Among the many inverter and battery storage technologies on show at the All-Energy Australia conference and exhibition last week in Melbourne was a few of the latest offerings from Israeli inverter company, SolarEdge.

SolarEdge, which like many other big players in this sector, has lately turned its focus to developing inverter technology that supports solar power storage and smart management, and has targeted Australia as a key market in this space.

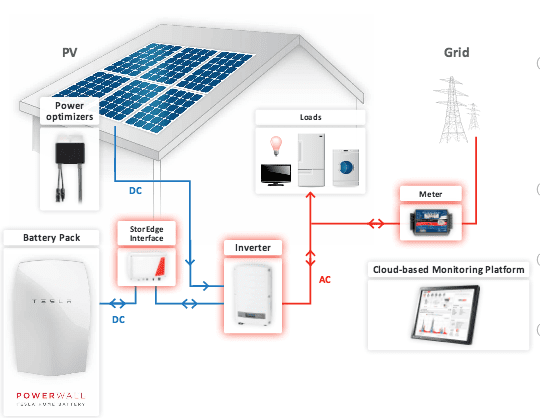

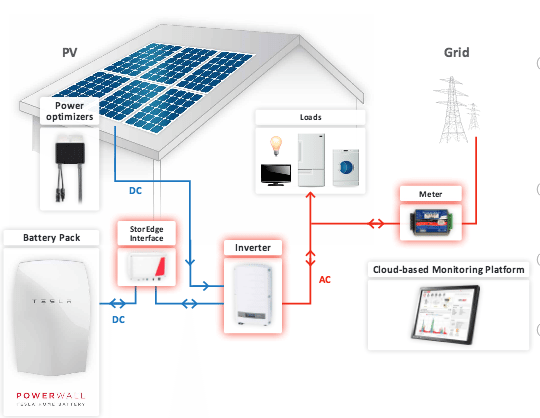

Its StorEdge product, which was launched in Australia at the Melbourne event on Thursday, is exactly that: an inverter solution that supports batteries – or at this stage, the well-hyped 7kWh Tesla PowerWall – allowing residential solar customers to store and use as much of the energy they generate from their rooftop PV as possible, and to monitor this via an energy management interface.

“Australia is one of the markets where self-consumption systems make a lot of sense,” said Lior Handelsman, SolarEdge’s vice president of marketing and product strategy, in an interview with RenewEconomy on the sidelines of the All-Energy conference.

By this he means that, with high electricity prices and low feed-in tariffs, it makes sense for those households that already have solar installed, or are planning on installing it, use as much of their solar electricity as possible, instead of selling back to the grid for a fraction of what they pay for grid power.

“I wouldn’t say it is ‘use it or lose it’,” said Handelsman, “but it is ‘use it or almost lose it’.”

It is not an insignificant cost to add storage, he adds, but the advantage is that it instantly makes the solar energy you are generating worth around five times more.

Handelsman explains: “So what the storage platform does, the inverter has a metering function, it measures the amount of electricity the home consumes, and then whenever it is that there is more production than consumption, instead of feeding energy into the grid, it will store it into a battery… and then, after the sun goes down, or any time you have more consumption than production, that battery is used to maximise self-consumption.”

As to the cost of the SolarEdge StorEdge system, Handelsman couldn’t say exactly what the cost would be in Australia, but said it would mostly be made up of the cost of the Tesla battery, and might add between $4-5,000 to the cost of a rooftop solar system.

“You buy the storage platform, our inverter, our meter, you connect that to the solar system – using our power optimisers on the roof – and then you have the Tesla battery, or in the future other batteries.. to maximise self-consumption,” he said.

Of course, the Tesla battery is not yet available in Australia, but Australian customers of SolarEdge, as a partner with the California-based company, will be prioritised once they are ready to be dispatched here, according to Handlesman.

“What we tell people is that they can basically buy the SolarEdge part of the system now, and add the battery later,” he said.

Handelsman also said that one of the reasons his company chose Tesla as its first partner for the roll-out of its StoreEdge product was that the PowerWall was an “outdoors product”, whose lithium-ion chemistry did not – unlike most of its competitors – deteriorate rapidly in performace at above 25°C or below 5°C.

Another product SolarEdge was launching at the All-Energy event on Thursday was its 26.7kW HD Wave commercial-scale inverter, an incredibly lightweight specimen – 16 times lighter than the next smallest and most efficient inverter in the industry, which is 25kg – due to its use of digital technology in place of heavy magnetics.

“Inverter evolution has been slow,” said Handelsman, on a technological growth trajectory he compares with televisions.

“The evolution of TVs was also slow, because televisions had this huge tube inside, as well as glass and other large and heavy components.

“But eventually, someone found a way to make flat screen TVs and they very quickly become larger, lighter, higher quality and cheaper.

“We think (the HD Wave) is a revolution in inverter technology,” he said. “The only thing limiting us from making it smaller is the processing power. But in two years, processing power will be cheap, too.”

“Inverters are becoming smarter and smarter, more grid interactive, more user friendly… starting to incorporate batteries and energy management,” Handelsman told RE.

In just a couple of months, he added, it will be standard issue that “when you get to the point that you have a full battery, inverters will start using the excess PV to turn on appliances in the home,” to heat and cool it, or to heat water, as a back-up form of energy storage.

“Australia is a focus market for us,” he said. “It’s already the third-largest residential market in the world, after Japan and US.

“And inverters are not yet a commodity market, which allows me to compete.”

“It’s a very interesting market. It seems to be, today, stable, in the sense that the regulatory environment is clean.

“I think the market is a good market, it’s an evolved market, it’s a market that appreciates value. It’s a very competitive market, also, but you can’t be afraid of competition.”

To this end, Handelsman says SolarEdge has more than doubled our team in Australia in recent months, establishing a larger, new office in Melbourne.

He says, for now, the focus is on Australia’s residential energy storage market, which he says will eventually be a strong market driver.

“And we have one of then best storage offerings in the market. And then our commercial inverter for the commercial market is also going to compete very nicely.”

Elsewhere in the world, Handlesman describes the UK – and more broadly, a lot of – as a market with some question marks around it.

“I personally think it’s going to be a market where solar makes sense even without the incentives, but, you know, all markets react the same to incentive cuts. There is a psychological loss aversion mechanism (that kicks in) and people stop buying.

In terms of storage, the reduction of feed-in tariffs is good news, he clarifies. “But any cuts of any incentive in any market has at least a six-month negative effect. It’s psychology. Loss aversion is a very strong mechanism.”