The federal government could cease being the primary buyer of Australian sourced carbon offsets, content to allow a surge in voluntary corporate pledges to carbon neutrality to do the heavy lifting of cutting Australia’s emissions.

One of the rare emissions reduction policies of the Morrison government is the Emissions Reduction Fund, which formed the core part of the ‘direct action plan’ conceived by the Abbott government after it dumped the economy-wide carbon price established by the Labor government.

The ERF was established to provide a mechanism where the government – and by extension, the Australian taxpayer – buys Australian Carbon Credit Units (ACCUs) created by carbon abatement projects. Instead of polluters paying for emissions, they got paid for abatement.

Now the market is starting to change, thanks to recent concerns that the supply of low cost abatement projects had run dry.

In an effort to revive a stalled market for new carbon abatement projects, the Clean Energy Regulator has begun to offer “optional” delivery contracts through the Emissions Reduction Fund that provide abatement projects with the right, but not the obligation, to sell the carbon credit units to the federal government at an agreed price.

Under this optional scheme protected a project if abatement activities were to fail, or if it were to achieve less emissions reductions than expected. But it also gives them the option to sell the abatement that they do generate at higher prices into the market for voluntary corporate offsets.

The Clean Energy Regulator’s Mark Williamson told RenewEconomy that with this level of flexibility, and the surging demand for voluntary carbon offsets from major corporate emitters, the regulator did not expect any of the optional delivery contracts to be fulfilled while the market price for ACCUs continues to rise.

“We’ve continued to see growth in the voluntary market and strong demand in the secondary market. This indicates the market for ACCUs is maturing, which we anticipate will lead to a shift away from government as the primary source of demand,” Williamson said.

“We are not expecting ACCU delivery under optional delivery contracts as the spot ACCU price increases and the market moves towards industry driving demand.”

Instead, the Clean Energy Regulator sees the role of the Emissions Reduction Fund as evolving to serve as an effective underwriter of new emissions abatement projects, using the optional delivery contracts to provide a guaranteed price floor that gives the certainty needed to get projects off the ground, while providing them with the ability to sell their abatement credits into a more lucrative voluntary market.

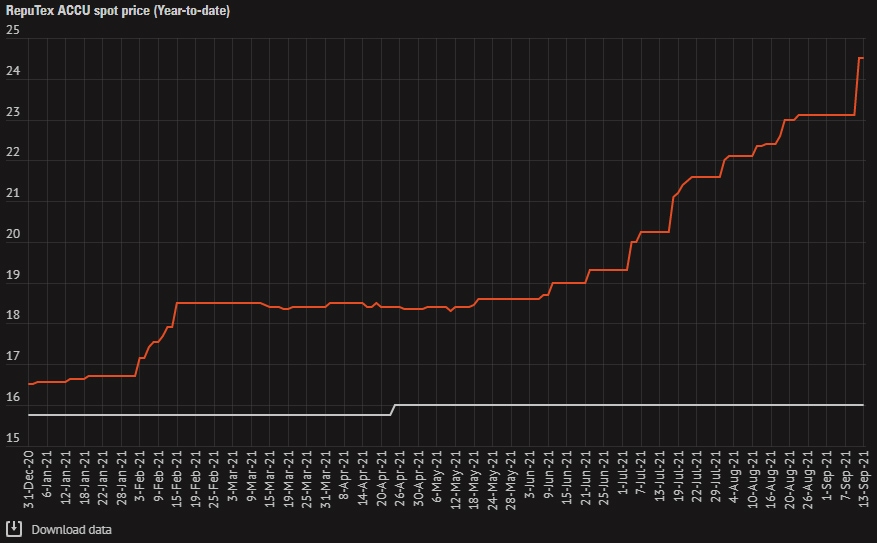

By way of comparison, the last auction undertaken by the Clean Energy Regulator to purchase ACCUs, held in April, offered an average price for optional delivery contracts of $15.97 per tonne.

While this guaranteed price is likely to be sufficient to ensure that an offset project can get underway, it is significantly less than the price available in the voluntary offsets market. As recently reported by Reputex, ACCU prices in the voluntary market have surged to record highs, surpassing $24 per tonne.

While there is such a large price differential, there is no prospect of abatement projects choosing to sell their ACCUs to the government under the optional contracts – they will sell into the voluntary offset market.

There has been a recent flurry of corporate commitments to carbon neutrality, including from major corporate brands that include Telstra, Qantas, AGL Australia, and each of Australia’s “Big-Four” banks.

The Clean Energy Regulator expects that this trend will only gather pace into the future.

“We’re pleased to see increasing market interest in optional delivery contracts, which have been the dominant form of contract since their introduction in March 2020. This demonstrates that industry is beginning to view Commonwealth contracts as a safety net; an important step in underwriting new projects,” Williamson said.

“We’re seeing large increases in voluntary cancellations of both ACCUs and LGCs through the government’s Climate Active carbon neutral program. We expect that to continue and further demand to arise from the new Corporate Emissions Reduction Transparency Report to be piloted later this year.”

“The ACCU market is evolving with new and varied methods likely to increase ACCU supply over the short and medium term. The large increase in new ERF projects being registered over the last year will also drive increasing ACCU supply in future years,” Williams added.

But this raises a challenge for a Morrison government that is relying on the Emissions Reduction Fund to deliver a significant portion of the emissions reductions needed to reach its 2030 emissions target.

In 2019, the Morrison government poured an additional $2 billion into the Emissions Reduction Fund, and it expected the fund to deliver an estimated 100 million tonnes of abatement. This was around one-third of the reductions needed to reach that 2030 target.

It now appears the Morrison government is content to allow voluntary corporate pledges to become the main source of demand for Australian carbon offsets, in much the same way that it is content to allow state and territory governments to do the heavy lifting when it comes to driving new investment in renewable energy projects and decarbonising Australian industry.

It will also allow the Morrison government to redirect some of the $2 billion in funding to its preferred technologies, including further funding new carbon capture and storage projects.