The five most important events in the world of energy for 2022 – in the opinion of this analyst – were:

1/ The passage of two components of Europe’s “Fit for 55” package.

2/ The passage of the US “Inflation Reduction Act.”

3/ The Queensland government’s “Energy and Jobs” Plan.

4/ Federal government initiatives – Safeguards scheme, rewiring the nation, FBT exemption on EVs and the Capacity investment scheme.

5/ The black mark of the federal government’s reversion to basic unionist/socialist principles by legislating a power to set the price for gas every year. Markets can be tolerated when prices are low but must be punished and controlled when prices are high. To be fair, in my comments Europe has just adopted a similar maximum price, notwithstanding the only reason Europe has enough gas this winter is they paid through the nose for it. To compare, the European cap is about $A76/gj which compares to the 2023 Australian cap of $A12/gj.

My take on this is:

– There is going to be a large step up in demand for wind, solar, and EV batteries over the next decade.

– Trade barriers, or as the proponents would say, domestic manufacturing, is rising. This is bad for Australia, which relies on low trade barriers. Australia has an open economy, we have lots of exports and imports. Trade barriers hurt our national business model.

– Australia’s electricity decarbonisation is locked in. But getting the wind turbines, solar panels, land permits, transformers and connections sorted remains a big deal. The growth in global supply should lower costs but we need to get what we need. It’s no longer about 200MW wind farms but 1MW ones – and plenty of them. We need to connect more than 8GW a year, excluding rooftop solar.

– The US is likely to be the best place for energy-intensive industry and manufacturing. Electricity at $US15/MWh is far ahead of Europe and Australia. Equally in the USA they don’t try to control price and supply of goods and services in the way the Australian government has just set out to do. Your analyst tries to make a difference and to promote decarbonisation and renewable energy. The private sector with markets and contracts will get things done in the most efficient way.

Interfering with one price is like interfering with all prices. We need to substitute gas, not support its domestic consumption. High electricity prices encourage new investment. Telling everyone that if the price is higher than the government thinks is appropriate then the government will regulate price and supply at once (as if) would discourage me from investing in wind, solar or lithium or rare earths. But that’s me and I am old enough to still believe in markets and prices.

Big thanks to Global Roam and others

To the extent that I add any value it’s due to the support of others, particularly Paul McArdle from Global Roam. Global Roam via NEM Review has provided the community with some of the best numbers for many years now.

Equally, I’d like to thank my anonymous illustrator/cartoonist for adding so much colour and appeal to my often overlong and overly detailed notes. Man does not live by bread alone.

There are, of course, many others who provide advice and comments about market conditions, technical advice about power and control systems, expertese on policy and on modelling and on market conditions.

Then, via the Energy Insiders Podcast, it’s my absolute pleasure to be able ask some of Australia’s – and on occasion the world’s – leading experts to explain what’s really going on.

And of course the sponsors of Energy Insiders – Pylon and Evergen. Support matters to all of us and the support for Energy Insiders is a great credit, in my opinion, to the sponsors.

Finally, without the RenewEconomy team, Australia’s decarbonisation crew would not have its very own Agora (my Greek buzzword this quarter), where the vast and growing network of people can share views, contribute and be part of proposing, designing and building a fit-for-purpose 21st Century Australian energy system.

Wishing all a happy and prosperous 2023.

Fit for 55

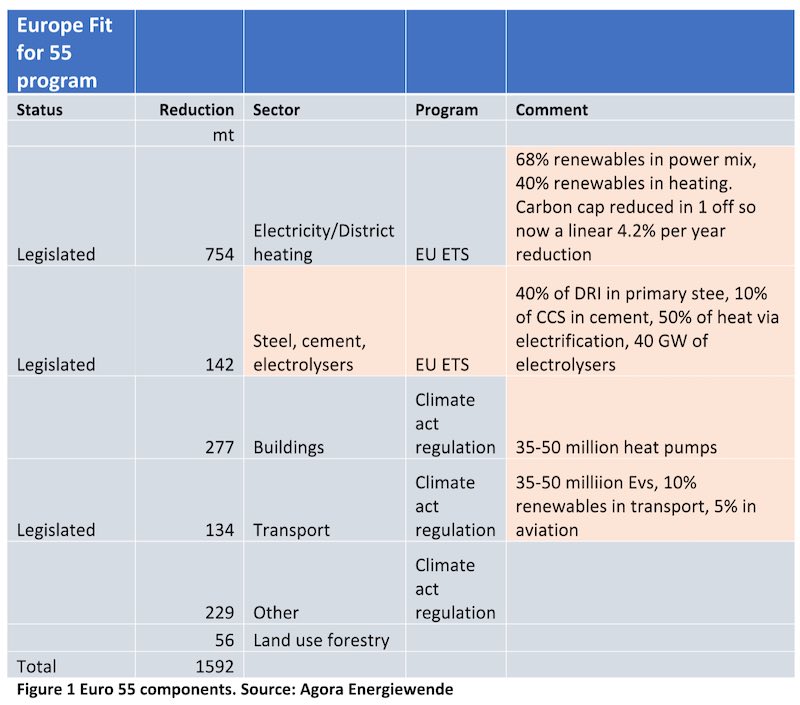

The Fit for 55 package aims to reduce Europe’s CO2 emissions from 2015’s 3.6 billion tonnes to 2 billion by 2030. It’s a big program, but the main components of it are now legislated.

The EV program is a complete world leader, of course, but is already well known. Here I want to draw attention to the steel, cement and hydrogen ambition/legislation. As Mathias Buck from Agora explained on a recent podcast, the carbon border tax has been put in place because steel, and other emissions intensive activity like cement, aluminum is no longer exempt from carbon costs.

This is absolutely bound to spur a wave of investment into decarbonising steel. Although my well informed birdies tell me that Europe starts the race with the handicap of not having much electric arc steel, at least not compared to the US. Decarbonised steel requires different iron ore. Australia will either directly or more likely indirectly be heavily impacted.

Impact of Ukraine war:

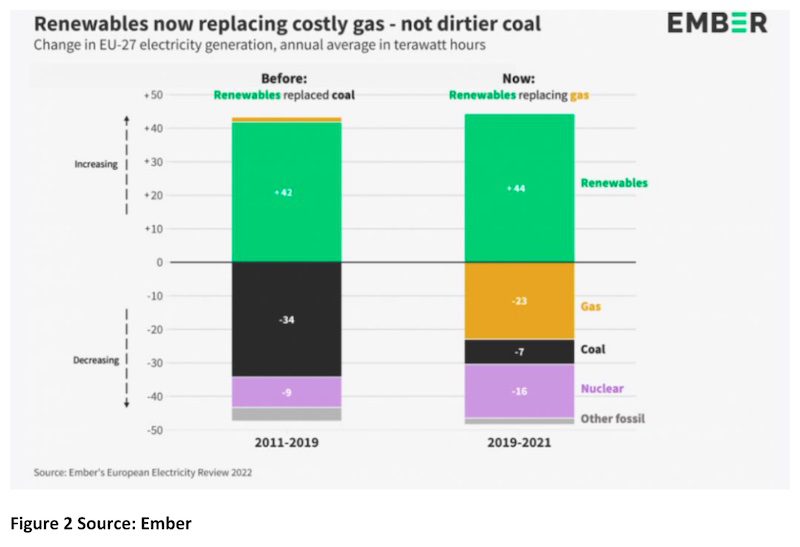

Energy prices remain high, higher renewable support but also fossil fuel support. It could launch a heat pump revolution, and a rush into the doubling of biogas.

USA Inflation reduction Act

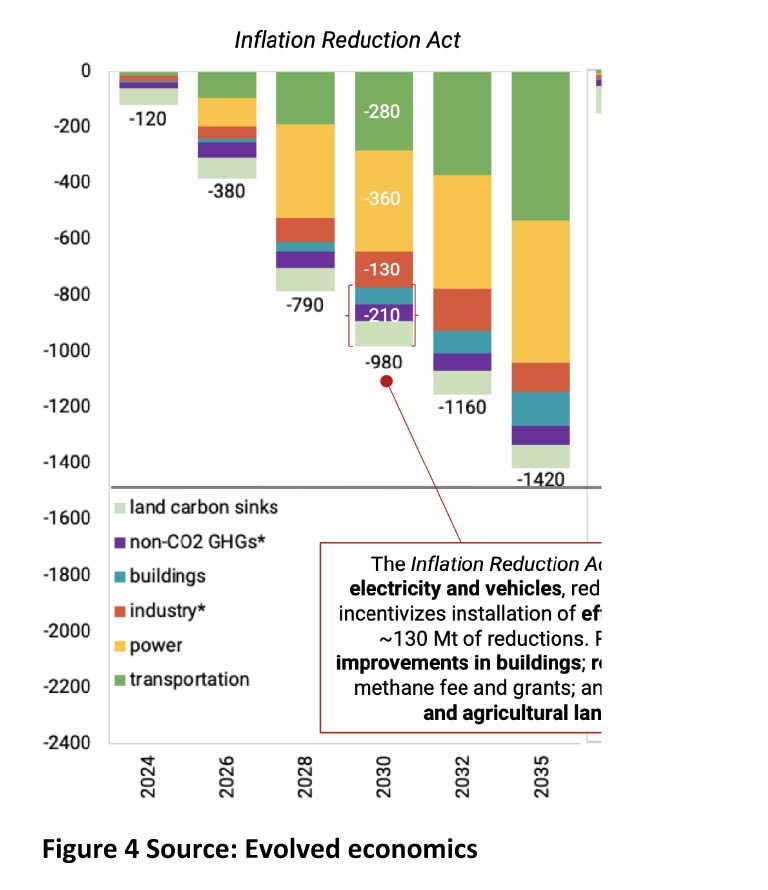

Over the same time period as Euro 55, that is 2015 to 2030, the US Inflation Reduction Act impacts are modelled to result in US carbon emissions falling from around 6 billion tonnes to around 3.9 billion tonnes, a bigger but broadly similar fall in magnitude to Europe.

The IRA provides about $US369 billion of total credits.

The Act provides incentives that, on Evolved Energy modelling, could drive $US4 trillion of cumulative investment, including $28 billion in carbon capture. Model outputs show hydrogen investment increasing to $4 billion per year and maybe 10-times that much by 2035.

The Act works largely by providing strong tax incentives. A project, when it gets a so-called production tax credit, is assured of being able to get that credit for 10 years. What’s more, under the IRA the tax credit has a fixed annual dollar value.

That combined with expected learning rates is expected to see PPA prices for wind and solar in the US in the $US10/MWh to $US15/MWh. Prices far below what Australian customers could expect to pay even though the wind and solar resource in Australia is probably at least as good and maybe better than that of the US.

In the past couple of years the US has been adding about 12-16GW of wind annually and about 10GW of solar. Those very strong incentives are expected to see annual installations increase about 4X to around 100GW per year and keep growing.

By sector and relative to a no IRA case the carbon reductions are mainly in power generation and transport.

A second focus of the IRA is that the tax incentives are much larger if the manufacturing is domestic, this can most clearly be seen from the following table where all EV assembly has to take place in the US. From 2027, 80% of the lithium or at least battery raw materials must be sourced in the US and from 2030 100% of the battery components manufactured or assembled must be done in the US.

However, you can see that other components, like for instance residential solar inverters, are strongly incentivised to be made in the US. And so they will be.

Queensland government program for 2035

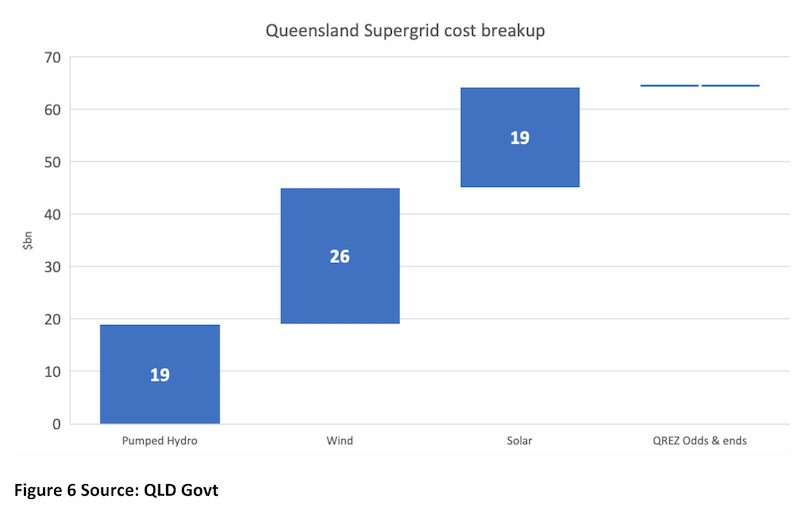

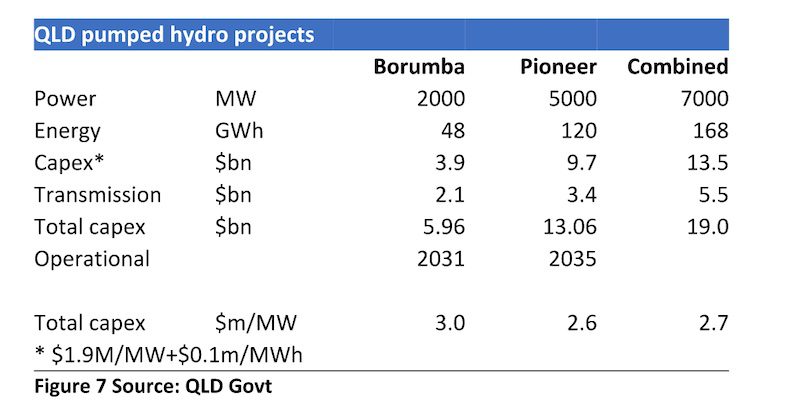

I’ve reported on the Queensland program already, so here I just repeat the estimated costs. I also note that the Queensland plan is the largest, both in capital and in energy and power terms, of the three big states. Queensland is already much larger than Victoria in terms of electricity generation and I, personally, only expect that difference to grow.

I’ve also noted that in fact the program, driven by the pumped hydro investment, is back-ended in the 2029-2035 window. As I’ve looked at these numbers more, and I have been thinking about them a lot, I get more and more struck by the pumped hydro component. This program is 3.5 times as large in MW as Snowy 2.0 and requires at least $5.5 billion of transmission.

The Borumba plant is one thing, but the Burdekin/Pioneer plan inland from Mackay is something else again. It’s a massive investment in an area without a huge load, at present. We have another 10 years to follow the progress of this. The duration of the storage, 24 hours, is big by the standards of everything other than Snowy 2.

Federal Government plans

As can be seen from the preceding sections, the federal government process is to proceed as “policy with Australian characteristics.” There is no ETS like in Europe, no fuel standards as yet for EVs, and nothing like the overall tax incentives or coordinated policy of the IRA.

This partly comes about because the LNP made progress impossible in the past decade, and partly because in the resulting policy vacuum the states took matters into their own hands.

A hangover of the LNP’s hamfisted, negative and virtually criminal approach, from a future generation perspective, was the destruction of the social license required to introduce a policy like a carbon price/tax. So things have proceeded differently and in a way that makes it difficult to assess the overall impact after only nine months.

The two signature polices the ALP took to the election were a tightening of the emissions safeguards scheme and transmission funding via Repowering Australia.

Emissions safeguard scheme reform

This reform covers about 137 megatonnes of carbon emissions from facilities emitting more than 100 kilotonnes of CO2 equivalents. The intent is that emissions fall to 99 megatonnes by 2030. This is about a 3.5% per year liner reduction, although if it starts in 2023 and 2023 emissions are similar to 2021 its more like 4.5% per year reduction.

The scheme will be a mini carbon price or carbon cap and trade scheme. An overall cap will be set (it seems the cap will be set at the current aggregate level of emissions from covered facilities) and then it will reduce each year.

Individual facilities will have baselines set and how this is done is still not determined, then reductions below their baseline (and the baseline declines each year) can be sold to emitters who are above their baseline.

The tradeable units are called Safeguard Mechanism Credits [SMCs]. As yet, there is no decision on how new emitting facilities will be incorporated, but it will be within the overall cap. This means either reducing existing emitter baselines or forcing new entrants to buy credits. I prefer the latter approach.

Emissions Intensive Trade Exposed Industries [EITE] will have tailored treatment perhaps by being given some “surplus” SMCs, but as Europe moves to a carbon border tax one can see the ultimate futility of this approach. The surplus SMCs could be created by setting the overall baseline to have some headroom.

Most of the scheme will be implemented by regulation, rather than legislation. A 4% per year reduction path is actually a similar rate of decline to the EU ETS, although the latter covers far more.

Rewiring Australian – Marinus Link is now sort of funded, as is VNI West

The federal government has allocated a not insignificant $8.6 billion to the CEFC to further the aims of the Rewiring Australia program. In practice, that means initial funding of Marinus Link, to Tasmania and support to make offshore wind in Victoria less uneconomic than it otherwise would be.

Marinus Link’s cost is supposed to be about $3.5 billion, of which 20% is equity funded. The equity is equal 1/3 each to Vic, Tasmania and federal goverments. Of the $2.8 billion debt, $1 billion comes from Rewiring the Nation, at essentially zero interest and the rest from the CEFC. Done deal.

EV policy – demand boosted with FBT exemption

An immediate piece of good news was the fringe benefits tax exemption for EVs and a commitment to make 75% of the federal fleet new purchases electric.

These moves will have a strong benefit in (1) lowering the cost of EVs to corporate employees and (2) due to these cars being turned over in three years creating a much larger second hand market.

The second hand buyer should get a car at round 60% of new price with say 90% of the new car battery capacity and this greatly improves the customer economics.

The fringe benefit tax exemption will apply to vehicles purchased since July 1 and which fall short of the Commonwealth’s luxury car tax threshold, which is set in 2022-23 for fuel-efficient vehicles at $84,916.

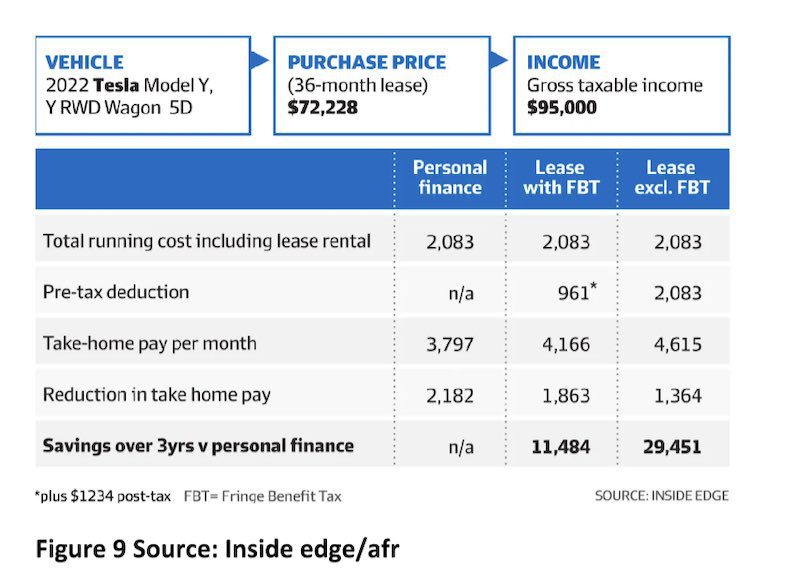

The example below was previously published and is sourced to novated lease provider Inside Edge. The table doesn’t show the residual value after three years but shows that compared to lease with FBT an after tax saving of about $500 a month or $6000 a year is possible. Compared to no lease at all, the saving is over $9000 a year. Not everyone can get a lease, of course, and there will as ever be people clipping the ticket, but it makes one think.

However all the FBT exemption does is increase the demand for EVs. In the short term, demand is not the problem – it’s supply. At present, car manufacturers are strongly incentivised to send their EVs to Europe. Not until there is a vehicle emissions standard will we see supply really increase. And, in truth, just now EV production globally probably isn’t high enough to meet demand. An emissions standard in Australia is still very much on the table.

Capacity investment scheme [CIS]

This scheme is presented as the replacement to the ESB’s proposed capacity market. However, in practice it seems to me more about shifting funding for “firming” investment from the various state goverments to the federal government.

The documentation to date is scanty but the scheme is modelled on the NSW cap and collar support and is designed to work with the various state schemes, that is to be additional. It is essentially a scheme to support batteries and pumped hydro or in any event firmed renewables.

Importantly, the first auction is to be held in 2023, so a lot of detail needs to be presented fairly early next year.

“A fair rate of return” for gas

The federal government has introduced the “Competiton and Consumer Amendment (Gas

market) Bill 2022. My comments are based on the exposure draft.

The Bill provides a power to provide “emergency price orders” and the more objectionable “gas market code”. Selected extracts from the exposure draft [ED] are:

ED1.41 A gas market order may include rules setting a price, including a maximum price, minimum price, or maximum and minimum price. The rules may also require a price to be reasonable and provide for matters that must, may or must not be taken into account in determining whether a price is reasonable. The rules may provide for determining a price (including matters to be taken into account in determining a price) and how a price is expressed. In setting a price, the rules may refer to the price of any gas commodity inside or outside Australia or any published information about any market.

ED 1.43 A gas market code may confer on the Minister, the Commission or any other person or body the function of setting a price.

ED 1.46 To ensure that there is a reliable supply of a gas commodity, the Bill provides that a gas market code may contain rules requiring a participant to supply, or not to supply, gas commodities in specified circumstances.

Everyone will have their own opinion on this. Mine is that it’s socialism and on the way to communism.

Goverments have never ever been any good at price setting. It is a universal rule for every commodity that you can control either price or supply but not both.

The greatest government since WW2 in Australia was the Hawke-Keating government. Even my Liberal voting but rational friends say as much. That government’s reputation rests on many foundations, but one was for instance floating the Australian dollar; reducing car tariffs and in general degregulation. It worked a treat.

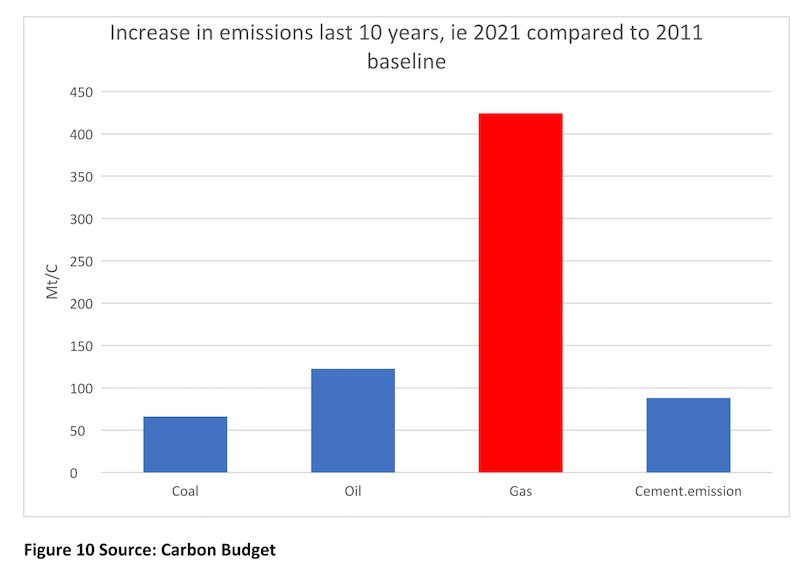

Like anyone that is invested in decarbonisation, I recognise that gas has been the LARGEST incremental contributor to global emissions in the last decade.

One of the many problems with the government’s policy is by holding the price down it reduces or even removes the incentive to electrify. What brick producer or industrial heat consumer is going to switch when the government is sending a signal it wants you to keep consuming?

However, that is really a side show. The overwhelming main issue is the negative signal and lack of trust that the message sends.

For me it means, don’t manufacture in Australia because if you do and make more money than, say, Ed Husic thinks is appropriate your price will be managed. Don’t build a lithium plant in Australia (where the price has gone from $15k/tonne to $60 k/tonne) build it overseas and import the product. Etc.

And what of Squadron’s LNG facility at Port Kembla? When complete in a year or two it will provide a natural link to the US price of gas, ie import gas parity. That would act to regulate price by itself, but now interference in the market is stuffing the signals up.

Again, governments should ensure that markets are competitive and then accept the resulting price outcomes. That is the way of the free world and the best way with safety nets to allocate scarce resources across competing needs. But not, it seems, the way for Ed Husic and his mates.

Finally, it’s not Australia’s gas, as the government asserts. It was a state government asset that was assigned to a producer in exchange for an annual royalty. But I’m probably wasting my time. It seems that socialism and price control have become the new opiate of the people.

The year in numbers

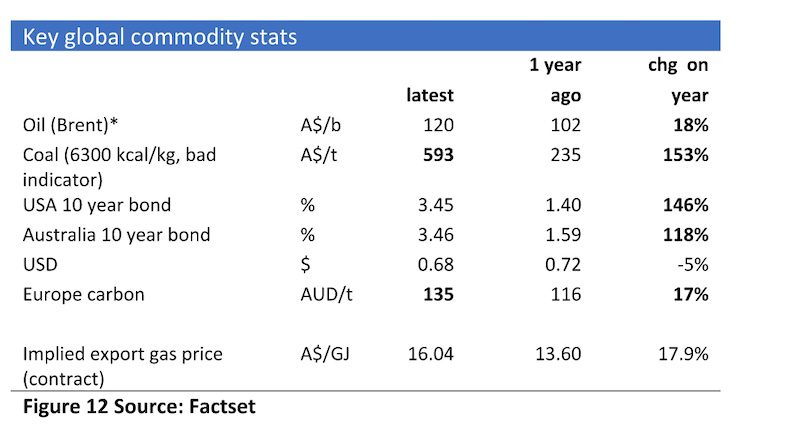

Despite Russia’s invasion the oil price ended the year only 18% higher, bond rate rises are likely much more significant to the global economy outlook. Although we show 6300 Kcal coal we have come to realise it’s a furphy. It’s a thinly traded contract.

A better view of coal prices both global and local is provided by 5500 kcal coal, but unfortunately there is no futures market in that coal in Australia and so the price is harder to find. Noted coal data commentator Clyde Russel, who has written for Reuters on the topic for years, stated in November:

“The more important Australian thermal coal price is for 5,500 kcal/kg Newcastle coal , which is purchased by a wide range of buyers in Asia, including India and Vietnam.

This measure ended on Nov. 25 at $136.47 a tonne, little changed from the prior week’s $136.04, which was the lowest since Jan. 14 and below the $155.43 on Feb. 18, the last weekly assessment prior to the Russian invasion of Ukraine, which Moscow terms a “special military operation.

The grade is also down 52% from its record high of $284.20 a tonne, reached in the week to March 11.”

That equates to a coal fired electricity short run variable cost of less than $A100/MWh.

Note the carbon price.

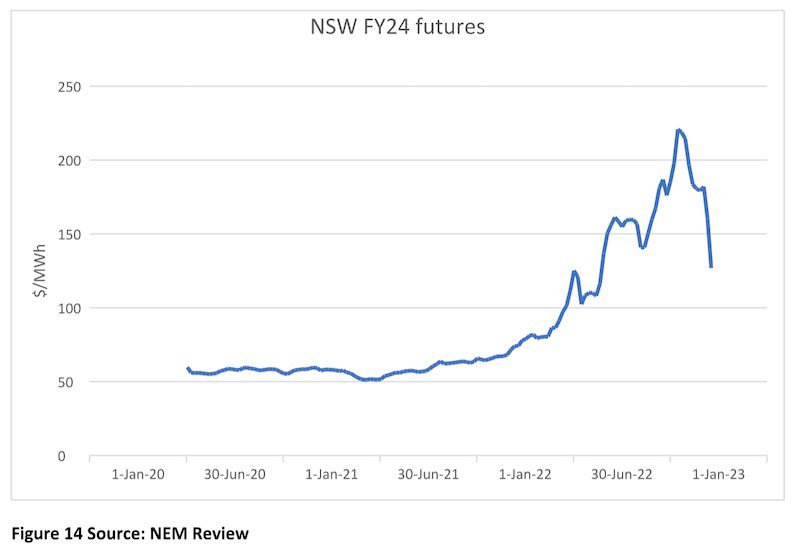

Turning to futures prices in Australia, there is close to a doubling compared to a year ago. We just show FY24, but they have come down very sharply post recent government policy announcements.

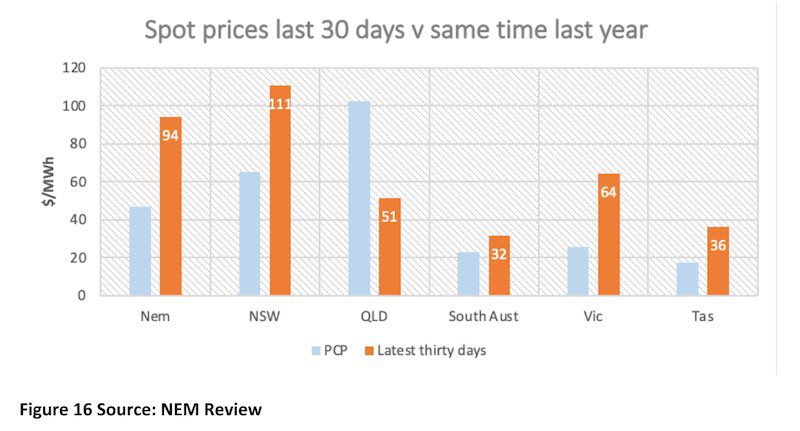

Spot electricity prices jumped, of course.

Although recent prices with depressed demand are generally a lot lower.

Prices jumped partly because consumption grew a strong 2.4%. It would be higher if there hadn’t been a sharp slowdown from the end of year cool weather. The consumption growth is all the more notable because it’s not supported in 2022 by much population growth.

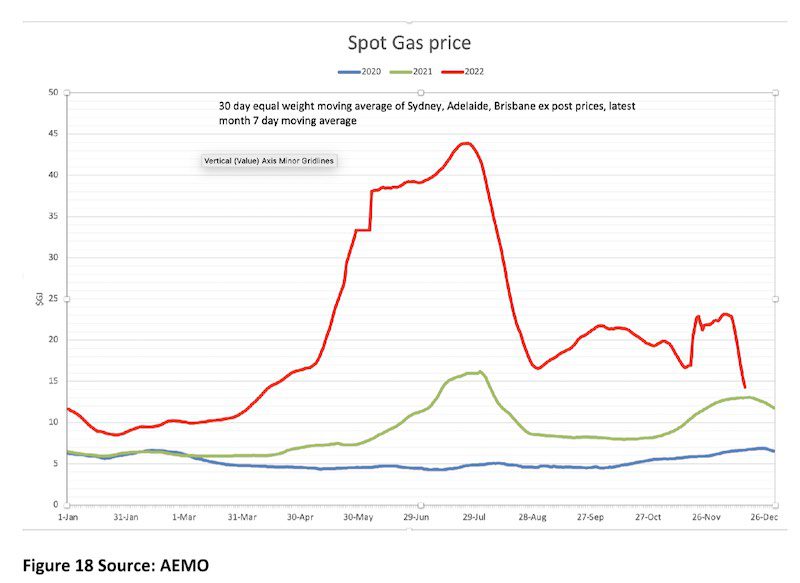

Gas prices, of course, jumped but thanks to intervention ended the year only marginally above where they ended last year.

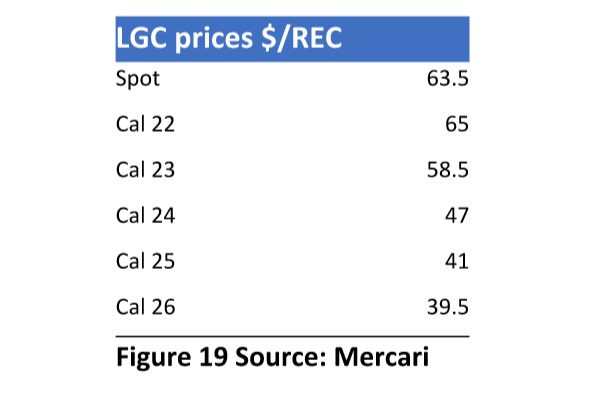

REC prices are still excellent, but they only last until 2030. Even so, for a merchant renewable wind producer you might in NSW in 2024 be getting around $125/MWh for your electricity and another $47 for the certificate.

Finally in this brief review of 2022 data let’s turn to variable renewable energy = VRE = wind and solar including rooftop.

Very exciting to report an all time 30 day record of an annualised 70TWh of VRE, 35% of NEM demand

It’s a seasonally strong time of the year, but even so we are running at an annualised 70TWh up from 50 this time a year ago and representing 35% of NEM wide demand. Very, very exciting.

Its likely that VRE supply has not yet quite peaked in annualised terms as it typically continues growing right to the end of December. I don’t show all the data in this overly long note.