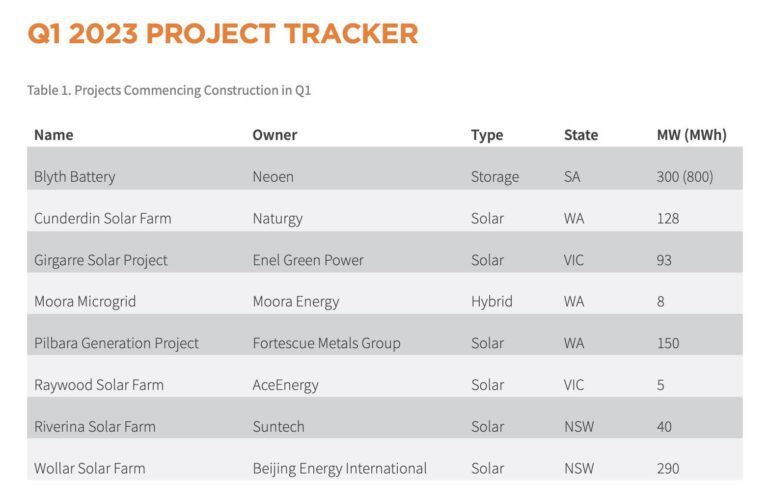

Clean energy construction hit a new peak in the first quarter of 2023, with eight new projects worth a cumulative $1.3 billion commencing construction, but the Clean Energy Council also warns that investment in new projects is at an all-time low.

First, the good news: The construction starts are double that of the last quarter of 2022. Three of the new projects are based in Western Australia, where the CEC says the shift away from coal-fired generation has began to accelerate.

The bad news is that no new generation projects reached financial close in the first quarter of this year. A single 200MW/400MWh big battery, at Rangebank, in Melbourne’s south-east, worth $400 million, was the only renewable to reach financial close in the quarter.

That is a a dramatic fall from the previous quarter and a rolling twelve-month quarterly average of $1.6 billion.

CEC chief executive Kane Thornton says that while the construction numbers are promising, the relative dearth of projects reaching financial close is cause for concern.

CEC chief executive Kane Thornton says that while the construction numbers are promising, the relative dearth of projects reaching financial close is cause for concern.

“Australia needs to double the rate of renewable energy deployment to ensure we have enough new supply to drive down power prices, replace exiting coal generation and ensure we achieve the target of 82 per cent renewable energy by 2030 and put Australia on a path to achieve net-zero by 2050,” he said.

“A slowdown in the rate of new projects reaching financial close is at odds with our need to accelerate deployment. While energy investors are enthusiastic about investing in clean energy in Australia, there are a variety of headwinds that are undermining confidence at present.”

Thornton says those pressures include global competition driven by US President Joe Biden’s landmark Inflation Reduction Act (IRA), a major economic package that included a suite of renewable energy investments.

This has made the US the more exciting prospect for potential investors. In response to that Act, the EU has also released an aggressive interim strategy to curry investment in green energy.

Other challenges that may be stunting new investments include grid connections and constraints, supply chain and workforce constraints, and unwieldy planning and approvals regimes.

“These worrying numbers,” said Christiaan Zuur, the CEC’s head of investment and policy.

“We need to do everything we can to accelerate investment in renewables, transmission and a portfolio of storage solutions to maintain reliability for customers.

“There are a number of issues at play that might explain this trend – from an overly complex techno-regulatory framework to planning complexity and social license, as well as supply chain issues and labour market tightness.

“What it highlights is the importance of streamlining regulatory processes and incentive mechanisms, to make it easier to attract the global capital that enables the investment we so desperately need in Australia.”

The CEC says that while the government has made strides in managing the energy transition, the imminent phasing out of Australia’s Renewable Energy Target (RET), which will become redundant in 2030, fails to lock in certainty about the future of renewable power generation and storage in the country.

The RET is a Federal Government target of achieving 33,000 GWh of additional renewable power generation by 2020; the target holds until 2030, and until that time new power stations can continue to be accredited under the scheme.

Accreditation under the scheme allows renewable power stations to create certificates for every megawatt hour of power they produce, which can then be purchased by electricity retailers.

“No policy has delivered as much abatement, given as much certainty and unlocked as much investment as the RET. Extending it beyond 2030 would be simple and fast, and the costs associated with this extension will be far outweighed by lower energy prices that we know will follow,” said Thornton.

“While we welcome increased leadership from state governments, there is also emerging concern about the role some state governments may play in the ownership of renewable energy generation.

“These risks and challenges need urgent and coordinated attention to ensure Australia gets back on track to delivering new clean energy supply critical in managing the energy transition.”

Globally, the International Energy Agency estimates that US$1.7 trillion will be invested in clean energy this year, far outpacing fossil fuel investments. The uptick in clean energy investments is mainly driven by solar and EVs.

A February joint report by IRENA and the Climate Policy Initiative (CPI) found that global investment in the energy transition last year was up 19% from 2021, and up 70% from pre-pandemic levels.

Since the IRA was signed into law in August last year, experts have warned that Australia risks being left behind in the global clean-energy ‘arms race’ if it doesn’t take major steps, with the CEC warning Australia could lose thousands of renewables jobs and face damages to its competitiveness for decades.