The growth of big battery projects – fuelled by falling costs and growing needs – is one of the dominant features of the Australian green energy transition, and with each passing quarter their impact on the grid is becoming increasingly obvious.

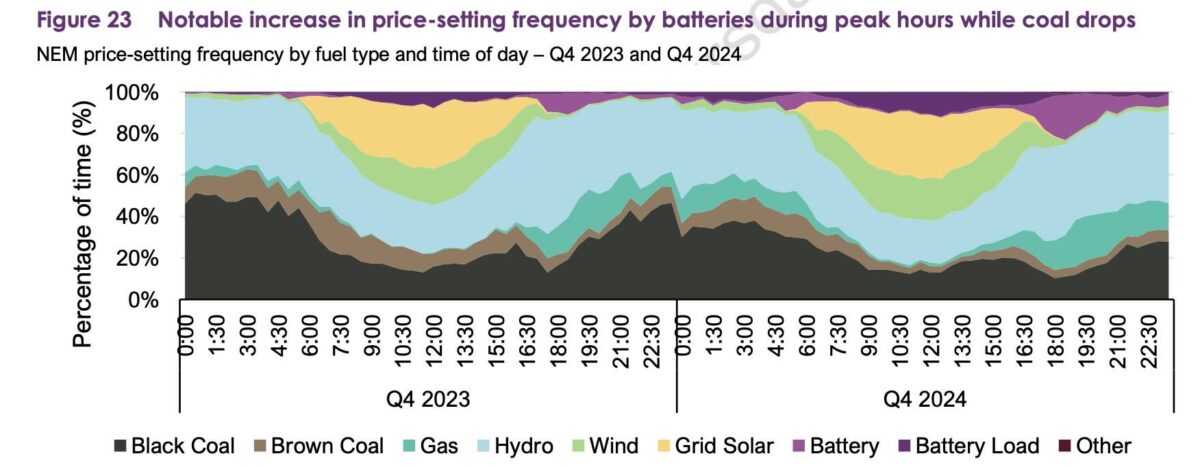

It has now emerged that big batteries have already become the second biggest player in the setting of electricity prices in the evening peaks, a mechanism that ultimately sets the quantum of wholesale prices that are inflicted on electricity customers.

According to the latest quarterly survey from the Australian Energy Market Operator, big batteries have already captured up to 22 per cent of the price setting market in the evening peaks (the 6.30pm) interval, overtaking gas and coal, and trailing only hydro in their influence over evening wholesale prices.

However, unlike the FCAS market where big batteries undercut the gas cartel and helped to lower prices – at least in their initial stage, the big batteries now being deployed are bidding at much higher prices in those peaks than other sources.

According to data from AEMO’s Quarterly Energy Dynamics report for the December quarter, big batteries set the price at an average of $309/MWh, compared to the average $189/MWh from gas, and $111/MWh from hydro.

That high price mostly reflects the fact that battery storage is being bid into the market in the demand peaks, where prices are high.

But it also reflects the fact that more and more battery storage facilities are now owned, or at least operated, by the big players in the market. They have more or less complete control when demand is high, and may be deciding it is easier and cheaper to discharge a battery than to fire up a gas or diesel generator.

And, it should be noted, that bidding into evening peaks is not the only function of a big battery. Most still provide FCAS and some are also contracted to provide various forms of grid and network support, allowing more fossil fuels to be retired and increasing the amount of renewables that can be supported on the grid.

But energy is now the major on-market revenue (which does not include some of those highly lucrative bilateral contracts with AEMO and network operators.

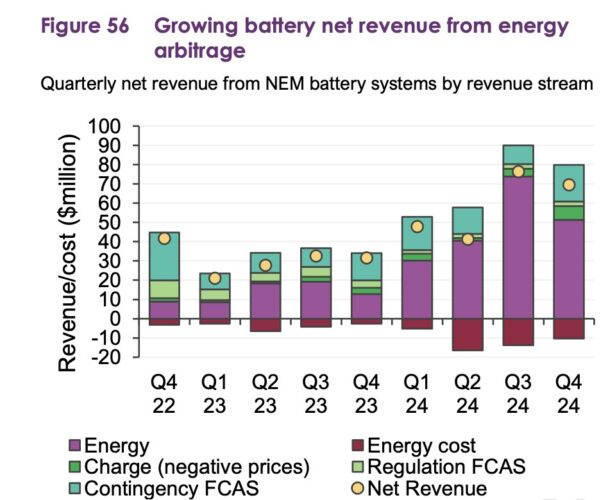

According to the latest QED, estimated net revenue (covering both energy and FCAS markets) for NEM grid-scale batteries reached $69.5 million 9n the December quarter, more than doubling the $31.5 million estimate for the same period in 2023.

Most of this (69 per cent) came from energy market net revenue, which increased by $34.6 million to a total of $48.1 million.

“This growth from energy arbitrage was primarily due to a $38.4 million (+300%) increase in revenue from energy generation (discharging),” the report says.

“Charging during negative price periods also yielded a $3.9 million revenue increase for batteries during the quarter, reaching $7.2 million. Energy cost (charging at prices above $0/MWh) increased $7.7 million (+298%) year-on-year.”

FCAS revenue grew by $3.4 million (or 19%) to total $21.3 million for the quarter.

AEMO notes that NEM-wide average battery availability grew by 44 per cent over the year, from 755 MW at the end of 2023 to 1,087 MW at the end of 2024.

Battery generation averaged 90 MW this quarter, nearly double year ago levels, and the price spread averaged $243/MWh, up from $129/MWh, reflecting growing volatility in the market – and perhaps sending a strong signal for yet more battery projects to be build.

Interestingly, AEMO noted that battery storage was capturing more value (high prices) during the peak pricingevents in the northern regions, i.e. the coal-dependent states of NSW and Queensland.

That’s likely because the inflexibility and unreliability of coal – whose output actually fell in the peak periods, particularly in Queensland – offers more opportunities for the market to bid prices higher, as noted elsewhere in the QED report.

Average prices in NSW and Queensland were more than double that of Victoria and South Australia, which have significantly higher shares of wind and solar generation.

That high priced volatility in the coal states was largely responsible for a big boost in net revenue for pumped hydro projects, which jumped nearly three-fold to $83.3 million in the quarter. Wivenhoe in Queensland was the big winner in that market.

Another point of interest was the big lift in wholesale demand response (WDR), where the dispatch totalled 103 MWh in the fourth quarter, compared to just 1 MWh in the same quarter a year earlier.

Most of this came in the high price events in NSW in November, where 92 MWh were dispatched as prices averaged $3,633/MWh in one period and $2,994/MWh in another.