As 2017 comes to an end its worth reflecting on the quite amazing recovery the renewable energy industry has staged since Tony Abbott was in power.

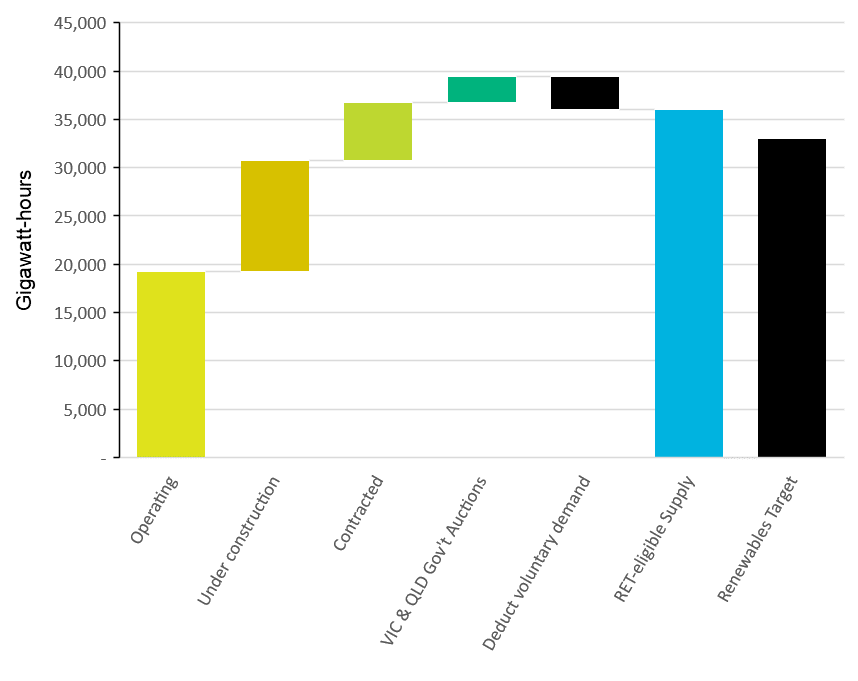

Analysis released in the November edition of Green Energy Market’s Renewable Energy Index shows that we now have enough projects either in construction or contracted to deliver 37,000GWh per annum in 2021. If we then add to this the supply that will come from the Victorian and Queensland Government tenders then we can expect a bit under 40,000GWh is likely to be produced in 2021 (ignoring further supply likely to come from large-scale rooftop solar installations).

If we then deduct voluntary demand, coming from such things as ACT Government’s 100% renewables target and Greenpower, it leaves us with almost 36,000GWh – above the 33,000GWh large scale Renewable Energy Target.

Sources of renewable energy supply are now sufficient to meet the RET plus voluntary demand

A word of caution though is that this is a snapshot in time. We will still be left with very tight supply-demand balance in the Renewable Energy Certificate market over the next few years. Consumers will unfortunately be hit with RET shortfall penalties until at least 2019 and probably 2020. This is due to former Prime Minister Tony Abbott’s success in destroying investor confidence in the renewable energy sector during his time in office which drove a freeze in new renewable energy capacity.

In early 2015 the industry was at a standstill. But in February that year there was a glimmer of hope via an attempt to spill Tony Abbott from the leadership. Even though there was no challenger standing, a large proportion of his backbench colleagues said they’d had enough of his ideological crusades. At that point the price of Renewable Energy Certificates, also called LGCs, that are used by retailers to comply with the Renewable Energy Target began to rise out of the dungeon of despair.

The government had reluctantly conceded it couldn’t completely scrap the Renewable Energy Target. But they still sought to cut the large-scale Renewable Energy Target back from 41,000GWh to 26,000GWh, arguing this was all that could be realistically achieved and that there was apparently a big problem having too much generating capacity (yes they really said that). Eventually in mid-2015 they accepted a compromise with Labor to reduce the target to 33,000GWh. Although on the day it was announced the then Energy Minister Ian Macfarlane (now a lobbyist for coal and gas interests) said he thought the target was unachievable and threatened to cut it back the moment any shortfalls emerged.

In spite of new legislation being passed in June 2015, Macfarlane’s threat, and Abbott’s unguarded admission to radio host Alan Jones that he’d prefer to have scrapped the RET altogether, left power retailers wary of signing long-term power purchase agreements, and financiers reluctant to invest in new projects. Consequently few new projects were announced and prices for certificates steadily rose close to the tax-effective shortfall penalty.

Abbott was replaced by Turnbull in September 2015 but he’d left in his wake a renewable energy industry that was battered and bruised.

In February 2016, Green Energy Markets delivered the bad news in RenewEconomy that we would have insufficient renewable energy produced to avoid shortfall penalties under the Renewable Energy Target over the next few years.

But at the same time we noted that ultimately the very high prices for LGCs would entice investors and retailers out of their bunkers and confidence would return. We also noted that Ministers Greg Hunt and Frydenberg (plus the removal of Macfarlane as Energy Minister) were assisting the situation by making it clear that the RET would not be further watered down and power retailers would be expected to comply with the scheme.

Sure enough by December that year we declared the renewable energy investment drought had broken, and predicted we’d see a flood of project commitments and power purchase contracts announced. But we were still blown away by the scale of what unfolded.

To put this in perspective from the first quarter of 2015 to the third quarter of 2016 a total of 782MW were committed to construction or just 112MW per quarter. With a large chunk of this supported by government initiatives independent of the RET scheme.

Then within just the last quarter of 2016 we saw 965MW committed. Over 2017 so far we’ve committed almost 3,200MW to construction at an average per quarter of 792MW. The chart below, showing annual project commitments stretching back to 2001, illustrates how 2017 completely overshadows anything achieved in the past.

Annual renewable energy project commitments (excluding rooftop solar) since 2001

Projects that are currently in construction are estimated to generate 13,443 job years of construction work, with Queensland leading the country.

Job-years of employment created by renewable energy projects currently under construction

Rooftop solar PV has also kicked it out of the park. As detailed in RenewEconomy earlier this month (Australia breaks record again for rooftop solar installs in November) last November we installed 120 megawatts, which overcame a monthly install record that stood since June 2012, when there was a surge of installations in Queensland to get in before the feed-in tariff expired.

Furthermore STC creation data indicates that December will also be a very big month and we’ll end up with installations over the 2017 year exceeding 1000 megawatts and beating the 2012 record set when government support for solar PV was three times what it is now.

But what is really pleasing about this year in renewable energy is that it provides a powerful demonstration of what is possible for the future. Green Energy Markets has sought to build up a database of all the projects that companies have indicated they wish to develop. This has grown spectacularly this year even after deducting the several thousand megawatts committed to construction or contracted.

Our database currently stands at a tad over 12,000MW of wind farms with 6400MW holding planning approval, and more than 15,000MW of solar farms with 7,700MW granted planning approval. We estimate this pipeline if it were all to be constructed would be capable of generating 72,000GWh of power per annum, although transmission constraints will need to be overcome to achieve this full potential.

These development projects, when combined with AEMO’s estimates of power production from behind the meter solar PV, plus the generation from operating, under construction and contracted projects could deliver half Australia’s expected electricity needs in 2030.

Potential power generation from renewable energy as a share of Australia’s 2030 electricity supply

2017 has been an impressive year for the Renewable Energy industry. But it ends with a major cloud hanging over it – what comes next now we’ve got the Renewable Energy Target sorted?

The National Energy Guarantee could potentially drive the next stage of growth. But as we explained in the article – Here are 4 essential fixes for the National Energy Guarantee – it requires a series of adjustments of which the most important is to align the emissions target with the government’s commitments under the Paris Climate Agreement. Without these reforms we expect that further investment in large scale renewable energy will slow to a snail’s pace outside of that supported by the Victorian and Queensland reverse auctions.

Tristan Edis is Director – Analysis & Advisory with Green Energy Markets. Green Energy Markets assists clients make informed investment, trading and policy decisions in the areas of clean energy and carbon abatement. Follow on Twitter: @TristanEdis