It has only been a week since the closure of South Australia’s last coal-fired generator, but already a new pattern is emerging that points the way to a new energy system, away from “baseload” built around coal, gas or nuclear, to a new system built around wind and solar and other renewables.

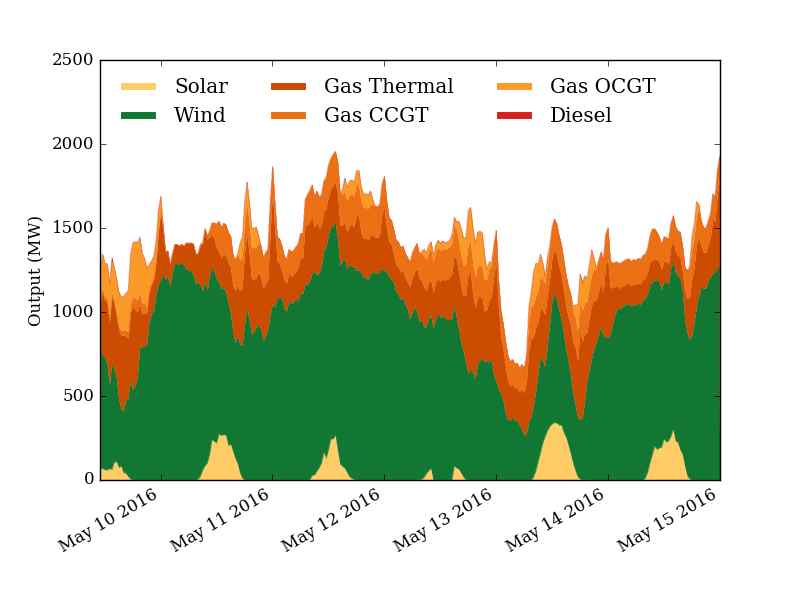

This graph – provided by Dylan McConnell from the Melbourne Energy Institute, shows he first week of production since the closure of the Northern brown coal generator on May 10.

This graph – provided by Dylan McConnell from the Melbourne Energy Institute, shows he first week of production since the closure of the Northern brown coal generator on May 10.

It shows wind energy provided the vast majority of power over the past seven days, supplemented by some rooftop solar, and by peaking and combined cycle gas plants.

This is expected to be the pattern of the future, as energy systems with high renewable energy penetration rely first on variable energy providers such as wind and solar, and then on “flexible” or “dispatchable” energy from the likes of gas, but ultimately hydro, solar towers with storage, and emerging technologies such as geothermal and ocean energy and battery and other energy storage.

Some days – at least in South Australia there will be likely be a lot more solar in the daytime, quite likely up to 100 per cent of daytime demand on occasions. And there will be times when there is a lot less wind. On some days there will be little wind or solar, so the South Australia grid will have to rely on more gas (expensive) or more brown coal from Victoria (dirty and not so cheap) through the inter-connectors.

But in the first seven days, as this graph above shows, the amount of imports and exports has been reasonably evenly balanced since the coal-fired generator was switched off. (White above the line signals imports, green below the line signals exports).

And as this next graph (above) shows, there is not a lot of difference between the level of imports and exports before Northern was switched off, and in the first week afterwards.

More importantly, there have been no blackouts (apart from some minor ones caused by some ferocious storms) and South Australia’s wholesale prices have been comparable (on some days slightly more expensive, on others slightly cheaper) than its mainland counterparts.

In addition, in the first week, the state has probably reduced emissions from its energy system by around 15 per cent, as output from Northern is largely replaced by output from gas fired generators, according to estimates from Mike Sandiford, also from the MEI.

Northern had emissions of 1.1 tonnes of Co2/MWh, while Osborne is rated around 0.64t/MWh (although some gas generators in South Australia, such as Hallett, have emissions of more than 1t/MWh).

McConnell and Sandiford stress that it is early days yet, just one week, but a pattern is emerging. As the penetration from wind energy and rooftop solar continues to grow – their combined share is expected to reach 50 per cent of annual demand later this year – then more dispatchable options will be looked at.

The local grid operator is already looking at options such as large-scale battery storage on its networks, and creating micro-grids along its lengthy and thin network.

Some energy advocate suggest pumped hydro, and there is a major push for solar tower and storage in Port Augusta, to partially replace the coal generators, that could provide power on demand, as well as ancillary services as frequency control for the grid.

Despite predictions of economic doom and unreliable power, the Australia Energy Market Operator has said that the exit of coal will not make the local network more unstable or more unreliable, although it will rely on the two inter-connectors to Victoria.

Last week, renewable energy accounted for more than 95 per cent of demand for a few hours on a Sunday in Germany, the world’s fourth largest economy, but it did not cause any grid issues. Germany, despite its high renewables penetration (actually less than South Australia), has one of the most stable grids in the world.

For more information on the “new base-load” and how renewables will replace the old “base load and peak load” power systems, read this and/or this. Or for the UK, read what the head of the National Grid said about the outdated concept of base load power.

Note: As South Australia’s wind contribution continued to surge in South Australia on Monday afternoon, providing more than 1,200MW of supply – or virtually all of the state’s demand at the time – prices fell to the lowest levels on the main grid, around $16/MWh.

Note: As South Australia’s wind contribution continued to surge in South Australia on Monday afternoon, providing more than 1,200MW of supply – or virtually all of the state’s demand at the time – prices fell to the lowest levels on the main grid, around $16/MWh.

See more live data on our website here.

In Tasmania, however, the need to switch on gas fired generation again after five days of 100 per cent renewable energy sent prices trebling to more than $120/MWh, according to the AEMO price data.