Remember when we used to talk about gas as the “transition fuel” to a low carbon energy future?

It was not much more than a decade ago that energy policy makers and their energy market modellers thought that we’d be building combined cycle gas turbines all over the place to hit our emission reduction targets.

Yeah wind and solar were nice, but they weren’t ready for the big league of displacing coal. They needed several more decades of maturing and R&D to build up scale and get down costs. Meanwhile we could depend on trusty gas, and there was plenty of it in coal seams around Queensland and NSW.

A few years ago most of us wised-up that gas was hard to come by and increasingly expensive. Although not Liberal Party MP Angus Taylor, who wanted to scrap the RET based on an assumption gas would cost $5 per gigajoule for the next few decades.

According to the ACCC gas contracts are now being offered at anywhere from $8 to $15 per gigajoule. Meanwhile contracts for wind power are being signed at around $55 to $65 per megawatt-hour instead of the $120 that Angus Taylor had estimated.

Gas as the transition fuel was built on incorrect forecasts like this one from Angus Taylor

Thankfully energy investors didn’t pay much attention to Angus Taylor’s forecasting abilities, and the Australian Parliament batted off his call to scrap the Renewable Energy Target. Otherwise this current gas crisis would carry far bigger implications for power supplies.

Since 2013 we’ve made progress, albeit haltingly, adding more wind and solar generating capacity to the grid. In Green Energy Markets’ September Renewable Energy Index we find wind achieved its highest ever level of power production at just under 1600GWh. Meanwhile rooftop and ground-mount solar chimed in with another 770GWh. Combined their generation outdid gas for the fourth month since January 2016.

If we expand our lens to consider bioenergy and hydro as well, then renewable energy made-up 21.9% of power supplies across the main grids of Australia’s states in September. –

Source: Green Energy Markets Renewable Energy Index – September 2017

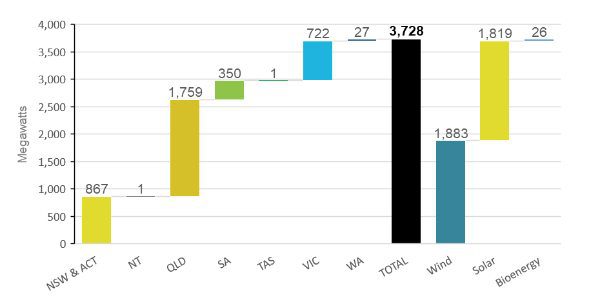

Of greater relevance is that once the 3,702 megawatts of wind and solar projects currently under construction become operational their generation can be expected to exceed that from gas throughout the year. This should come as welcome news to big gas consumers that have been struggling to get their hands on reliable gas supplies.

Megawatts of renewable energy projects under construction at end of September 2017

Source: Green Energy Markets Renewable Energy Index – September 2017

All up these projects are estimated in the Renewable Energy Index to support 12,702 of jobs years’ worth of construction activity.

Source: Green Energy Markets Renewable Energy Index – September 2017

In addition to the projects under construction listed above we should also remember the supplies coming from rooftop solar installations. Small scale solar installations continue to track close to the historical highs of 2012, with 96.6 megawatts recorded in September STC creation. The 14,931 systems installed are estimated to have involved enough work to support 4,819 full time jobs across installation, design and sales.

Source: Green Energy Markets Renewable Energy Index – September 2017

In addition they can be expected to save the homes and businesses that installed them around $180 million off their electricity bills.

Source: Green Energy Markets Renewable Energy Index – September 2017