As Prime Minister Tony Abbott continues his assault on the nation’s clean energy programs and incentives, one technology that could emerge relatively unscathed (in the medium to long term) is the market for rooftop solar PV – much to the frustration of the incumbent utilities that are pushing the government to try to lock the country into the business models and technologies of the past.

One of the biggest fears of the Australian solar industry is that the government’s review of the renewable energy target will result in an abrupt cancelling of the federal incentives that support the rooftop solar industry. They say that this could cause the loss of thousands of jobs, and the collapse of many businesses, as customers reassess their short-term commitment to rooftop solar. The industry says that solar will be targeted – despite its political risks – because it is a bigger threat to incumbent utilities than large-scale wind or solar projects.

The contrast with the political rhetoric in Australia and that of the US – where President Barack Obama has re-installed rooftop solar on the rooftop of the White House (it was removed by Ronald Reagan), and gotten major retail brands to commit to install nearly 1GW of solar – could not be any different.

There are strong arguments to keep solar incentives – as Alan Pears points out today – including that their removal will simply penalise those less wealthy or in less solar-rich regions, and will serve to protect only coal and gas-fired generators. And it will cause huge disruption to a growing industry.

But a new analysis by investment bank UBS suggests while a dumping of the solar support mechanisms could slow down the uptake of rooftop solar in the short term in Australia, the impact would not be permanent. Indeed, as its study shows – and as some of the more progressive minds in the energy industry now readily admit – the continued fall in the cost of solar means that over the medium term there is not much the utilities or the government can do to stop growth of rooftop solar PV.

The UBS report notes that the uptake of rooftop solar PV in Australia – around 3.2GW now sits on more than 1.1 million rooftops – has been consistent in trend terms despite the changes in policy – underpinned by a combination of rapidly rising delivered electricity costs (the network), and firstly by high feed in tariffs and then with falling technology costs.

Indeed, because of its extraordinarily high retail electricity prices, Australia was one of the first countries in the world to reach what is known as “socket parity” – where the cost of rooftop solar undercuts the cost of grid-sourced electricity.

The small scale component of the renewable energy target currently accounts for around 29 per cent of the up-front cost of solar panels – although there are variations across different states, as this graph below shows.

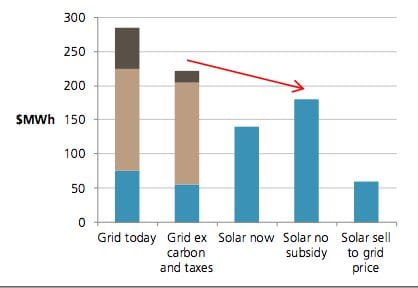

But the UBS analysis shows that even with the carbon price repealed, and solar incentives cancelled, rooftop solar still looks compelling to households. That’s because solar power used in the house avoids buying electricity from the grid at a cost of at least $260/MWh and the cost of installing solar is much lower than that.

Much of the cost is determined by assessing the “discount rate” – roughly equivalent to the time value of money. UBS says if 10 per cent is a reasonable discount rate then rooftop solar presently needs a price of around $140 MWh with subsidy and about $180 MWh with no subsidy to cover its cost of capital.

(In the US it could be argued that 6 per cent is a reasonable cost of capital, UBS says, but notes that Australia’s cost of capital – like so many other costs – is higher than other countries. If the discount rate is lowered to 7.5 per cent, it reduces the costs in Australia to $100/MWh with subsidy and around $140 with no subsidy).

“Therefore, if the household can use the solar electricity in the house, it is from a financial point of view a no-brainer decision,” UBS writes.

“Equally if the solar power is sold back to the grid it’s an equal no-brainer, but of a reverse outcome. From this perspective solar is just a financial arbitrage. Grid delivered electricity relies on the grid delivering “cheap” electricity produced 100s and even 1000s of km away from the point of consumption. Solar costs much more at the generation level but the unit cost of a 1 kW system bears little difference from a 1 GW system, and so it’s perfectly economical to install on the roof of the house and arbitrage away the wires and poles cost.”

The question is, if the government does remove the remaining solar incentives, what will happen to demand? This graph below provides an indication.

According to the UBS data, the current IRR (internal rate of return) is currently around 18 per cent. If this were to continue, something like 50 per cent of households would likely adopt rooftop solar PV. The removal of the SRES would likely drop that IRR to below 10 per cent, a return that would likely mean only around 20 per cent of the market switches.

“As with any other market though, the marginal new customer may require a higher incentive,” UBS says. “Some people will switch even if there were a net cost because of environmental reasons. Some households and businesses won’t or will be unable to switch at all. In between sit a group that will switch if the financial incentive is sufficient.”

So UBS estimates – that even with all subsidies removed and a low, and voluntary, feed in tariff in place in some states – the market for rooftop solar will likely remain around 400-500 MW per year. This would be made up of around 100 MW commercial (while expecting this component to grow) and around 300-400 MW of household rooftop PV. It should be noted that for large users of 100MWh or more, the cost of solar makes sense at $140/MWh or less – and PV is about there now ex-subsidy.

UBS estimates that around 37 per cent of a typical household’s daily electricity consumption occurs when the solar system is operating (see graph below). Therefor, if the household wants to avoid exporting any power to the grid, then the PV system needs to be sized so that peak output is roughly equal to average hourly household consumption.

“Our numbers suggest that for a household consuming 8 MWh per year (20 kWh per day) the solar system “should” be around 1.5 kW. That’s less than half the average size of new installations today.”

UBS says that given a sufficient incentive, households can shift part of their power consumption around during the day, or even within a week.

“Fridges, typically the largest single source of consumption, obviously have to be on constantly – but washing machines, clothes dryers, swimming pool pumps, solar hot water heating etc. can all have their time of consumption shifted relatively easily. For households not receiving an FIT, there will be a preference to use equipment during the day when solar represents the low cost option.”

Ultimately, this leads into the question of storage. As we noted in our report on Friday, that could become cost competitive quickly, to the point that the average Australian household may not have to pay more if they disconnect entirely from the grid, as soon as 2018.

That’s a prospect which is causing enormous disquiet among utilities – scrapping schemes such as the RET, and institutions such as the Clean Energy Finance Corp and the Australian Renewable Energy Agency are just a crude attempt at buying the incumbents more time.