Australian plans to export green ammonia for co-firing in Japanese coal generators have been questioned in a major new report by BloombergNEF (BNEF) that raises doubts about both its economics and its emissions savings.

Japanese utilities have been exploring the case for ammonia-coal co-firing, retrofitting their existing coal power plants to allow ammonia to burned alongside coal. Australian companies and governments have been jockeying for position to secure green ammonia supply deals for the Japanese market.

Japan signed a historic deal with Australia in January of this year to import renewably-generated hydrogen and ammonia, and billions of dollars of investment has been earmarked for the market.

Australian companies targeting the green ammonia market for co-firing in Japan coal plants include AGL, Dalrymple Bay Infrastructure and North Queensland Bulk Ports Corp, and it is one of the main target markets for the massive 27GW Asia Renewable Energy Hub proposed for the Pilbara by Intercontinental Energy and CWP.

Australia can supply cheapest green ammonia

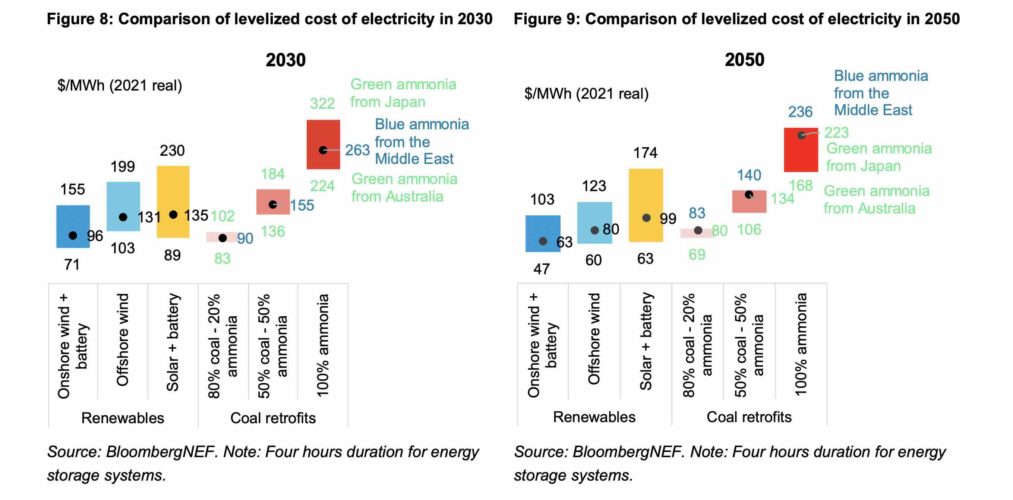

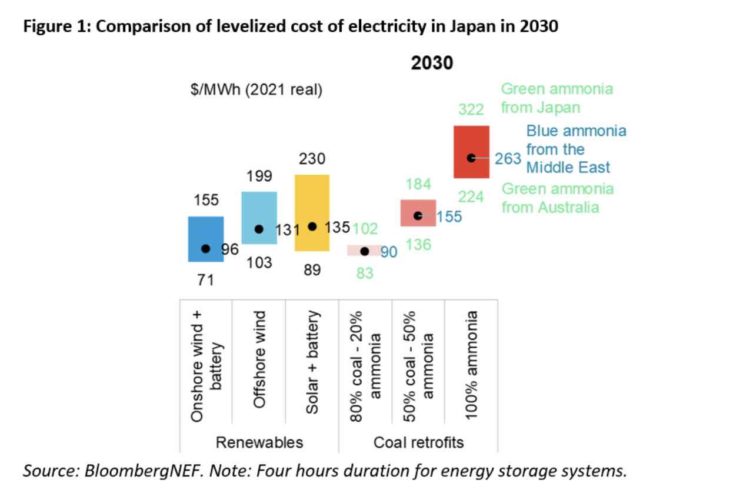

The report by BNEF says that Australia – thanks to its low cost wind and solar – is well placed to deliver the cheapest green ammonia – well below Japan and even blue (or fossil fuel) ammonia from the Middle East.

But the report says it will still be very expensive compared to renewable options, and will require a huge carbon price to justify.

But the report says it will still be very expensive compared to renewable options, and will require a huge carbon price to justify.

“Retrofitting coal plants to burn ammonia is too expensive, especially with a high co-firing ratio,” said Isshu Kikuma, Japan analyst at BNEF and lead author of the report.

“Japan would be better served accelerating the deployment of renewable energy to decarbonize its power sector.

“Coal power generation is currently used to provide baseload power, but this should not be the case for ammonia co-firing technology given its poor economics.”

BNEF questions emissions savings from co-firing

The report also raises concerns about the emissions value of co-firing with green ammonia. It says this will cut CO2, but lead to emissions of other greenhouse gases such as nitrous oxide, whose global warming potential is 273 times larger than that of CO2 for a 100-year timescale.

“BNEF’s analysis also found that a coal power plant retrofitted to co-fire ammonia at 50% or lower blend rates still emits more CO2 than a natural gas fueled combined cycle gas turbine power plant.”

(It should be noted, however, that initial tests of ammonia co-firing at the IHI Aioi Works in Hyogo Prefecture, Japan, showed no net increase in the output of NOx at a 20% ammonia co-firing rate).

Japan has a relatively large fleet of coal power plants, generating 30% of its energy supply in 2021, and its big utilities see co-firing ammonia with coal is seen as a less costly transition pathway, requiring fewer decommissions.

They also insist there’s limited land for building renewable infrastructure, making ammonia co-firing a more straightforward strategy.

Big carbon price required for green ammonia

Alarmingly, the Japanese government introduced a new classification in May 2022 recognising hydrogen and ammonia as non-fossil fuels from April 2023 onwards, regardless of the production method – suggesting so-called ‘unclean’ ammonia and hydrogen could be used without constraints.

The BNEF report says the carbon price required to make green ammonia co-firing economically viable in 2030 would be at least 20 per cent. By 2050, the carbon price needed to make 100% ammonia-fueled retrofitted coal plants economically viable could be reduced to around $159/tonne of CO2.

The BNEF report does say that the falling cost of renewables in Australia will eventually mean that retrofits co-firing green ammonia imported from Australia to be the cheapest ($69/MWh) out to 2050.

“The retrofits burning 20 per cent green ammonia from Australia could become cost competitive against CCGT (combined cycle gas) in 2040 and offshore wind in 2050,” the report says.

But it also warns: “Yet, 20 per cent ammonia co-firing would only cut CO2 emissions by 20 per cent and emit more CO2 than CCGT.”