Vertically integrated Chinese solar manufacturer JinkoSolar announced its “third straight quarter of profitability” along with net profitability for 2013 with a Q4 gross margin of 24.7 percent. Even some Chinese module makers are seeing good days return.

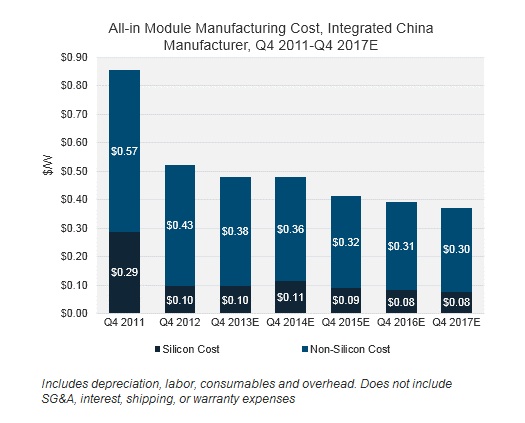

The company had a great quarter with strong margin and geographical diversification — but the more interesting news came from Arturo Herrero, Jinko’s Chief Strategy Officer. During Monday’s earnings call, Herrero noted, “Basically, if you look at our Q2 to Q4, our ASP is around $0.63. Our non-silicon cost is, I think, $0.39, and plus the silicon cost of $0.09, it is around the $0.48 mark.”

Shyam Mehta, Senior Solar Analyst at GTM Research, notes, “I believe this is the first time in human history that a module company has recorded cost under 50 cents per watt — although the cost may go back up a bit in 2014.”

In fact, a forecast from one of Mehta’s recent reports shows top Chinese manufacturers making solar modules for 36 cents per watt by 2017. “There was a reaction from some people that our projection for 36 cents per watt is crazy. To that, I offer the point that our forecast only implies an annualized reduction of 6.3 percent from 50 cents a watt today,” he said. “It’s not exactly a game-changer; it’s 14 cents. But the industry has had a mental block because people didn’t think we could produce modules for less than 50 cents per watt.”

First Solar recently reduced the cost of its cadmium telluride-based PV panels to 63 cents per watt, falling to 53 cents per watt in the fourth quarter of 2013 on its best line (excluding underutilization and upgrades).

The U.S. DOE SunShot Initiative, which has the aim of reducing the all-in cost of solar power to less than $1 per watt, counts on module costs of less than 50 cents per watt.

Prof. Mike McGehee of Stanford University doesn’t hold the view that silicon can achieve these costs. In a lecture yesterday, he suggested that the true cost of silicon solar cells, when stripped of Chinese subsidies, is 85 cents per watt. Brad Mattson, the CEO of Siva Power, claims that the prices put forth by Mehta are “completely unsustainable,” based on his conversations with Chinese solar CEOs. Mattson’s estimates of silicon solar costs are close to those of McGehee. SolarWorld is making the case that Chinese solar module manufacturers receive unfair subsidies and sell product below cost in the U.S.

Here are GTM’s projections for a Jinko-type supplier:

Source: Global PV Competitive Intelligence Tracker

Some other notable items from the Jinko Q4 2013 and year-end 2013 call:

- Jinko expects “a robust 45-gigawatt market this year.”

- China domestic market: “We continue to leverage our leadership role in China, where we have seen good payment terms and better prices as we shipped record high volumes.”

- Jinko suggests that the European PV market in 2013 fell from 17 gigawatts to between 10 gigawatts and 11 gigawatts in 2013.

- In Q4, total solar product shipments were 586 megawatts, a new record, an increase of 13 percent from Q3 and almost double that of Q3 2012.

- Total revenues in the fourth quarter of 2013 were $361.4 million, an increase of 11.5 percent sequentially and an increase of 87.5 percent year-over-year.

- Income in the fourth quarter of 2013 was $43.3 million, compared with loss from operations of $117.8 million in the fourth quarter of 2012.

- Total revenues for the full year 2013 were $1.17 billion, an increase of 47.6 percent from $769.6 million in 2012. Income from operations for the full year 2013 was $106.6 million, compared with a loss from operations of $198 million for the full year 2012.

- “Total long-term borrowings were $59.8 million as of December 31, 2013, compared with $26.8 million as of December 31, 2012. As of December 31, 2013, the company’s working capital cash flow was negative $312.9 million compared with that of $361.6 million as of December 31, 2013. As of the end of the year 2013, the working capital was negative. The major cause is the CD in our non-current liability, as well as the $230 million industrial and downstream project.”

- For the first quarter of 2014, total solar module shipments were expected to be between 440 megawatts and 470 megawatts. For the full year 2014, total solar module shipments are expected to be in a range of 2.3 gigawatts to 2.5 gigawatts.