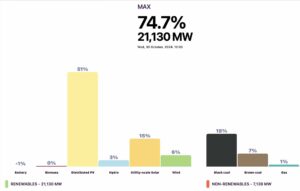

The ongoing expansion of wind and solar power in Australia’s main grid has delivered stunning price falls in the latest quarter, along with big falls in demand and further reductions in emissions. The absence of any major outages in the summer season meant that the grid was cheaper, cleaner and more reliable.

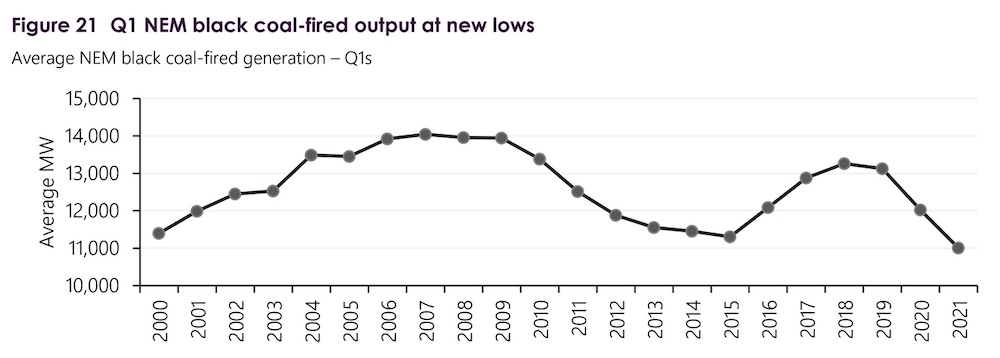

The latest Quarterly Energy Dynamics report from the Australian Energy Market Operator lists a series of major new milestones, both in the share and reach of wind and solar, but also in the setting of new lows for minimum demand and record low output for black coal generators.

Less than a decade ago, the main concern was the grid’s ability to meet growing levels of peak demand, but now the focus is on dealing with periods of low or even minimum demand, although this is likely to be a transient experience as more storage and demand response is added to the grid.

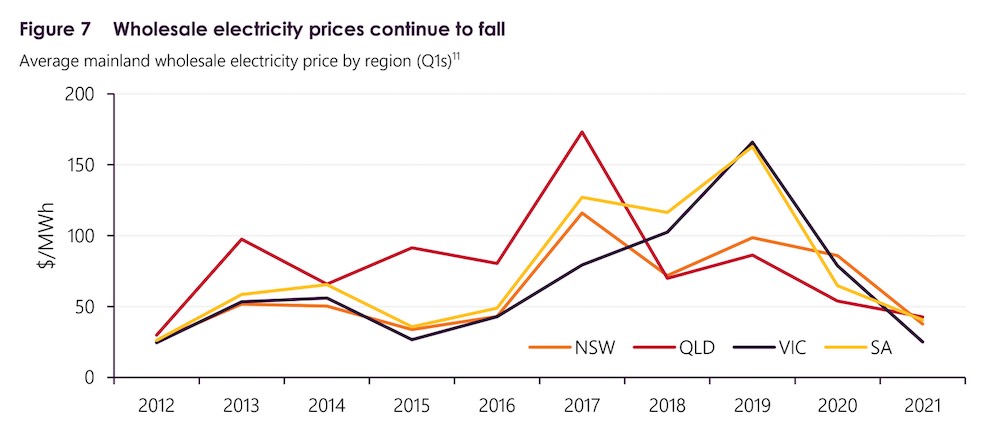

Average wholesale prices plunged 68 per cent in the quarter, thanks to surprisingly low volatility (which turned out to be bad news for pumped hydro and batteries), the lowest levels of gas generation since 2005 (so much for the gas led recovery), and new records for wind and solar.

These included the highest level of grid-scale VRE (wind and solar) output of 6,886MW at 10am on February 18, and the highest level of grid scale solar at 3,411MW at 10.30am on March 5.

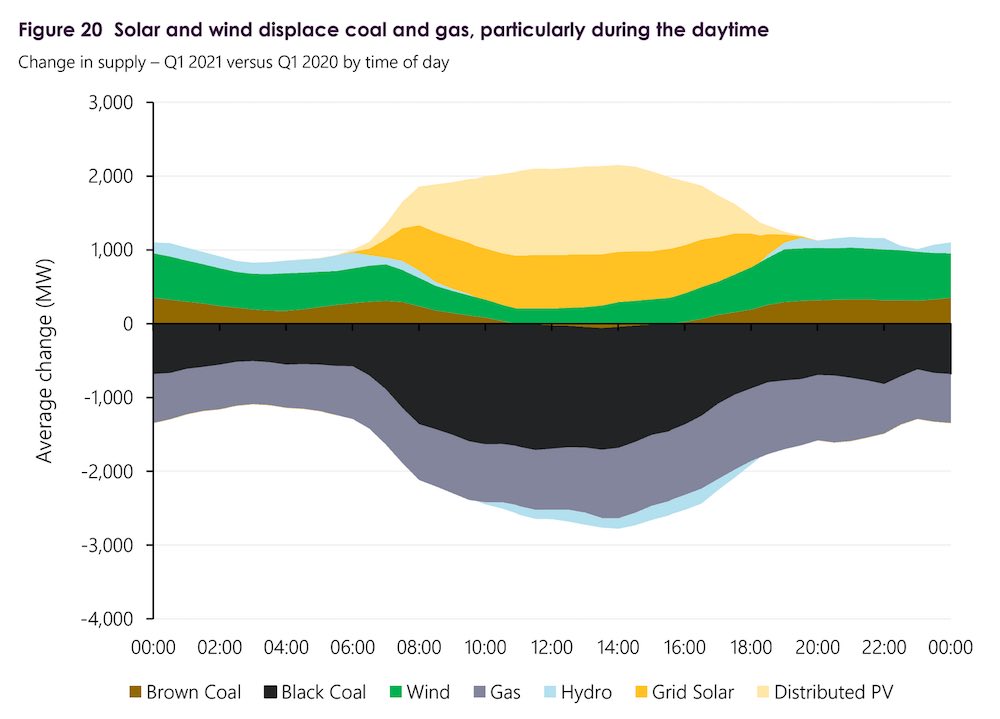

Compared to Q1 2020, average VRE generation increased by 786MW, the report said, with wind and grid-scale solar contributing 472MW and 314MW, respectively, thanks mainly to newly added capacity and ramping up of projects, as well as reduced curtailment in Victoria’s West Murray region.

The quarter also saw a significant increase in low-priced supply – offers below $40/MWh – which was up by 1,340MW on average compared to Q1 2020, with combined wind and solar accounting for more than half of the increase in low-priced offers.

“In the last quarter, we’ve experienced less price volatility, an increased volume of low-priced coal and hydro generation and a 29 per cent increase in wind and solar generation, all contributing to lower wholesale prices,” said AEMO chief markets officer, Violette Mouchaileh.

The two most striking elements of the Q1 report, though, were the fall to record lows of black coal output – down to an average of 11,006MW, its lowest Q1 output since NEM start more than two decades ago, and 1,018MW lower than the same period last year – largely as a result of more outages and displacement by rooftop solar.

Even attempts by black coal generators to bid low did not guarantee more output. As a result prices fell across the board, but mostly in Victoria, which had the biggest increase in renewables and where prices fell from $79 per megawatt hour (MWh) in Q1 of 2020 to $25/MWh, and in New South Wales where prices declined from $86/MWh to average $38/MWh.

The impact of rooftop solar was mostly keenly felt in South Australia, where daytime prices averaged minus $12/MWh, marking the first quarter anywhere in the NEM when the daytime average fell below zero on a consistent basis, and lowering the overall average by $10/MWh to around the $40/MWh mark. Read more about that here.

Gas power generation also took a series of hits over the quarter, falling to the lowest levels in New South Wales (47MW) since NEM start and in Victoria to the lowest quarterly output since Q1 2003, of 25MW on average.

“Few periods of extreme heat, combined with low NEM price volatility, and increased renewable energy output resulted in diminished demand for gas-powered generation (GPG), representing the lowest quarter since 2005,” the report said.

Finally, the combination of the increased renewables output, reduced operational demand, and reduced coal and gas generation also meant that grid emissions also hit a new low for the Q1 period, at 31.5 million tonnes carbon dioxide equivalent (MtCO2-e), 9% lower than Q1 2020, but 3% higher than the previous quarter’s record low.