EEnergy Informer

It was bound to happen, and apparently it has: utility-scale solar-generated power, certainly in sunny parts of the world, appears to be cheaper than wind and both are cheaper than fossil-fuel generated power – read the fine print for details of when, where and under what conditions this applies.

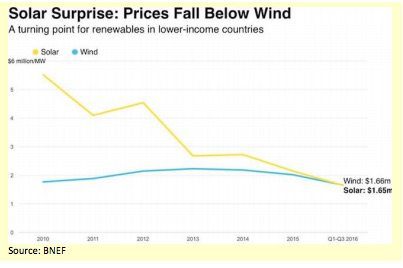

The headline news – long awaited by renewable enthusiasts – is based on a number of recent competitive auctions in sunny deserts of Chile and the Middle East resulting in record-cheap solar prices. According to the latest data from Bloomberg New Energy Finance (BNEF), unsubsidized large-scale solar is beginning to beat not only wind but also coal and natural gas at current prices.

If true, and if the same begins to apply elsewhere, it will be a turning point in global electricity markets making solar-generated power the cheapest form of electricity generation.

The BNEF’s accompanying chart, which shows the average cost of new wind and solar from 58 recently completed projects and/or auctions in places such as China, India, and Brazil suggests that the solar’s steep price drop since 2010 has caught up with wind – which has more or less held steady in the recent past.

“Solar investment has gone from nothing—literally nothing—like five years ago to quite a lot,” said Ethan Zindler, head of BNEF’s US policy analysis, who attributes “a huge part” of this to China, which has not only been rapidly expanding its own solar capacity but actively promoting and/or financing other countries to do the same. As the biggest manufacturer of solar panels in the world, there is a lot at stake in how fast solar capacity is installed beyond China’s own borders.

BNEF reports on several competitive auctions in 2016 where private companies seeking to win massive contracts to provide electricity, have offered record low prices to deliver solar power. It started with a contract in January 2016 to produce electricity for $64/MWh in India followed by much lower prices in August at $29.10/MWh in Chile. That is roughly half what it costs to generate power from a coal-fired plant these days – even with today’s depressed coal prices.

Heralding the new age of solar, BNEF’s colorful chairman Michael Liebreich declared, “Renewables are robustly entering the era of undercutting” fossil fuel prices. He said he was basing his statement on numerous solar projects completed in 2016 with more to follow in 2017.

When the data are tallied for the year, it’s likely that the total solar PV capacity added globally in 2016 will exceed that of wind for the first time. The latest BNEF projections call for 70 GW of newly installed solar compared to 59 GW of wind for 2016. What is stunning about these figures is that both are significant, but solar appears to have overtaken wind.

Two important caveats, of course, apply and should be obvious to the readers of this newsletter:

• First, neither wind nor solar runs dependably around the clock, 24/7, as a coal- or gas-fired or nuclear plant normally does. Hence while the 3 cents/kWh solar price may be half that of a coal or gas plant, it must be backed up in one form or another so it is an apple vs. orange comparison; and

• Second, the low prices mostly apply to developing countries where new capacity is needed and can be added at scale, which results in lower prices.

The BNEF’s Liebreich acknowledges that, “… the overall shift to clean energy can be more expensive in wealthier nations, where electricity demand is flat or falling and new solar must compete with existing billion-dollar coal and gas plants,” adding, “But in countries that are adding new electricity capacity as quickly as possible, renewable energy will beat any other technology in most of the world without subsidies.”

Another turning point, acknowledged by the International Energy Agency (IEA) in its Nov 2016 World Energy Outlook – covered in Jan 2017 issue – is that globally, more renewable capacity is coming on line than coal and natural gas combined. BNEF, and others, are projecting that peak fossil-fuel use for electricity generation may be within reach within a decade, if not sooner.

In a report called Climatescope, BNEF profiles emerging markets for their ability to attract capital for low-carbon energy projects including China (Box on page 4), Chile, Brazil, Uruguay, South Africa, India and others – countries with significant demand growth who are increasingly embracing renewables.

Not surprisingly, BNEF concludes that emerging markets have taken the lead over the 35 member nations of the Organization for Economic Cooperation & Development (OECD) in renewable investment. In 2015, the former invested $154.1 billion compared to $153.7 billion by OECD members, a trends that is likely to gather momentum. The lower costs of renewables and the need for new capacity additions makes renewables a good fit for rapidly growing economies. Climate concerns and the Paris Agreement to cut down emissions is mere icing on the cake.

China goes for the sun

China’s latest 5-year energy development plan calls for more than $363 billion to develop additional renewable resources through 2020 In a press conference in early Jan 2017 describing the country’s future energy vision, Yang Li Zhe, deputy director of China’s National Energy Board said the goal is to displace fossil fuels and transition to clean, lowcarbon resources including hydro, wind, solar, biomass, and geothermal energy. According to the plan, China is expected to boost renewable capacity fivefold while slowing the growth of coal-fired generation – a radical departure from historical patterns. Even with this major reversal, however, China is still expected to get as much as 63% of its power from coal by 2020.

BNEF, like the IEA, says coal and natural gas will continue to play a key role for some time to come, but if the trends of the past few years continue, their ultimate role will – eventually – diminish to that of providing backup to renewable generation. And that is certainly good news if one is concerned about the climate.

Fereidoon Sioshansi is president of Menlo Energy Economics, a consultancy based in San Francisco, CA and editor/publisher of EEnergy Informer, a monthly newsletter with international circulation. He can be reached at [email protected]