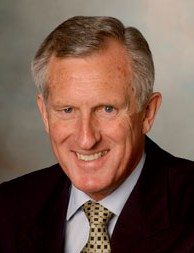

Economist and former federal Liberal leader John Hewson has criticised the Future Fund – Australia’s largest – for the way it manages, or fails to manage, the risks of climate change to its $75 billion portfolio.

Hewson chairs the Asset Owners Disclosure Project, an organisation encouraging funds to recognise the long-term risks of climate change – both in policy terms and its physical events.

The AODP says a Freedom of Information search conducted two years ago found that climate change had not been mentioned in any of the board meetings of the Future Fund, and it was still refusing to provide stakeholders with clarity about its strategies to protect its portfolio because of “resource constraints”.

Hewson said it was “extraordinary “ that Australia’s largest fund, which will have to supply pension liabilities over the long-term, had decided not to come clean over its climate position.

“While investors all over the world continue to build understanding of how to protect themselves from the market and physical impacts of climate change, the Future Fund thinks it is immune,” Hewson said in a statement issued by the AODP today. The AODP intends to publish its first global index of funds later this year.

The statement noted that David Murray, former head of the Future Fund and of the Commonwealth Bank, was a “climate denier”, who refuted the conclusions of the scientific community regarding climate change.

“This isn’t about science, this is about risk, and thus the risks to the assets in the Future Fund portfolio,” Hewson said. “There are many ways in which we could see a rapid shift to the low-carbon economy in the coming years.

“Under any of those scenarios, we will see rapid direct or indirect repricing of carbon, and then the Future Fund will be unable to sell any stranded assets and so it must start planning now. Australia’s retirees cannot afford another sub-prime crisis,” he added.

The AODP intends to publish its first global index of funds later this year. Its board members also include general secretary of the International Trade Union Council Sharan Burrows, the former head of risk at Goldman Sachs Bob Litterman, and Andrew Hilton, director of the London-based Centre for the Study of Financial Innovation.