Australia has experienced its own version of the “solar revolution” in the past two years, when some 2,000MW of rooftop solar PV was added to households – mostly as the result of generous feed-in tariffs and other incentives.

The fact that many of these tariffs have now been removed suggests a cooling-off in the solar market. But the costs of solar PV modules has fallen so far, the industry actually faces another problem – it could soon reach “saturation” point in many key markets.

The overall takeup of solar is estimated to be at nearly 10 per cent of dwellings across Australia, and close to 20 per cent in South Australia. In the owner-occupied housing market, the national average is already running at 20 per cent, and is at more than 35 per cent in many markets.

In one locality, Port Elliott in South Australia, the penetration rate on available owner-occupied housing has reached 90 per cent. According to solar industry forecasters Sunwiz and Solar Business Services, this “saturated” solar market could be repeated in many other localities around Australia.

“Under our High scenario by 2017 rooftop penetration will hit 90 per cent (of detached owner-occupied homes) in some states, with massive consequences,” the authors write in their report.

This will be driven by high rates of return. The authors say the average IRR of a 3kW PV systems are expected to be in the range of 20-35 per cent by 2015, and returns like this are already available at the low-price end of the market.

“Although not like the heady days of 2011 and 2012 (when state governments were offering attractive feed-in tariffs), payback on a 3kW system is expected to be between 2.8 and 5 years in the near future.”

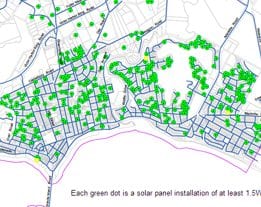

So what does a saturated solar market look like? This graph below gives some idea. It’s not Port Elliott, but an area of nearby locality of Victor Harbour, and the data actually dates back to 2011. But it clearly shows how much solar has been taken up by the residents.

So what does a saturated solar market look like? This graph below gives some idea. It’s not Port Elliott, but an area of nearby locality of Victor Harbour, and the data actually dates back to 2011. But it clearly shows how much solar has been taken up by the residents.

The Sunwiz and Solar Business Services report says these penetration rates are a serious concern, because it will reshape the dynamics of the market, and force the industry to service previously ignored market segments – such as the rental and apartment markets.

The Sunwiz and Solar Business Services report says these penetration rates are a serious concern, because it will reshape the dynamics of the market, and force the industry to service previously ignored market segments – such as the rental and apartment markets. And it could force some solar businesses to relocate.