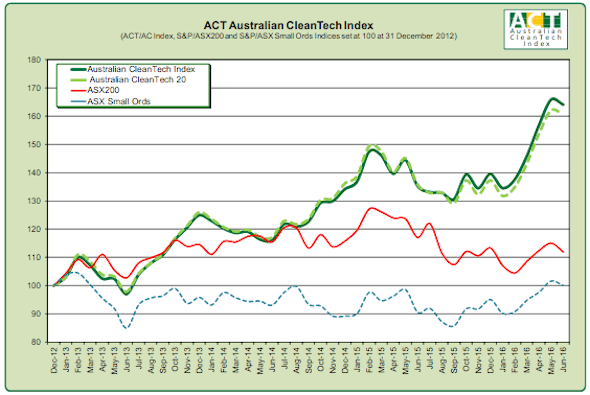

The Australian CleanTech Index has significantly outperformed the wider market for the full 2015-16 financial year, a new report has shown, capping off a “stellar three years” with returns of nearly 70 per cent for investors that have held the course.

The ACT Australian CleanTech Index Annual Performance report for 2015-16, published on Monday, puts market capitalisation of the 64 stocks in the Index at $A23.5 billion, down from its peak of $23.7 billion in May 2016, but “a very long way up” from its July 2012 trough of $A6.2 billion.

The report’s author, Australian CleanTech’s managing director John O’Brien, said the strong Q4 performance – which saw the Index gain 12.6 per cent compared to the ASX200’s gain of 3 per cent and the ASX Small Ordinaries’ 5.5 per cent gain – was driven by 16 companies with gains of more than 20 per cent.

As you can see in the table below, the greatest gains were recorded by CleanTeQ (CLQ), Environmental Group (EGL) and Emefcy Group (EMC).

These gains were, however, partially offset by losses of more than 20 per cent recorded by eight companies, led by Intec (INL), Vmoto (VMT) and “the once mighty” Geodynamics (GDY).

The FY16 performance was driven by 17 companies with gains of more than 50 per cent, with the greatest gains recorded by Eden Energy (EDE), Neometals (NMT) and Bluglass (BLG).

These gains were partially offset by nine companies recording losses of more than 30 per cent, led by EcoSave (ECV), Tag Pacific (TAG), Australian Renewable Fuels (ARW) and Intec (INL).

The best performing cleantech sector for the three months to June 2016 was the Australian Efficiency & Storage Index and the worst performer was the Australian Waste Index. Over the 2015-16 financial year, the best performing index was again the Australian Efficiency & Storage Index, being driven by strong interest in energy storage and its suppliers such as lithium mines, with the Australian Waste Index showing the weakest performance.

It is worth noting that The Australian CleanTech Index also underwent its quarterly rebalancing at the end of June, which took account of recent share issues and other corporate activity. As part of this process, three new companies were added to the index, including emerging vanadium producer Australian Vanadium Limited, energy efficiency specialist BuildingIQ, and wave energy company Protean Wave Power.

Another three companies were removed from the index for various reasons, including Alterra, Novarise Renewable Resources and Ultimate Power and Energy.

The largest 20 largest Index constituents by market capitalisation on 30 June 2016 are shown in the table below, including new entrants CleanTeQ and Emefcy Group. These companies will make up the Australian CleanTech 20 until the index is rebalanced again on 30 September 2016.

Each of the Australian CleanTech 20 members has a market capitalisation of more than $108 million.