Australia is about to become home to one of the world’s largest oil and gas producers, following a deal that will see BHP’s oil and gas businesses merged into Woodside Petroleum.

It’s not exactly a deal that Australia can be proud of.

The deal will establish Woodside as a $41 billion fossil fuel giant and one of the world’s ten largest oil and gas companies, as well as becoming the largest energy company listed on the ASX.

Critics say it looms as a disaster for the climate as it is predicated on an assumption that Woodside – contrary to the warnings of the International Energy Agency and those of the latest IPCC report – will use its new financial muscle to unlock new oil and gas projects and that the world can’t do without fossil fuels.

This transaction is significant both because of its scale and its purpose. BHP has made clear that it sees its future in zero emissions technologies, providing minerals needed for the production of renewable energy technologies, batteries and electric vehicles. It has also indicated an intention to focus on future food security.

Under the merger proposal, BHP shareholders will be given shares in the expanded Woodside business, many of which may find themselves surprised to find themselves co-owners of such a large pure-play fossil fuel company.

At least they hold their exposure at arm’s length. If global markets go pear-shaped for the fossil fuel industry, as the world must hope it does for the sake of the climate, the merger could see these new Woodside shareholders left “holding-the-bag” of stranded oil and gas assets.

The deal allows BHP to free itself from direct exposure to the fossil fuel industry, having previously undertaken a significant sell-off of its thermal coal production facilities, which came with its 2019 commitment to reduce its emissions and its contribution to global warming.

Woodside, on the other hand, appears undeterred by the global transition to clean energy and commitments to decarbonisation.

Newly appointed Woodside CEO Meg O’Neill proudly boasts that combining the two businesses will provide Woodside with the resources necessary to expand its operations, including the massive $9 billion Scarborough gas field to be located off the Western Australian coast.

“Merging Woodside with BHP’s oil and gas business delivers a stronger balance sheet, increased cash flow and enduring financial strength to fund planned developments in the near term and new energy sources into the future,” O’Neill said.

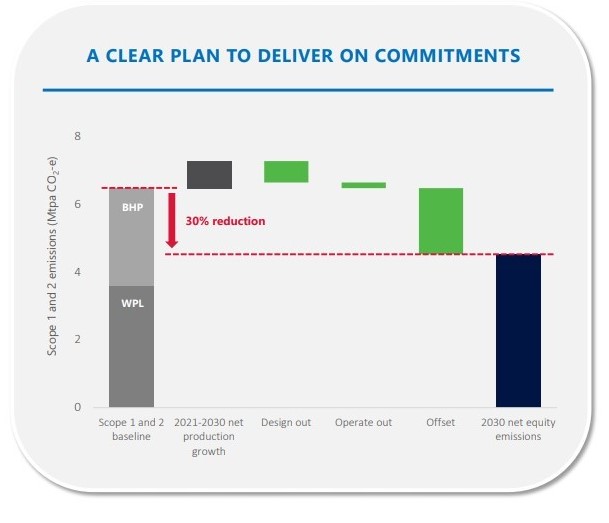

Woodside’s climate commitments are unnervingly similar to those of the Australian federal government – a commitment to cut its operational emissions by 15 per cent by 2025, 30 per cent by 2030 and an ‘aspiration’ to reach net zero emissions by 2050.

An outline for how these targets could be met suggests that Woodside will be heavily reliant on the purchasing of carbon offsets to meet those goals.

“The combined business is expected to generate significant cash flow this decade to support the development of new energy products and low carbon solutions including hydrogen, ammonia and carbon capture and storage,” Woodside said in its statement.

Shareholder advocacy group, the Australasian Centre for Corporate Responsibility, says the deal is “disastrous” for shareholders and the climate, given Woodside will grow to more than double its current size and massively expand its exposure to the fossil fuel industry.

“Woodside is doubling its exposure to oil and gas, while at the same time claiming the merger reduces risk,” ACCR’s director for climate and environment, Dan Gocher, said.

“BHP and Woodside have been at the heart of Australia’s inability to tackle climate change for the best part of 30 years. For Woodside, that will likely continue. And while BHP may one day claim to be ‘fossil fuel free’, it cannot erase its past,” Gocher added.

Major energy companies are facing growing pressures, from both shareholders and (mostly state) government policy, to reduce their exposure to fossil fuel industries as scientists warn that rapid decarbonisation of the global economy will be necessary to avoid the worst impacts of global warming.

The Woodside upsizing mirrors the ambition of Santos, which is undertaking a $22 billion merger with oil and gas competitor Oil Search, again with the goal of using its boosted balance sheet to pursue more oil and gas production projects.

AGL Energy, meanwhile, is hedging its bets, a bit like BHP, choosing to carve out its coal and gas generation business into a separate entity, Accel Energy, while leaving the AGL Australia brand largely carbon free and fighting for a position in a zero carbon world.