Prior to the Industrial Revolution, humans managed to survive without fossil fuels. The question is, having indulged in a carbon-rich period for the past two centuries, can they make an orderly transition to a sustainable fossil-free future without sacrificing the high standards.

The mere fact that such a question is semi-seriously being contemplated in some circles is remarkable indeed. The fact that some ex5perts believe that such a transition can be achieved in time to avert climate change is even more remarkable.

Among those who are brave – or foolish – enough to talk about an eventual transition away from fossil fuels is Jeroen van der Veer, ex-CEO of Shell, and currently Chairman of ING. In an interview with Karel Beckman of Energy Post published 5 April 2016, van der Veer said the unspeakable, crossing the line many current oil major CEOs do not dare cross yet.

Even more surprising was the tone of his message. Instead of repeating the old and tired message that it simply cannot be done and shouldn’t even be attempted because it is impossible, van der Veer characterized the challenge as a great opportunity for oil and gas majors – remarkable indeed. Perhaps being the ex-CEO of an oil major gives one better insights and a license to speak the unspeakable. He said, among other things,

“The energy transition presents great opportunities for oil and gas companies to develop new forms of energy and gradually move away from fossil fuels.”

The former CEO of Shell, however, was quick to dismiss the notion that the oil majors are in danger of ending up with large stranded assets, as some investors fear and some environmental activists claim. He also made a distinction between oil majors and major oil exporting countries whose economies rely predominantly or exclusively on fossil fuels.

“A country like Saudi Arabia may be concerned whether they can exploit all their resources, but the assets on the balance sheets of the international oil companies are resources they will develop over the next 20 years or so.”

A few excerpts from the exclusive Energy Post interview appear in the accompanying box, the full text may be found at the website at the end of article.

What did Shell’s ex-CEO dare say?

What is holding back investment, according to Van der Veer, is volatility in the market, in particular the instability of CO2 prices. “Companies are willing to invest, but if you have no idea what the CO2 price will be over the next 20 years, while this is essential for the profitability of the project, you will not commit your capital to it. Energy investments are highly capital-intensive, so it is essential to have some certainty about this from the outset.”

Van der Veer says 3 things are critical to the future of energy:

Van der Veer says 3 things are critical to the future of energy:

- First, the world is still not doing enough to save energy;

- Second, for large parts of the world, natural gas is the best transition fuel; and

- Thirdly, as the world is using more and more electricity, we need to develop renewable energies that are much cheaper than they are today.”

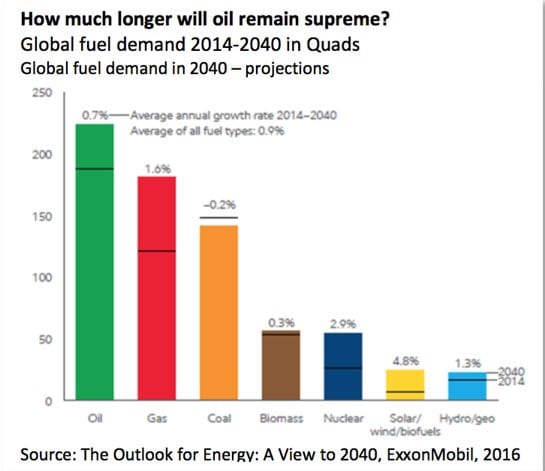

As a member of the World Economic Forum working group, he is developing scenarios “that stay within 2 degrees, but that the energy industry can believe in.” The exercise, soon to be published, show a decline of oil in the global energy mix from the current 31% to well under 20% by 2050, with share of gas slightly over 20%.

What will be the future of incumbent oil companies in such a future? “There are two schools on this topic”, adding, “I belong to the first school.”

- The first is that big energy companies develop new forms of energy rather than fossil fuels; and

- The second school says the mission of oil and gas companies is to produce oil and gas, and if this mission ends, then the companies end too. Then you pay out the dividend to the shareholders and stop.”

As for the climate conference in Paris, he says it may well be a turning point in energy history. “It is the first time that everybody agrees about the problem and has committed to tackle it.” There is no discussion anymore on the direction we need to move in. The big discussion now, he notes, is on the speed of the change. “Most politicians”, he adds, “are too optimistic about that. Most businessmen are too pessimistic.”.

But why would anybody be talking about a transition away from fossil fuels? Why leave a party that has been so much fun? The answer may be the same given to a heavy smoker, drinker or, worse, a drug addict. Because it is not good for you. It was great fun while it lasted but it is not ultimately sustainable.

There are investment and pension funds, university endowments and others who are beginning to wean themselves from heavy exposure to fossil-heavy businesses not only because of environmental concerns but because they believe it is prudent investment strategy to avoid possible future risks (visual below).

Speaking before a gathering of major global insurance companies in London in Sept 2015, the head of Bank of England, Mark Carney stunned his audience by pointing out the obvious, that billions of dollars invested in fossil fuel assets could conceivably become stranded as governments try to curb global warming.

Financial Times (1 Oct 2015) wondered if Mr. Carney was ―a far- sighted visionary or a dangerously deluded fool.‖ Not surprisingly, Carney became an instant celebrity among proponents of climate change, and a villain among climate skeptics. What he uttered was not particularly new or novel – environmentalists have been saying it for some time. What made his comments controversial and important was that the words came from the head of Bank of England, an institution which oversees 1,700 banks, investment companies, pension funds etc. together holding vast sums of private and public money. Among his responsibilities is to prevent another collapse of the global financial systems as occurred in 2008.

That was before the historic Paris agreement in December 2015. The risks are more real and more imminent for those who wish to acknowledge them. Others, of course, can ignore the signals and warnings at their own peril.

Denmark, for example, has vowed to transition towards a fossil-free economy by 2050 including its transport sector. With abundant wind resources that frequently exceed the country‘s total electricity demand, Denmark may indeed be able to pull it off without a hitch.

Neighboring Norway is looking into adopting a National Transport Plan with 100% electric cars, buses, and small trucks by 2025. The scheme could conceivable become law, perhaps with modifications. Norway is blessed with huge hydro resources, which can also be used as storage, absorbing excess renewable generation, balancing the delicate task of matching variable generation and demand. Converting its transport sector to renewable electricity not only makes sense but can be done economically.

Denmark and Norway are, of course, exceptions. The transition to a fossil-free future will be much more difficult and take much longer for major economies where fossil fuels are seen as a way of life. Moreover, rapidly growing economies of India, China and others are less likely to be able to make the transition successfully anytime soon.

And for countries like Saudi Arabia, Australia, South Africa, Indonesia – to name a few – fossil fuels are the sole or main drivers of the economy. No serious politician will have the guts to even utter any words such as those uttered by the head of Bank of England or Shell‘s former CEO.

Yet as other articles in this newsletter describe, the broad outlines of an eventual transition away from fossil fuels and much higher utilization efficiencies of whatever energy forms are used, is beginning to emerge.

Coal, the most carbon heavy

Coal, the most carbon heavy

of fossil fuels, is already

facing strong headwinds, and

these pressures will only grow

over time. Natural gas is

roughly twice better than coal

in terms of units of carbon

emitted per kWh produced. It

is half as evil as coal, but it is

evil nevertheless. Much of the

gas escapes from the wells and the pipes making gas not as attractive as it appears. Oil and its many derivatives, of course, are indispensible in many applications today – for example as aviation fuel. Its energy density will be hard to match for decades to come. It too, however, will face headwinds in due course as price of alternatives declines and their performance improves.

The chart on bottom of front page based on historical and announced investments of world‘s top 540 oil and gas companies, courtesy of James Moore of Redburn Capital Goods Research, illustrates a significant scaling back in Capex to 2020 reflecting the current depressed oil prices. But even when/if oil prices rebound to their historical levels – whatever that may be – how likely will the rebound in upstream exploration and development investments be?

Shell‘s former CEO suggests that many oil majors will be reluctant to invest heavily in expensive and challenging fields moving forward. Some may decide to put their eggs in different baskets. Few may decide to move away from exclusive reliance on fossil fuels. Perhaps some will come around to see renewables as a complement to their traditional business models rather than a competition.

He is not alone in seeing the beginning of the end of fossil fuels. In April The French oil giant Total announced that it wants to be among the top 3 global solar companies and will expand in electricity trading and energy storage. Total said it was creating a fourth business unit to cover gas, renewable energy and power stating that the move will ―strengthen its position as a global energy leader‖, according to Total CEO, Patrick Pouyanné. The transition away from fossil fuels is already underway.

Even more surprising is an ambitious plan spearheaded by Saudi Arabia‘s crown prince Mohammed bin Salman to create a $2 trillion sovereign wealth fund, the largest in the world, to gradually wean Saudi Arabia‘s economy away from oil. If Saudis see dependence on oil as a dead-end, it must be a dead end.

The writing, in other words, is on the wall. Not today, nor tomorrow, but sooner than many predict.

Perry Sioshansi is president of Menlo Energy Economics, a consultancy based in San Francisco, CA and editor/publisher of EEnergy Informer, a monthly newsletter with international circulation. He can be reached at [email protected]