Next week, the Australian Energy Market Commission – the national rule maker – is expected to deliver its initial verdict on a call to change the settlement period for Australia’s wholesale electricity market, a move its supporters say will lead to a significant reduction in prices.

It’s a decision that could precipitate a major swing point in the evolution of Australia’s energy markets. If the settlement period is changed from 30 minutes to 5 minutes, to align with dispatch, supporters say, it will prove a big incentive to install fast response technologies such as battery storage and demand response.

Opponents, on the other hand, say it will cause significant disruption, because the loss in revenue will cause peaking gas plants to close, leaving the security of the grid exposed. In effect, they agree that the rule change will reduce costs, but insist the impact (on their assets), will outweigh the benefits.

It is, in many ways, the biggest test of the regulatory oversight of the National Electricity Market in years.

Fossil fuel generators have fought vigorously against any sort of initiative that would impact their revenues – carbon price proposals, energy efficiency policies, renewable energy targets, demand response mechanisms and the introduction of rules such as the 5-minute settlement.

All have been resisted on the basis that the costs (to them) outweigh the benefits (to everyone else). And their ultimate fall-back? If you do this or that, then the lights might go out.

It is now clear that policy-makers can no longer allow themselves to be blackmailed in such a way – the current state of the electricity market, with its soaring prices, and the old, clunky and unreliable state of much of its generation – puts their own political future and the country’s economic future at risk.

South Australia has shown the way forward with its much discussed energy plan – whose primary purpose is to ensure that the power supply is not beholden to the vagaries of the markets and the whims of the powerful oligopoly.

The Senate passed a non-binding motion in support of the 5-minute rule unanimously; and even the networks are sick of it, with Spark Infrastructure accusing the generators of withholding capacity to push up prices.

In its submission to the Finkel Review, it accused the fossil fuel generators of “trading in scarcity” – effectively withdrawing capacity to manipulate markets. It said many generators were operating “far below their capacity, only offering electricity to the market for a very high cost.”

The 5-minute rule is equally important. The proposal asks that the settlement period on wholesale electricity market be changed from its current 30-minute period to 5 minutes, so it matches up with the 5-minute “dispatch” period, and removes the incentive of bidding up prices in one five-minute period, so that the benefits are averaged over the whole 30 minutes.

The decision is seen as a big test of the AEMC’s ability to shift with new technologies, and open the way for new competitors. The market operator and the regulator both support the shift, as do many large energy consumers and, of course, the battery storage industry.

A perfect example of exactly how the market is being played by the fossil fuel generators was revealed in a new report from the Australian Energy Regulator this week. It is hard to find another more obvious reason for a change in the rules.

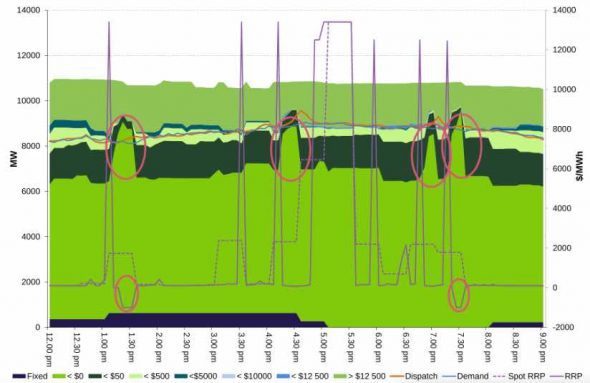

It occurred on February 2, in Queensland, when the Callide C and Alinta’s Braemar A power stations rebid significant amounts of capacity and prices jumped to $13,400/MWh and above in one five minute period.

Five minutes later, the price was back down again as the market was flooded with capacity that suddenly became available. Generators were so desperate to get some of the action that they bid the prices down to minus $1,000/MWh, (see table bottom) knowing that they were guaranteed a price of $1,740/MWh set by the first five minute period.

This is not an unusual ruse. When a very high price is established for one 5 minute period it guarantees a good price for the whole 30 minute period. So after a spike, you inevitably a rush of “cheap capacity” suddenly becoming “available” so the other generators can cash in.

As the AER notes:

- It is not unusual for generators to seek to increase revenue by rebidding capacity to low price bands to facilitate higher dispatch levels during the high priced trading interval, for example in the 1.30 pm trading interval. The 1.05 pm dispatch price reached $13 400/MWh, meaning the 1.30 pm spot price was guaranteed to be at least $1400/MWh. By the second dispatch interval, 632 MW of capacity was moved by eight participants from high to low prices, this can be seen in Figure 2 by the increase in the bottom green section after a price spike.

And this the graph they are referring to. Not the green on the right hand side when the capacity rushes back in to grab a share of the spoils.

Dylan McConnell, from the Climate and Energy College in Melbourne says: “This is absolutely an artefact of the 30 minute settlement rules – and it creates problems for the interconnectors too.

That’s because it can result in a sudden flows in one direction or another as capacity is withdrawn or suddenly made available.

And the networks flows, and the constraints that are put on them by the operator to ensure grid stability, are another plaything for the fossil fuel generators – as we reported here when Origin and Snowy bid down prices, forcing Victorian competitors out of the market – and so finding themselves free to push prices back up towards the market cap.

That’s another story. But it makes an absolute mockery of comments such as those from the former head of the Productivity Commission, Gary Banks, who told an AFR conference this week that “the energy crisis is self-evidently not the result of market failure but of government failure.”

He added: “The inconvenient truth is that the increasingly high prices for increasingly unreliable electricity are a direct consequence of the increasingly high utilisation of renewable energy required by government regulation.”

Tragically, the economists at the AEMC appear to agree. Next Tuesday’s ruling will be a test of whether they are listening to the pleas of COAG ministers and everybody else seeking to release the stranglehold over the markets by the fossil fuel generators.