There has been a lot of focus on figures which show that one quarter of consumer bills pay for the infrastructure that is used for just 40 hours a year to cope with peak demand. But here’s another number from the Energy White Paper: 30 per cent of the revenue from the wholesale market comes from just 30 hours of critical peaks a year. In other words, nearly one third of the revenue of the major generators comes from firing up every plant they can find for a little more than a day.

So while it’s well and good to seek solutions to remove those critical peaks, this creates a problem for the generators – their business models are framed with the critical peaks in mind, that’s how they’ve structured their financing and their returns. It’s not just the expensive gas (and jet fuel) peakers that receive $10,000 a megawatt hour in critical peaks, it’s also the brown coal generators who are shovelling dirt into their boilers at $4 a tonne.

Time of use pricing at the retail level – along with deregulation of retail prices–is seen as a solution to these critical peaks. But there is a lingering suspicion that this could be abused: sure it might flatten the peak, but it may also broaden the period when consumers are required to pay premium rates. In the energy industry, it’s all swings and roundabouts – if the utilities lose revenue from one source, you can be sure they will find it somewhere else.

Foot on the gas

As we mentioned in our first take on the Energy White Paper, this is all about gas. As he suggests, and the mainstream media warmly applauded, it’s about digging up as many fossil fuels as possible as quickly as possible to make as many billions as possible. And this is the inherent contradiction of a document which purports to take climate change into account – it makes mention of the International Energy Agency’s scenarios to meet climate change goals, but frames its targets around the scenario where the world does little.

At the same time , the document hails gas as a transition fuel but warns of not wanting to “lock in” polluting fuel sources. “Technologies defined as ‘clean’ today may no longer be considered clean by 2050 (or earlier).,” it notes. Indeed, the IEA said just last week that by 2025 gas will be considered a “high polluting” energy source unless it has carbon capture and storage. But even Australia’s Energy White Paper does not expect that to happen until 2035.

Ferguson keeps nuclear door open

Ferguson may (begrudgingly) acknowledge that nuclear is not part of the Labor Party platform, but he clearly wants to keep the door open. As he said in the draft white paper, and repeated in the final edition, nuclear might be the only option for a zero-emission future if other technologies such as carbon capture, large scale solar and other renewables fail to develop in the next decade.

“If those technologies fail to develop as expected, future Australian governments may need to consider other clean energy alternatives to meet our emissions reduction targets and to minimise the risk of higher adjustment costs,” the Energy White Paper says. Bet get a wriggle on then. But it’s just a little ironic, given his department’s botched handling of the funds designed to bring those technologies to the market – and here you could cite any number of schemes such as Solar Flagships, the Renewable Energy Development Program, and the Geothermal Drilling Program.

Thankfully, the Greens and the Independents forced the Labor Party to put these together under an independent body called the Australian Renewable Energy Agency, which is about to swing into action. Ferguson, however, would have been pleased by the CSIRO’s eFutureonline modelling tool, which displays a nuclear scenario that can best be described as wishful thinking. But as the Energy White Paper admits, the establishment of a commercially based nuclear energy industry in Australia would also require additional financial and/or other forms of government support, and a social licence to operate.

Modellers and renewables

Why is it that economic and energy market modellers find it so hard to model green energy? The experience in most places in the world is that as the penetration of renewables increases, it has a sort of snowball effect – the result of the impact it has in redefining energy systems. This is pretty much true of any new technology breakthrough in an established market. Not in Australia, we are asked to believe. The Energy White Paper suggests that renewables may rise from 20 per cent in 2020 to 40 per cent by 2030 (which makes you wonder why Ferguson dismisses the Greens request to have such a target).

And then, it is suggested, it will come to a crashing halt, adding only another 10 per cent in market shares over the next two decades. What happens? Well, apparently the carbon capture and storage cavalry come charging down the road to offer cheap and clean fossil fuel generation. I’d suggest that if renewables had gotten to 40 per cent by 2030, then the cost of the technologies predominant by that time – be it wind, solar PV, solar thermal with storage or geothermal – will be so dominant that CCS will have little role to play, when it does come to market circa 2035, apart from cleaning up those gas-fired generators needed to fill the gaps, if there are any left.

What fossil fuel subsidy?

Australia has long argued that it does not have fossil fuel subsidies, but one man’s tax incentive is a fossil fuel subsidy, no matter which you cut it. The Energy White Paper says business tax deductions or specific tax treatments, such as the fuel tax credit, are just a normal part of business. Strangely enough, the US regards tax incentives for renewables as a subsidy, which is why the Republicans wanted them to be repealed. And then, of course, there are the artificial suppression of retail prices in Queensland and WA, and the subsidised coal supply contracts in NSW and Queensland. These are most definitely described as subsidies by the IEA. Even the Saudis accept that, which is why they are keen to replace oil fired generation with solar, so it can end the subsidy and sell the oil to someone else at a much higher price.

Yes, let’s be flexible

The energy white paper got one thing right: The energy market needs to be flexible. It actually made this point in reference to electric vehicles, noting the technical, financial and regulatory barriers it needs to overcome, and for the need to ensure that these new technologies can integrate effectively into energy markets. Quite so. Hopefully the market will extend such care to the rooftop solar market as well.

Oh, those generators!!

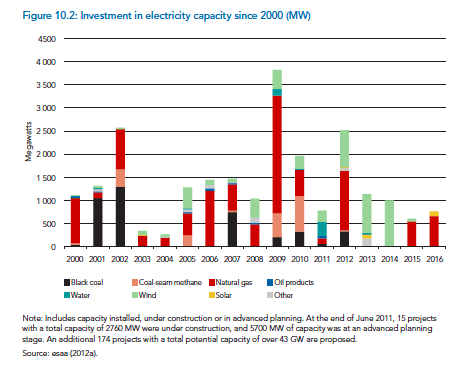

Speaking of solar PV, does it really exist? This graph below, included in the Energy White Paper, highlights the investment in electricity generation in the last five years – coal, gas, wind – and no rooftop solar. But solar PV, despite its cumulative total reaching 2GW this week, which represents an investment of between $6 and $8 billion by the nation’s households over the last few years, does not rate a mention.

As one correspondent suggested to me today, the graph-makers would argue that solar PV is not plotted because it is not a single generator, so it is not recognised as capacity, even though it clearly is. Meanwhile, the electricity industry continue to lament the so-called “reduction in demand”. But households have their 3 TV’s, two air conditioners and the dishwasher, it’s just that they are generating their own power, so it does not show up as demand on the NEM. Hey, who stole my cheese!

And finally, the numbers

The final talking point is a set of numbers. That is, the number of pages these technologies are mentioned in the Energy White Paper. Make of it what you will.

PV: 7 pages

Nuclear: 10 pages

Solar thermal: 16 pages

Geothermal: 20 pages

Carbon Capture: 25 pages

Solar: 26 pages

Wind: 26 pages

Coal: 63 pages

Gas: 147 pages