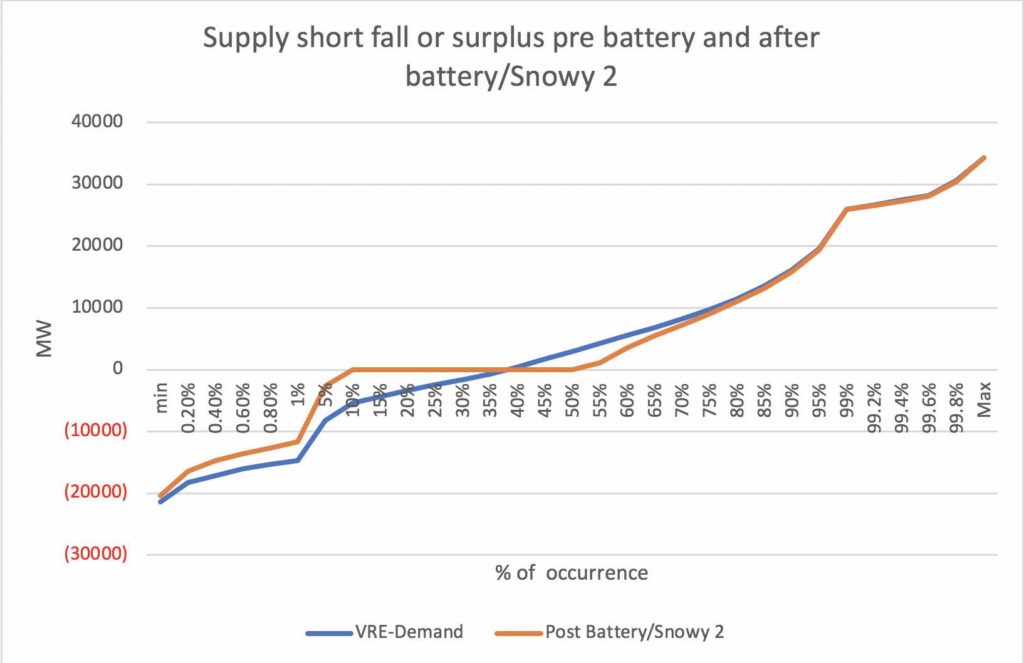

This note builds on previous work looking at the seasonality issues of high (> 90% share of total electricity energy produced) wind and solar penetration in Australia.

We are more pessimistic than the likes of Andrew Blakers and the ANU team, partly because ITK’s model is based on scaling up actual output as compared to using wind speed data over the entire National Electricity Market (NEM).

By building a system that over-produces wind and solar relative to demand in the past 12 months, and by employing about 15GW of 4-hour batteries we find that well less than 10TWh of “backup” energy is required.

In our spreadsheet model the longest duration that the backup is needed for is 12 hours. However, the size of the backup in power terms is about 41GW.

So a lot of power is needed over and above the batteries, but for relatively short duration. Indeed the vast majority of the time it’s needed only for a couple of hours. Also, in our system there is something like 40TWh of spilled energy which could of course go to making hydrogen and replace gas altogether.

Even when total wind and solar output over an entire 12 months is equal to 120% of demand we find that as much as 650GWh of storage would have been needed during 1 week in July if there is no gas or equivalent form of firming power.

That 650GWh is the excess of demand over wind and solar production during that week. That’s about 162GW/4 hr storage which is clearly implausible.

It’s not just the energy but actually the implied power (our model does not measure power directly), which is in the order of 40GW above what the VRE sources are providing.

Many variations of the model are possible.

For instance, there can be less spilled energy at the expense of more gas generation, more batteries reduce the quantity of gas generation but not its capacity requirement.

It’s worth noting here without further comment that Blakers and the ANU team who modelled using wind data over the entire NEM rather than actual wind output found that less firming capacity and storage was needed for 100% renewables and no gas or other long duration storage.

The following is an extract from their 2017 publication:

And nor do we allow for offshore wind, which although much more expensive than onshore, is apparently much better correlated with demand and also less correlated with onshore wind and so could still end up cheaper to the system by reducing storage investment.

In general our modelling is just a way of providing some perspective on some key questions.

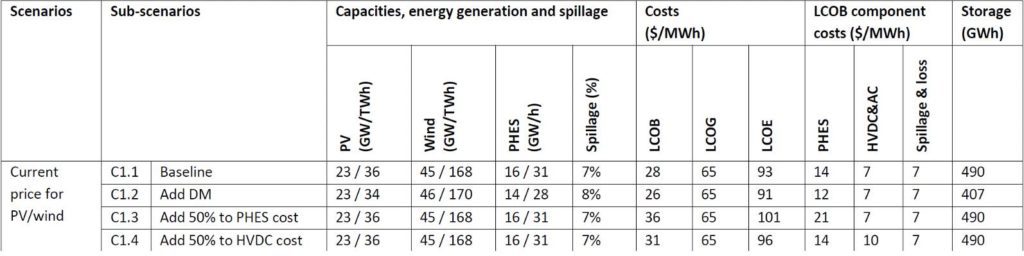

ITK evaluated the various choices by assigning some very crude costs to each of our assets. A summary of the costs are;

Note that in ITK’s usual jumbled fashion, the VRE (variable renewable energy) costs are the additional costs of new supply, but the battery and gas costs are the total costs. In fact there is already about 40 GW of gas installed across the NEM and the question is how much is suitable for this firming role.

We don’t account for any transmission, round trip efficiency, line losses etc.

Total cost is not an NPV (net present value) as it assumes all the capacity was installed overnight at something like today’s cost. The annual operating costs very crudely calculated are multiplied by 15 to give some kind of approximation to NPV, but are still small relative to capital.

We assumed a carbon price roughly equal to the European price, a number that would no doubt cause Queensland nationals to attempt a coup d’etat if ever adopted in Australia. When it comes to carbon, Queensland Nationals are firmly on the side of China and very anti-European.

Originally, there was some idea of using a linear program or more specifically the Excel “Solver” to optimize the solution.

However, in practice it’s been easier to just play around with a few variables by hand. That is the ratio of the wind and solar, the quantity of spilled energy, and the quantity of batteries.

As well as the total system cost, we have had an eye on the total of gas generation and carbon emissions. The purpose of this analysis was not to find “the” solution but to understand a bit about what was possible and the various tradeoffs.

Some of the many significant limitations of this model are that it doesn’t allow for demand growth, and indeed only uses the actual data from one fairly unusual year, albeit the very recent 12 months ended May 10, 2021.

Demand growth is likely to increase the demand for firming power. Equally, the actual wind and solar production from the past 12 months, half hour by half hour are used and these will be different in other years. All of this could be overcome if we had more time to spend.

The model also lacks information on wind speed data that could optimize total wind output in a way that various other studies have done. And, it should be noted, we did not consider other assets like demand management.

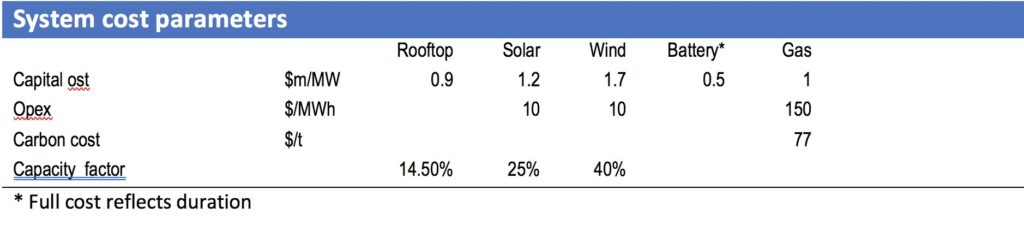

The figure below compares a few alternatives of what we did model.

We subtracted the about $41 billion of gas capacity cost from the total on the grounds that most of it is already installed. The lowest cost scenario is E which overbuilds wind and solar and uses as little battery as possible.

Nevertheless, we prefer scenario A and simply observe that in many things consumers don’t always choose lowest cost.

Note that for all scenarios the minimum level of VRE production is about 1 GWh over 30 minutes and in all scenarios there is a shortfall of 23GWh in the worst half hour of demand to VRE. To produce 23GWh in 30 minutes requires around 46 GW of power with every unit working.

It’s worth noting in regard to the spilled energy, that if it might go to making hydrogen.

If so, we estimate spilled energy could produce enough hydrogen to produce say 13-14 TWh of firming power, ie it would allow us to do away with gas entirely. But the capital costs would be high and beyond observing it can be done we make no further comment.

Using our Scenario A the impact of the 15 GW of battery is shown in the following figure.

The figure is expressed as MW but is actually MWh in 30 minutes. The figure shows the percentage of half hours in a year for which the difference between demand and VRE was less than X %.

A 15GW/4 hour battery can take care of the excess or shortfall of VRE about 50% of the time and reduce the need for firming power or quantity of spilled energy for some of the rest of the time. But it can’t do anything about the extremes at either end.

Snowy 2.0 is also contributing. It benefits from its long duration but can only provide 1000 MWh in any 30 minute interval as it has 2GW of power capacity.

For ITK’s scenario, which is not the lowest cost one as we model it, the following chart shows that the role of gas is to provide power and not energy. The maximum run time for gas is 12 hours and most of the time gas is only running for an hour. It just needs to deliver a lot of power in that hour.

You might say therefore why not build more batteries, they are perfectly suited to running for an hour. The answer is that in the way we use batteries in this model they are going to be empty when needed for these energy droughts.

The model

The model works using the actual 30 minute data for the 12 months ended 10 May 2021. For every half hour we take the actual rooftop solar, utility solar, wind and operational demand.

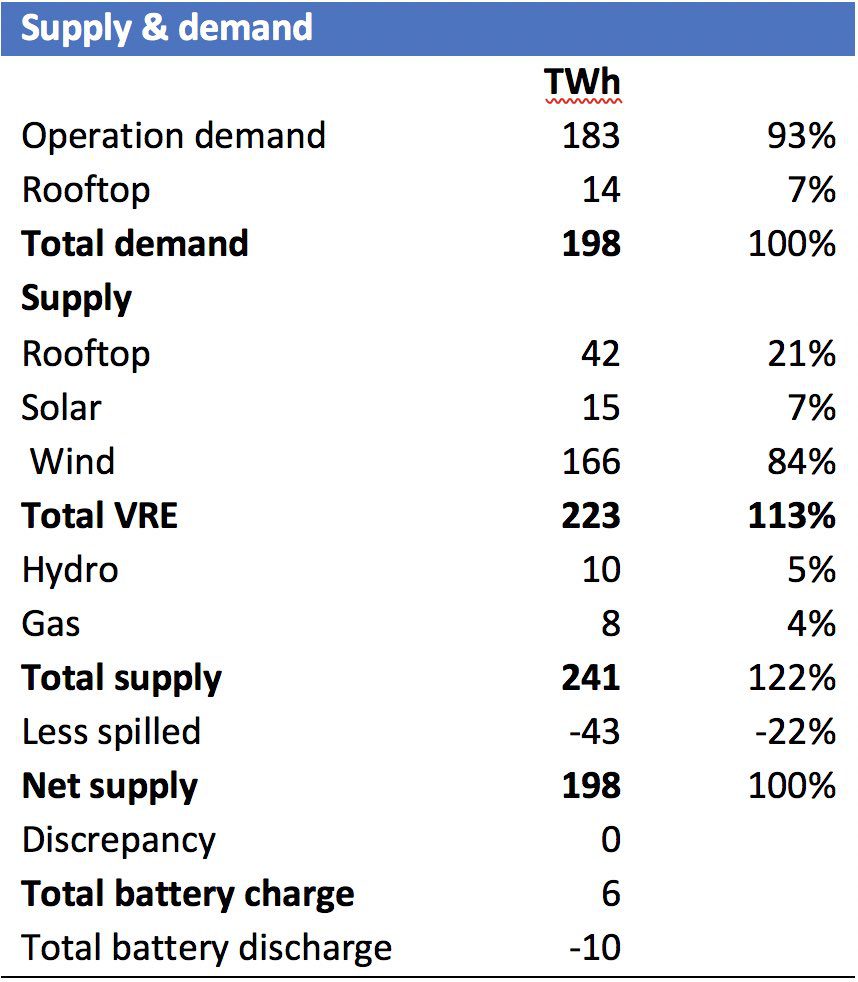

Variable Renewable Energy [VRE] is the sum of rooftop, solar and wind for each half hour. Demand is operational demand plus rooftop.

We define a decarbonized grid as one where total annual VRE is >= Demand.

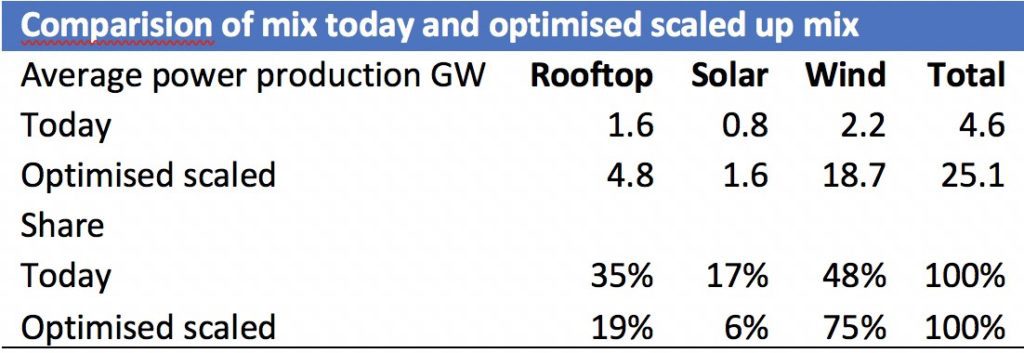

For the 12 months ended May 10, 2021 total annual VRE was about 40TWh compared to Demand of 198 TWh. To scale up VRE we multiplied the actual half hourly output by some factor such that total VRE was at least 5 times greater than actual. In our preferred scenario the factors were 3 for rooftop, 2 for utility and 8.5 for wind.

We then subtracted the scaled up VRE from demand. If there was a shortfall we first used hydro, but operating at a rate no greater than 5GW, and total output limited to last year’s actual 14TWh. Then we used battery.

If there was still a shortfall it went first to Snowy 2.0, and if there was still a shortfall it went to gas. If the battery was empty gas was used to recharge it if there was enough gas power available.

If the battery was full we simply assumed it could be discharged to ground to 50% within an hour. An improvement would see the battery discharge back to the grid resulting in more spilled energy or alternatively being used for hydrogen.

There are limits to what a part time financial analyst can do in limited spare time.

Should we build more wind and less solar?

We find that increasing our current wind and solar production to 100% of demand in the same wind/solar ratio as over the past 12 months will result in a very poor correlation with demand both for the average day in the year and seasonally.

We’d produce a huge amount of solar in the middle of the day, a huge amount in Spring and early Summer but a relative short fall in Winter and of course none at night.

By contrast if wind is grown much more strongly than solar the overall fit between supply and demand is much improved. That improvement holds for the average day and also seasonally.

We compare as an index the current NEM wide VRE profile with a profile that grows wind much more than solar as we go forward. If solar was way cheaper than wind it might still make sense to have lots of solar and put the excess into storage.

But we argue that wind and solar LCOEs are relatively close at the moment. On top of that it may be that wind is actually more land use friendly than utility solar, although that is just a thought bubble.

And our “Energy sources and uses table” for the ITK preferred scenario is.

How much battery compared to gas or hydrogen

Recently, we wrote a note that stated:

- The process which led to the investment by Snowy Hydro in Kurri Kurri was poor from a perception point of view. It looked as if it was driven by Federal Government ideology. No proper commercial justification or rationale was offered by Snowy management, not in the way I am used to seeing at least. No explanation of how the project would earn a return was offered. It looked expensive compared to the subsidized cost of the EnergyAustralia brownfields expansion at Tallawarra.

- Snowy would end up with a very large share of the firming market, at least the long duration firming market; and

- Batteries could do a lot of the job that gas firming has traditionally done and would be able to under cut gas in terms of variable cost.

- Gas might/would end up with 10% or less of the total firming market.

We don’t resile from those comments.

That said, ITK has always been at pains to point out that there is a role in the market for long duration firming and it lowers overall system cost.

All of our previous work has pointed to the strongly seasonal nature of VRE in Australia and the likelihood that there would be shortages in June and July and excesses in October and November.

If you want to read an academic reference, albeit relating to the USA market, a good start might be

“Role of Long-Duration Energy Storage inVariable Renewable Electricity Systems” Dowling et alia in Joule September 2020. Here is a quote from a summary of the article which is exactly in accord with the results of the work ITK has done. LDS is long duration storage:

“We find that the introduction of LDS lowers total system costs relative to wind-solar-battery systems, and that system costs are twice as sensitive to reductions in LDS costs as to reductions in battery costs. In least-cost systems, batteries are used primarily for intra-day storage and LDS is used primarily for inter-season and multi-year storage. Moreover, dependence on LDS increases when the system is optimized over more years. LDS technologies could improve the affordability of renewable electricity”.

See RenewEconomy’s latest map resources:

Large Scale Wind Farm Map of Australia