining ERF budget, with the expectation that auction four will be the last full-scale auction event prior to the erosion of current funding for the scheme. With $817 million remaining in the first tranche of ERF funding, we continue to assume that auction four may be the final full round of the ERF, with a smaller run-off auction event in early 2017, or the contracting of ACCUs via off-market purchasing processes.

As we have seen in earlier auctions, contract prices, supply and competition remain unique to each event, with these factors driving the shape of bid-stack (ACCU supply volumes versus bid-price) and the operation of the variable clearing threshold. This reinforces the importance of understanding project supply volumes prior to the bidding process in order to optimise bidding results in line with the dynamics of each auction event.

Our ERF Outlook for auction four will be released following the final registration of projects in October, containing our projected ERF bid-stack, simulations on auction clearing, and detailed price expectations.

In the interim, you can access our ERF auction three statistical review here, or view our ERF auction insights within our Knowledge Centre.