The cost of solar PV has hit a stunning new low – with a bid for a 300MW solar project in Saudi Arabia pitched at just $US1.79c/kWh – or $US17.9/MWh ($A22.7/MWh) – with no subsidies.

The stunning offer – coming in the oil kingdom’s first major tender for solar power – represents a significant fall of 75 per cent in costs below those considered “not credible” less than two years ago.

And it comes from two major players in the energy industry. The consortium behind the offer is made up of EdF, the mostly French government owned nuclear giant that is currently building the world’s most expensive nuclear plant in the UK, and the Abu Dhabi-based Masdar.

News of the bid came as the technology conservative International Energy Agency declared that we are entering “a new era of solar”, and predicted that renewable energy by 2022 would top 1000GW around the world – built in a fraction of the time it took to construct the same amount of coal power.

Yet it also came as a new report from Australia’s Climate Council lamented the political roadblocks that sees Australia’s government ignore the advice of the CSIRO, the Finkel Review and the Australian Energy Market Operator that could pave the way for a much high renewable energy share.

The Saudi bid, however, is the big news. The tender is the start of a $US50 billion program to substitute clean energy – mostly solar – for fossil fuels in its domestic energy supply. Mostly it burns oil, but it has figured out it is far cheaper to use solar and other renewables and then sell the oil overseas.

The bidding result was announced in a web-cast ceremony held in the Saudi capital of Riyadh. Six of the seven lowest bidders offered prices below $US30/MWh. It compares with the previous low of $US25.40 for a solar plant in Dubai.

In early 2016, a sub-$60/MWh solar offer – also in Dubai – was deemed “unachievable” by disbelieving energy experts and competitors, yet prices have continued to plunge ever since.

There is some skepticism about the bid, in the same way that a recent contract signed by SolarReserve for a 150MW solar tower plant in Port Augusta signalled a price of $75/MWh, when in fact the actual “cost” would be higher.

“There is great pressure in the Middle East to come up with an impressive headline number, and these are becoming increasingly divorced from the reality of payments,” said Jenny Chase, chief solar analyst for BNEF in Zurich.

Still, solar is being seen as the major new force in global energy markets, even by those who had previously dismissed it as a sideshow, and not part of the main game..

The IEA on Thursday predicted a “new era in solar PV”, based on its latest update that increases its usually conservative forecasts for the deployment of solar PV by 12 per cent – even though some people still think it is undershooting on its forecasts.

The IEA – created in the 1970s to protect access to oil and gas markets – has often been criticised for underestimating the uptake of both wind and solar, and for grossly over-estimating the contribution of coal and gas. And this report is no exception.

But the IEA still recognises that solar PV capacity grew 50 per cent in 2016, and by 2022 the combination of wind and solar will contribute half as much capacity as coal, built in just a fraction of the time.

“What we are witnessing is the birth of a new era in solar PV,” said IEA executive director Fatih Birol, noting that China was underpinning the huge growth and plunging cost in solar.

“Along with new policies that spur competition in several other countries, this Chinese dynamic has led to record-low announced prices of solar PV and onshore wind, which are now comparable or even lower than new-built fossil fuel alternatives,” Birol noted.

“This is radically changing the narrative in other emerging economies, which are now looking at renewables as attractive options to sustain their development.”

But in Australia, these facts are ignored, as are reports by key institutions that suggest that high levels of renewables are both achievable and affordable.

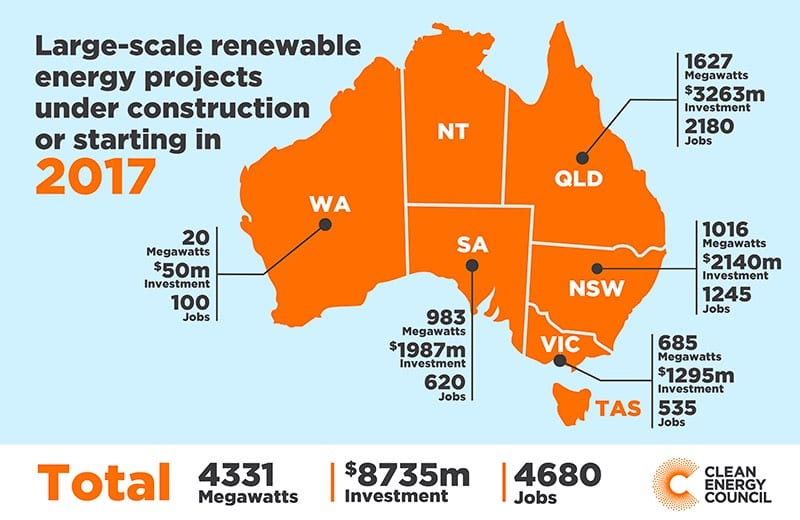

Figures released by the Clean Energy Council on Thursday suggest Australia is undergoing a renewable energy investment boom – after three years of drought – because of the renewable energy target is finally starting to bit.

The CEC says 41 renewable energy projects have now been committed in 2017, creating an unprecedented wave of investment worth over $8 billion, and creating approximately 4680 new direct jobs and massive economic benefits for local businesses across the country.

“These 41 projects will deliver over 4330MW of new capacity, which is crucial to increasing supply in the energy market, replacing old coal-fired generation that continues to close and ensuring downward pressure on power prices,” CEC boss Kane Thornton said.

Half of these projects, by capacity, are solar, with its costs falling to match wind in some areas and challenge it in others.

“It is incredible to see the shift in conversation and action around and in the industry,” Thornton said, noting also the strong uptake of rooftop solar, with another $2 billion invested by homes and business in another 1000MW in 2017.

Thornton praised the individual state-based renewable energy targets, but warned that the momentum may be lost with a long-term national policy, such as a Clean Energy target.

A Climate Council analysis said the only hurdle towards a grid with a high penetration of renewables was politics, as the independent advice from the CSIRO, AMO and the Finkel Review made it clear there was no technology obstacles.

“There’s no disputing it – fossil fuel technology is obsolete, expensive and unreliable. In fact, Within 10 years, over two thirds of our coal plants will be over 50 years old. It’s time to look to the future with an energy system fit for the 21st Century,” the Climate Council’s senior energy expert Andrew Stock said.

He said Stock the only thing holding Australia’s energy grid back is the ongoing climate and energy policy deadlock: it was clear that renewables were the cheapest form of new generation, and other technologies could deliver the dispatchable power needed.

“You wouldn’t try and salvage a broken down, 50-year-old clunker of a car – so why is our government attempting to do the same with old coal-fired power stations?

According to PVMagazine, the second lowest bid was proposed by Saudi power group ACWA, which offered a LCOE $US22.36/MWh, while a $US26.6/MWh offer from Japanese conglomerate Marubeni also beat the previous world low.

Other bidders to offer contracts below $US30/MWh included French energy group Engie, the owner of the now closed Hazelwood generator in Victoria, Japanese engineering company JGC Corporation, Japan-based industrial conglomerate Mitsui, and French oil group and SunPower’s largest shareholder Total.