This year, the retail part of the electricity sector will be getting lots of official attention.

Professor Alan Finkel’s review is understood to be interested in retail. In Victoria, Professor John Thwaites and Mr Terry Mulder will review this part of the industry. Nationally, the AEMC will be producing their study of the competitiveness of the retail sector, under the supervision of new Senior Director.

It is appropriate to scrutinise this part of the electricity sector: many, perhaps most, small customers in Australia seem to be charged more for electricity to be sold to them, than they are for electricity to produced. This is weird and explains in part why electricity prices in Australia compare so poorly with those in other countries.

But it is difficult to work out what retailers are actually charging for their services, compared to the other parts of an electricity bill (network charges, wholesale charges and environmental charges). For example:

- Network charges are visible through published tariffs (for larger customers, network charges are itemised on their bills).

- Wholesale charges can be reasonably estimated based on spot and contract market data.

- State and federal environmental charges can be reliably estimated.

But retailers’ charges are not itemised on customers bills. The retail charge has to be derived by backing out the network, wholesale and environmental parts of the customer’s total bill. And customers do not pay the same price.

There are currently 31 retailers that together make more than 8,000 different offers to the circa 8.3 million connections in the deregulated small customer markets in New South Wales, Victoria, South Australia and South East Queensland. Many of these retailers change their offers quite often during the year.

Since April last year MarkIntell has been keeping track of all retail offers through software that automatically collects all the electricity price fact sheets of these retailers (from their websites) and then mines the fact sheets for the data they provide on prices, solar charges, exit fees and incentives.

So, now it is possible to see much more clearly what is going on in the retail market for different types of customers on different retail offers.

In the interest of a more transparent market (competition thrives in the sunshine) we developed the MarkIntell Residential Indices (MRI) to show how electricity bills and the break down of those bills into their components are change over time.

MRI contrasts prices and retailer charges on the Standing Offers of the three biggest retailers in each state, the cheapest Market Offers of these three biggest retailers and the average of the two cheapest offers from all retailers in each state.

In the development of these indices we have been guided by the best practices elsewhere. In Britain, the energy regulator has published similar indices for the British market, for the last four years. Similar excellent retail market monitoring can be seen in the publications of the Council of European Regulators.

Indices – in any market – are generalisations. A good index provides a useful feeling for a market and, as long as its calculation is consistent, provides a reliable picture of changes over time.

For MRI we assume a 4,800 kWh per year customer – a typical household customer. And we assume the customer does not have controlled load, solar panels or batteries. In due course we may publish indices that also cover these market segments.

MRI will be available through Reneweconomy. You can find it here.

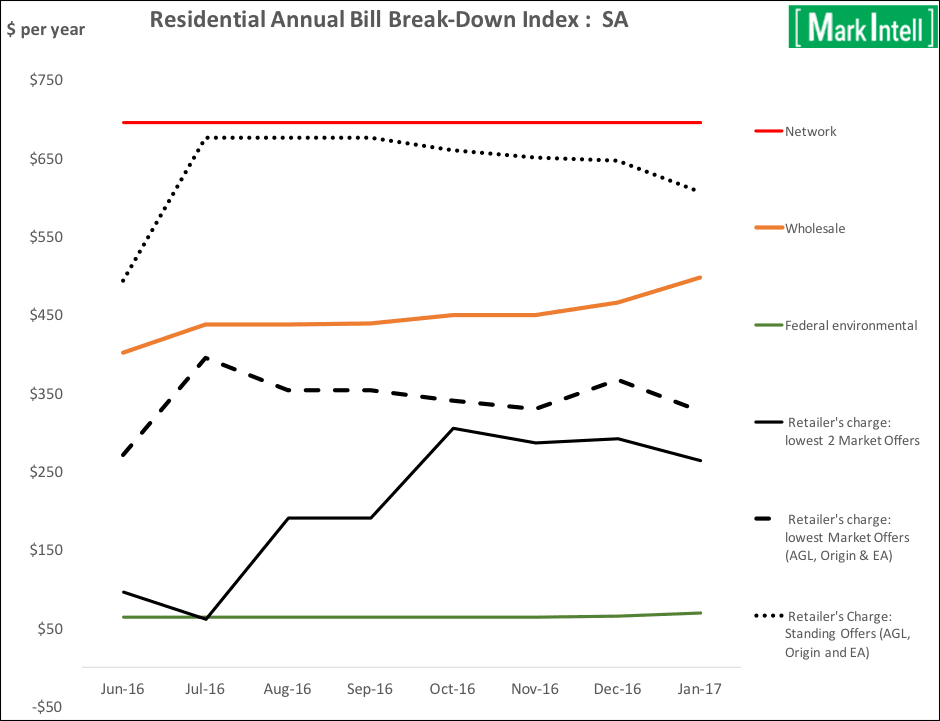

The package of eight indices for the period to the end of January 2017 can be found here and will be updated each month in the first week of the month. The Residential Annual Bill Index (for South Australia, below) shows that bills on Standing Offers jumped up in July last year and, as expected have stayed about the same since, increasing again at the end of last year.

The average of the big three retailers’ cheapest Market Offers also jumped up in July and since then have stayed about constant. But perhaps the most notable feature in the index is that the cheapest offers from all retailers have been increasing since July and are now much the same as the cheapest offers from the big three.

It is widely advertised by government officials, some customer groups and retailers that you can get better deals by shopping around. But the index for January in South Australia is now showing only a small gap between the cheapest offers from the Big Three retailers and the cheapest offers in the market.

Big Three retailers might be looking at the new entrant retailers’ offers and feeling pretty comfortable right now: where is the competitive threat (on prices at least). Some equity analysts have made similar comments in their assessment of the valuation of these retailers. I wonder what consumers, solar and battery vendors, and of course policy makers think of this?

Stepping into the analysis of bills, the Residential Bill Break-Down Index takes the retail bill and strips into retailer, wholesale, network and environmental charges. It shows the annual charges for network, environmental and wholesale charges and then shows the retailer’s charge:

- firstly assuming retails bills are based on the average of the Big Three retailers’ Standing Offers;

- secondly retail bills are based on the average of the Big Three’s cheapest Market Offers; and

- thirdly retail bills are based on the average of the two cheapest market offers from all retailers.

Many more things can be seen in this and the other indices. Maybe they can help those concerned with outcomes for consumers to direct their attention to the right issues.

Bruce Mountain is the Director of Carbon and Energy Markets and co-founder of MarkIntell.