Following on from the first article in this series looking at the opportunities in addressing the G= generation value stream todays article will focus on the R = retail, T= technology and H= hardware in the esoteric energy blockchain “Grantham” taxonomy.

I realise that this does not address the elements in the exact order as outlined above but given that technology and hardware were more appropriately explored as part of the retail value stream I felt it was best to deal with them in this article.

As mentioned previously we have taken a snapshot of the 120+ energy blockchain projects being conducted globally focusing in on three of the companies targeting the Australian market and analysing their platforms through the potential impact on a customer’s bill.

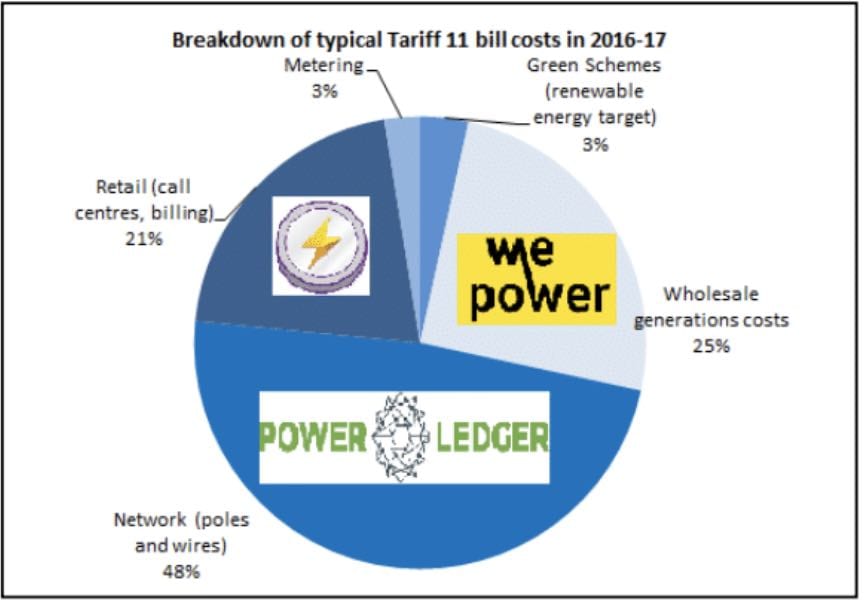

The promise of blockchain has long been to cut out the bloated and inefficient middleman so it is natural that platforms would emerge targeting the retail value stream.

In Australia this typically represents about 20% of a customer’s bill, but it is difficult to distinguish its exact contribution given the vertically integrated nature of the large gentailers.

Probably one of the main immediate benefits that retailers could seek to exploit with the blockchain relates to the potential for reducing compliance costs.

The fact that smart contracts could manage everything from carbon emissions, renewable energy certificates, tariff structures along with a load of regulatory compliance requirements has the potential to significantly improve their productivity.

The retail value stream would also benefit from significantly improved working capital because retailers could now collect the payment at exactly the same time as the energy is delivered rather than waiting 90 days to send a bill out and then another 14 days for payment.

Another factor likely to improve the working capital management of a retailer is the decreased counterparty risk that having their transactions on the blockchain would provide. If payment is transferred at the time the electricity is consumed then the risk of unpaid consumer liability is much lower.

The potential for the development of ewallets and frictionless digital transaction tools linked to retail accounts will also make payment processing easier for customers and at lower costs relative to some traditional payment processes especially if it can be easily integrated into mobile platforms.

If consumers are able to participate in wholesale markets it is also likely to add additional price liquidity where trading over the blockchain is encouraged.

This additional price liquidity if there is enough solar and storage on the grid could allow for the emergence of smaller niche retail offerings.

While this is unlikely to occur in Australia anytime soon there may be oversupplied distributed energy markets where a blockchain could facilitate non-vertically integrated offerings (ie retail only) along with more market fragmentation.

Risks

While there are certainly opportunities in the retail value stream for innovation with blockchain there are also some significant potential risks relating to the regulatory environment that they operate in.

Could a blockchain really deal with all of the complexity and exemptions that a regulator would require such as

- How it deals with priority customers with dialysis machines etc

- Power of choice legislation (ease of unpicking them from blockchain)

- Rules about not immediately disconnecting them from the grid when the smart contract does not receive the payment

- Rules for if the smart meter data stops being transmitted or gets corrupted

- Protections for the consumer in the event that the retailer goes into liquidation

As discussed in our the BZE interview (link below) we did with Wayne Pales author of “The Digital Utility” one of the significant headwinds they are likely to face when dealing with established retailers will be the need to run both new and legacy retail platforms at the same time.

So it is likely that it will only be attractive to new retailers seeking to enter a market unless they can find an efficient low cost strategy to migrate users and avoid the ongoing costs of maintaining both the new and legacy systems.

Technology

These technology (data management) related factors are not specifically associated with an average bill and do overlap somewhat with both generation and network value streams but I felt that their best fit was with the retailer given their closer relationship with the customer.

The opportunities are obvious so this section will focus mainly on some of the risks associated with scalability, privacy and cybersecurity which must be addressed by any platform hoping to enter the market.

It is important to note looking at these issues through a new retailer entrant lens (especially privacy and cybersecurity) that the outcomes for any potential retailing product are likely to be binary ie if you don’t satisfy them you are not allowed to enter the market.

There is also very little expertise at present both on the regulatory side (AEMO) and consultancy side (Accenture, Deloitte, PWC etc) in terms of managing and advising on these risks for both retailers and networks looking to implement these platforms at scale.

Platform Specific Risk

- Can the platform scale

- How interoperable is it with the current system networks/retailers are using

- How resistant is it to hacking (both physical tampering and systemically)

- How will it protect a user’s data and identity while at the same time advertising to the network a price signal for either consumption or demand management

- Will it be flexible enough to meet local laws relating to where data is housed

- Will customers own their data and be able to monetise it on their terms ie not facebook

- How reliant is it on the stability of the internet/5G and what happens when it goes down

- How easy is it to migrate users from legacy higher cost systems retailing platforms to newer low cost smart contract based platforms

The scalability of how data is managed is going to be key for any application using smart meters and will become vastly more complicated if they move to some sort of near real time dynamic pricing model where nodes or microgrids are self-stabilising.

At the moment grid operators pull data about every 15 mins and if we want to get that down to 1 min that is 15x more data every 5 sec is 180x which given they are struggling with the data that they have got is going to be quite a leap.

Laws relating to where data is housed could also determine whether public or private blockchains are permitted in certain regulatory environments.

If as an example Energy Queensland had some legislation where all its data needed to be kept in the state of Qld then that may exclude any public blockchain application.

It would also have the perverse effect of potentially making it less secure because the nodes would need to be established in Qld rather than spread around the world.

Who owns and gets to monetise the ownership of the data will also come under increased scrutiny in any customer centric model given the recent issues surrounding how large companies like facebook and google profit from their users data.

There are already people out there looking at the specific electrical fingerprints that devices have and if a third party owns this data you may get an email on your way home advertising a special on fridges only to find that yours has just stopped working.

Some users may not mind this but a retailing value proposition with customers at its centre is likely to want to put them in control of this data rather than the retailer to avoid the risk that they may feel they are being spied on.

Systemic Risk

I have highlighted only a small number of the technology related risks relating to data and privacy but it is also important to highlight the systemic risk that all these new blockchain based platforms face.

Given the highly regulated and political nature of energy both in Australia and globally it will only take one platform hacking, failure or regulator embarrassment and the whole sector will be effected.

One possible solution to mitigate this risk would be for the industry to work together with regulators to establish some sort of equivalent of a star rating system. This would allow for an agreed minimum standard which could then be applied by a regulator to any new platform entering the market.

In the same way the solar energy council certifies the standard of solar PV products this protects both consumers and the market generally a similar body may be needed as new entrants seek to enter the blockchain energy landscape.

Hardware

Smart Meters

One problem that all blockchain platforms face is the need for near real time data which in the absence of a smart meter (or equivalent low cost device) at the consumer level represents a significant risk for the rollout of any blockchain based retail offering.

In the Australian context this makes states like Victoria along with NSW with their competitive retail environment and smart meter roll out programs a more attractive market for these platforms seeking to gain traction.

On the other side of that coin if the state or local government were to mandate the rollout of “dumb” smart meters that could not provide near real time data for conversion to a price signal then the value of the blockchain retailing offering would also be diminished.

If it only collects data every half hour and then only sends it to the grid twice a day then the ability to put in place the price signals to slurp up the cheap solar in the middle of the day won’t be there.

Good analytics around the real time price signal will be needed to extract the full value for consumers when combined with the plethora of IOT devices coming onto the market to manage demand from pool pumps, hot water systems and air conditioners.

Vertical integration

Vertical integration of hardware with specific blockchain protocols is going to need to be something that both customers and regulators (both competition and network) are going to have to keep a close eye on as these platforms are deployed.

Regulators will need to be mindful that specific hardware deployed in greenfield sites do not adversely impact the competitive landscape they are responsible for protecting.

If specific hardware rolled out in a way that tied or biased customers to a particular retailing product while great for creating customer stickiness would probably not be good for consumers in the long term.

While there is nothing wrong with consenting adults choosing blockchain platforms linked to particular hardware it is certainly something that customers need to understand and be aware of when weighing up the switching cost and benefit of a particular retail product.

Looking at the issue of hardware from a competitive landscape perspective in the case of Electrify Asia they are vertically integrated with their powerpod device.

Assuming all the retail competition issues are resolved if this device is superior to the other IOT devices on the market in terms of price and functionality then it may offer them a significant competitive advantage.

Having, if it is inferior to other hardware products then it will create a competitive disadvantage.

It is also relevant to note that other interesting vertically integrated hardware offerings are also entering the market like Solara who are trying to create value at the panel level rather than the IOT device/smart meter level.

For a link to additional content covered in this series of article on BZE radio please follow the link to the interview we did with Wayne Pales author of the Digital Utility here

Matthew Grantham is a guest contributor for RenewEconomy. This is the second in a three part series on energy blockchain technology.