Large-scale Generation Certificate (LGCs)

The steady march of the spot LGC market was halted in July, with overall trade activity down for the month. The outcome seems to be less a result of the renewed anti-renewables campaign and more a reflection of the fact that the spot market is sitting within $7 of the scheme’s cap with 18 months to go before Cal 17 surrender.

With the spot LGC market having pushed through the $85 level in early July, the market reached a high of $86.05 at the end of the first full week. That proved the end of the positive run, with the market first stabilising just below $86 for close to a week before gradually softening in quieter conditions across the remainder of the month. The spot ultimately closed July at $85.40.

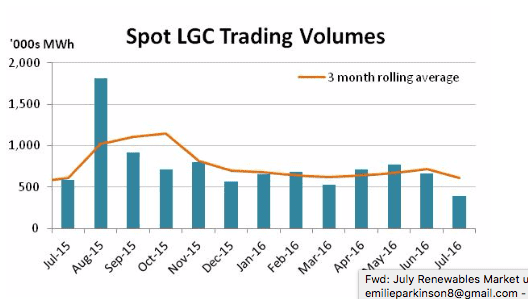

Trade volumes in the spot across the month were well down on recent levels with just under 400k reported for the month, a drop of over one third on the three month rolling average that has prevailed across the year to date.

The forward curve for Cal 16 and Cal 17 remained fairly flat with escalations for those contracts around the 1.5-1.8% level. When it comes to the Cal 18s however the curve is backwardated, with the value of that contract sitting in between the spot and Cal 16 price.

The forward curve in its present state reflects the fact that the market currently sits very close to the tax effective penalty level of $92.85, the implied value of the nominal $65 penalty (after tax considerations) that may have to be paid in February 2018 in the event that liable parties have not surrendered sufficient numbers of LGCs to meet their obligations. In the case of Cal 16 and Cal 17, across July it meant buyers would only pay an escalation (1.5-1.8%) below the prevailing cost of finance for forward transactions. In the case of Cal 18, they were prepared to pay only a very modest premium to spot because of the additional regulatory risk that an extra year presents.

The strong opposition to renewable energy and wind in particular was indeed on display across July, with an opportunistic attack on the deployment of the technologies in South Australia where high wholesale electricity prices caught the public eye. While the criticisms were subsequently undermined and eventually acknowledged as inaccurate by the new Minister for Energy and the Environment, Josh Frydenberg, the incident was a timely reminder that there remain forces within the Coalition Government and indeed the media who are prepared to continue the fight against the renewable energy target.

The appointment of the new Minister presents an interesting quandary to the renewables industry. Frydenberg’s past comments have implied a greater ideological proximity to former Prime Minister Abbott than to his successor. Indeed Frydenberg holds more sway with the powerful right grouping within the Coalition than the man he replaced, Greg Hunt. Yet whatever his views may have previously been, Frydenberg may just turn out to be internally influential enough to see off any further uprisings in the party room on the issue of the renewable energy target. He may also prove a very interesting appointment when it comes to the issue of carbon pricing.

Despite the considerable hoo-hah caused over the issue of the growing share of renewable energy in South Australia, it seems unlikely to have had much impact on the LGC market. Instead, it appears the market has become a victim of its own success, strengthening more quickly that was perhaps expected and, in its approach to the market’s cap, eroding the appeal to buyers.

Small-scale Technology Certificates (STCs)

The surrender for Q2 compliance taking place across July was enough to ensure the Clearing House remained in deficit across all of Q2, maintaining the status quo in the STC market

Spot activity once again remained very subdued with only occasional activity at $39.90. The passage of the 28th of July (the final surrender date for Q2 compliance) revealed another modest under surrender with just under 4.1m STCs acquitted against the nominal target of 4.24m STCs.

STC submissions remain marginally below the level required to meet the 2016 target.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.