The east coast energy market is now experiencing extraordinarily high prices. Wholesale gas prices have reached such high and sustained levels that it has invoked a mandated cap, although this is still at an eye watering level of $40 per GJ. They are normally around $6 to $12 per gigajoule.

Meanwhile over May wholesale spot power prices averaged over $300 per megawatt-hour in Queensland, NSW and SA. In April they were a bit better but still exceptionally high.

Prices weren’t quite so bad in the preceding months of this year but as shown in the chart below, prices across all the months to date of 2022 are exceptionally high for Queensland, and also elevated for NSW.

Source: Green Energy Markets Analysis based on NEM Review data

High gas and electricity prices – are they the fault of coal, wind and solar falling short?

Some in the gas industry have claimed that the extraordinarily high prices have little to do with them and are in fact a function of shortfalls in generation from coal as well as wind and solar.

Gas prices have only risen, they say, because an unusually high amount of gas has had to be directed into power generation to come to the rescue, due to shortfalls from these less reliable alternatives.

So is this true and what does it mean for how we should respond to our current circumstances?

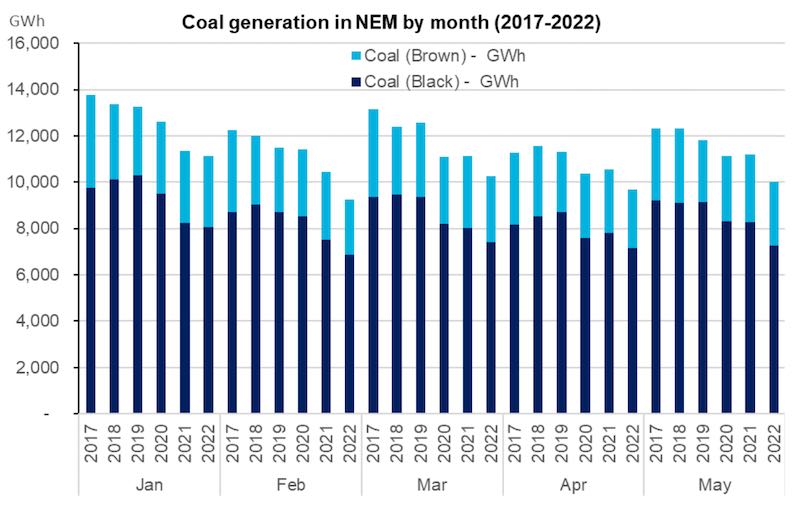

If we look at monthly generation levels by fuel type it is indeed true that coal output has fallen. The chart below compares coal output in each month over the years of 2017 to 2022. Because electricity demand is seasonal and heavily influenced by weather it is a good idea to compare output within the same month across years to evaluate how changes in output have led to changes in market outcomes.

Source: Green Energy Markets Analysis based on NEM Review data

Overall, we can see a very clear trend of steadily falling coal output across every month over the years examined. But in 2022 relative to 2021 there is a particularly steep drop off in coal output in every month other than January.

On average across the months of February to May this year coal output was around 1,000GWh lower per month than in 2021. In addition, it’s worth keeping in mind that January 2022 had noticeably higher electricity demand than 2021, so all other things being equal coal output in January 2022 should be higher than 2021, not lower.

Part of the answer for the lower coal output is that – completely contrary to the assertions of gas industry – wind and solar generation has been higher in 2022 than in 2021. But the other explanation is that coal generators have been suffering greater outages – some planned, but worryingly a lot have been unplanned breakdowns of various kinds.

The chart below shows there is not a single month in which combined wind and solar output has fallen in 2022 compared to its output in 2021. The worst that could be said is that output in May 2022, which was up 103 GWh compared to 2021, didn’t grow in line with the other months of the year, which were up by between 471GWh and 868GWh relative to the same months in 2021.

Source: Green Energy Markets Analysis based on NEM Review data

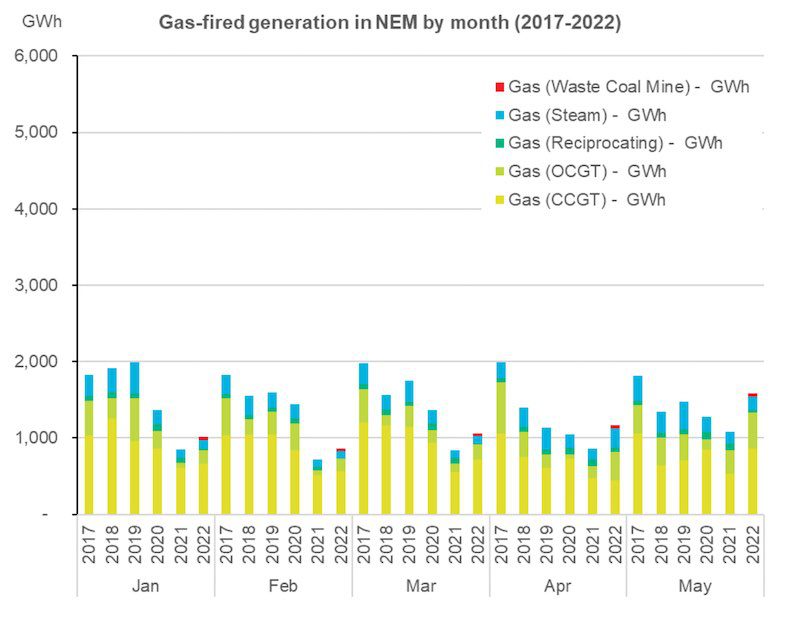

So did gas generation dramatically rise to unusually high levels to save the day in 2022, thereby causing gas prices to spike?

The chart below shows the level of gas power generation in 2022 is not, in any way, unusually high compared to what we’ve seen over the prior five years. Sure, it is higher than the record lows of 2021, but in many months so far this year it is lower than what we’ve seen over the preceding years.

The one month where things were a bit high was May, but output was still lower than what occurred in 2017. It seems hard to believe that the higher gas power output in May this year was something beyond the gas industry’s supply capabilities.

Source: Green Energy Markets Analysis based on NEM Review data

To close the loop, below is the output of hydro by month over the same period of time. Output in May was high relative to prior years, but all the other months were relatively in line with prior years, suggesting it can’t be the explanation for unusually high power prices over 2022.

Source: Green Energy Markets Analysis based on NEM Review data

The reason for high prices is because gas and coal producers can and do charge international market prices

The reasons for very high electricity prices and also gas prices in Australia’s east coast over 2022 have precisely nothing to do with some mythical shortfall in wind and solar output. It also seems rather odd that the gas industry finds it so difficult to supply a level of gas power generation in 2022 that is not much different to what has occurred historically.

What appears to be the real reason for high prices is that both gas and coal miners are charging very high prices for their products because that’s what they can sell them for into international markets.

This is flowing through to electricity prices because outages of coal power plants mean there is far less competition amongst coal producers. So instead, the remaining coal generators, as well as hydro plants, are pricing their own output relative to the very high costs faced by gas generators.

So what should our State and Federal Governments do about this – the less attractive ideas

Unfortunately many of the options dominating our political discourse so far are unlikely to help or come with some serious drawbacks.

Gas operators are already approved to tap new gas reserves and it seems unlikely they’ll charge any less for this gas than what they can obtain by exporting it.

Gas exports could be curtailed and instead this supply could be forced into the domestic market. But the new federal Labor government is concerned that this undermines our reputation as a reliable supplier of energy to our northern neighbours. This could then act to undermine future investment in the country, and it’s worth noting not just in fossil fuels but also a future hydrogen industry.

What should concern energy consumers is that it appears that the solution that energy regulators are encouraging ministers to adopt is to force consumers to pay more money to coal, as well as hydro and gas generators via a “retailer reliability obligation.”

This is also known as a capacity or availability payment. The argument behind this rather counter-intuitive proposal is that if less of the coal generators were suffering outages then we’d have more competition and lower energy prices. We’d also need less gas to go into power generation and therefore apparently lower gas prices.

By paying the generators extra money, not just for the power they actually generate, but also for having their capacity available just in case, they will be encouraged to better maintain their power stations so they’ll suffer less unplanned outages.

Of course, this will do precisely nothing to address the very high coal and gas prices generators face, which are a function of international markets. But in addition, part of the reason for the coal power station outages we’ve been experiencing is planned maintenance.

With these coal power stations getting old, they need more maintenance to remain reliable and that maintenance often requires them to be taken out of service.

Even worse, this capacity payment is really a coal and gas life extension payment. This will deter investment in brand new power plants like batteries that would be more reliable and more flexible and so be a better complement to further expansion of wind and solar power.

So what should our state and federal governments do about this? – The good ideas

Instead of these options our energy ministers need to look at options that would allow us to use less gas and provide greater competition to the existing generators.

The first item on the agenda that could provide immediate relief doesn’t actually require building anything new.

At present there are many hundreds of megawatts of wind and solar plants that are fully built but are being constrained from exporting their full output due to what has become a very drawn out grid connection commissioning processes imposed by grid operators.

This commissioning process is intended to ensure the grid operates in a stable manner, but everyone agrees it is taking far longer than it should. Ministers must start demanding answers for how this process can be sped up and provide the appropriate resources to help it happen.

The second item on the agenda should be helping low income consumers get access to more energy efficient equipment and housing.

At present, there are almost no meaningful standards for ensuring the energy efficiency of rental properties in this country. Admittedly, Victoria does have a standard. The problem is it is nothing short of pathetic (a 2 star efficient gas heater is all that needs to be provided).

The end result is that rental properties in this country often have little to no insulation in the ceiling, they almost never have solar PV systems, and they contain inefficient heaters and water heaters.

Consequently, more people die of cold in their homes in Australia than they do in Sweden. Also more energy is consumed to heat the average home in Victoria than in the far colder UK and Holland.

Fixing this problem is not expensive – $10,000 of upgrades per home will leave renters with comfortable homes and affordable energy bills – permanently. It will also free up more gas for Australian manufacturers.

Fixing energy efficiency of rental properties will take a few years, however, and many need relief in the short term. Also manufacturers also need assistance. Cash assistance is obviously very fast, but it has to be paid for, and the federal budget deficit is already very large.

This is where serious consideration should be given to a short-term Putin Windfall Profit gas levy. Where gas is exported at very high prices, for example $20 or more per gigajoule, it is not unreasonable for the government to take a share of that windfall profit on behalf of the Australian people, who ultimately own the gas resource.

This could be used in the first instance to provide short-term cash relief. But to leave a lasting legacy it should also be used to help finance energy efficiency upgrades for manufacturers and households.

This will mean we are far less vulnerable to such international energy shocks in the future. It will also lower carbon emissions, unlike almost all of the other options currently being actively debated at present, which will increase emissions.

Tristan Edis is Director Analysis and Advisory at Green Energy Markets. Green Energy Markets assists clients to make well informed investment, trading and policy decisions in energy and carbon markets.