The attacks on South Australia’s energy policy continue apace – across mainstream media – and continue to ignore the contribution of record high gas prices and supply constraints to the spike in electricity prices in the last few weeks.

The latest weekly review published by the Australian Energy Regulator on the gas market provides some more insight into what has been happening, explaining the reasons for the sudden surge in the gas price, and noting that during the high priced electricity price events, a huge amount of “base load” coal fired capacity has been sidelined and unavailable.

As the South Australia government has made clear, and as the AER has repeatedly underlined, the principal causes of the high electricity prices over the last few weeks has been record high gas prices and supply constraints on the main link to Victoria.

South Australia has had coal-free generation in the past, without these spikes, because at the time the cost of gas was low. It has had big price spikes in the past too, before wind and solar came along, because the cost of gas at the time was high. Gas has always been the swing factor in setting the final price.

According to the AER, one of the principal reasons that gas prices shot higher was that most major coal plants – and one big gas plant – had units unavailable in the first week of July.

Here’s the list from the AER: Stanwell 2 (off since 25 June), Torrens Island B3 (since 29 June), Liddell 2 (since 30 June), Yallourn 4 (since 1 July), Eraring 3 (since 3 July), Gladstone 3 (since 4 July), Loy Yang A1 & A2 (since 6 July – due to coal issues), Hazelwood (units 1 & 2 since 1 July and unit 5 since 5 July).

That’s a total of around 3,200MW of coal fired capacity not available, plus the gas outage.

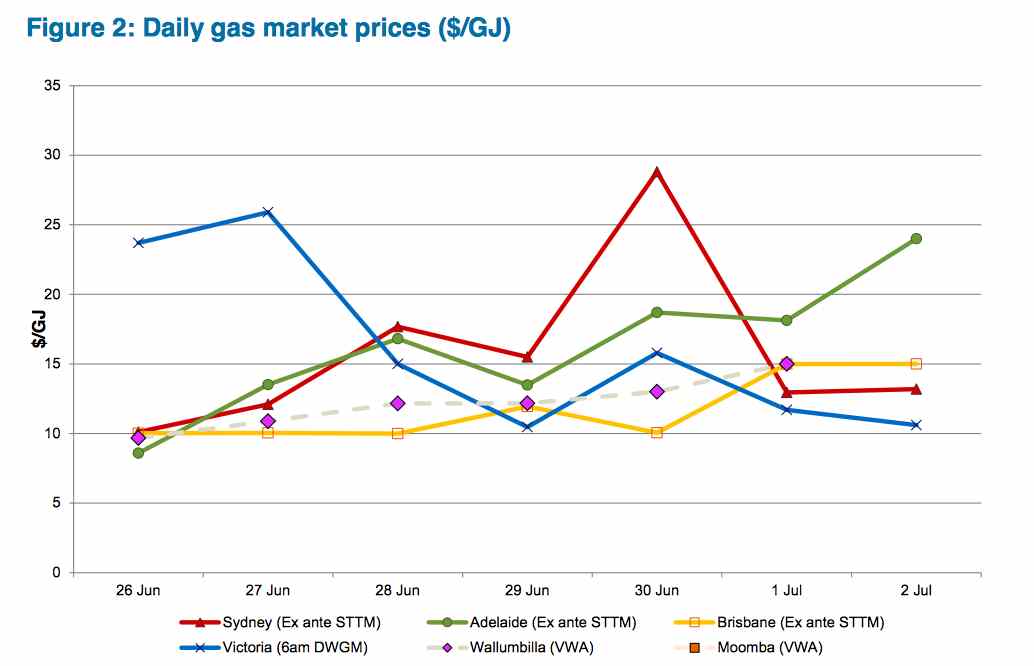

As the AER noted, that wasn’t the only problem. Gas demand surged to $36.65/gigajoule in Victoria, mostly due to heating needs, and was also high in Sydney, where the price reached a record $28/gigajoule. Records were set in Adelaide too. Gas supply was also tight because so much was needed for the export market, and because of supply constraints in Queensland.

And, on top of that, gas customers were being hit by transportation “penalty charges” related to higher than normal pipeline use.

That’s the sort of monopolistic pricing behaviour that the South Australian government is trying to force out. Building more wind and solar farms, and providing more interconnectors, will go a long way to solving that, as will the change in market rules that the generators are fighting so hard to stop.

As SA energy minister has highlighted, gas prices have also been impacted by problems with the gas network, and the danger that supplies on both its pipelines could be interrupted.

The AER report confirms that – the quantity of supply to Adelaide on the SEAGas pipeline decreased markedly, highlight the huge demand in Victoria, where prices surged to $36.65/GJ – 10 times the normal price of a year or so ago.

On top of this, the SEAGas pipeline also had technical issues, due to a “Miakite compressor valve fault (upstream of Port Campbell in Victoria),” the AER noted.

Poor old Adelaide: “In Adelaide prices increased across the week despite there being no substantial increase in demand,” the AER noted, and what increase that occurred was due to increase in demand by the power generators. Its gas price hit a record $24/GJ on the Saturday, largely due to issues elsewhere in the gas network.