At the end of December 2023, the Australian Energy Market Operator (AEMO) quietly released the Energy Security Target Monitor Report it had delivered privately to NSW climate and energy minister Penny Sharpe in October.

The report should be required reading for vested interests bleating about widespread blackouts if the NSW government holds its nerve and commits to the phased closure of Australia’s biggest coal clunker – the 2.88GW Eraring power station – around the planned date of August 2025.

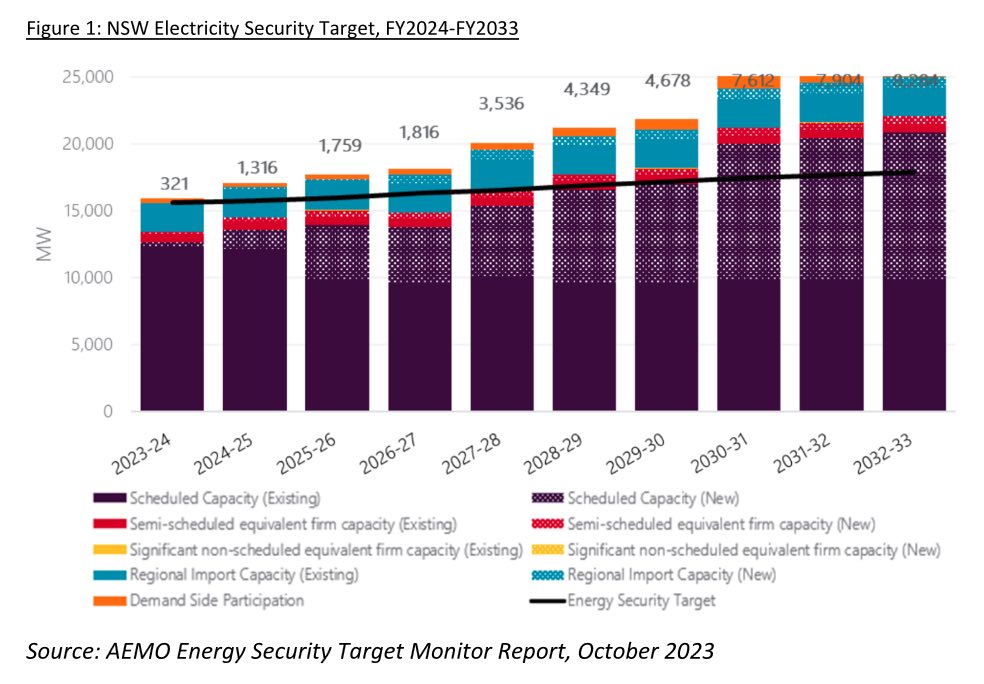

AEMO’s own modelling shows that once federal and state capacity schemes are included, there is no NSW electricity supply reliability gap forecast in any year out to 2033, notwithstanding the on-time shutdown of Eraring next year.

After some dangerous inertia around the change of state government, there has been significant progress in the NSW electricity market transformation over recent months, with strong collaborative efforts with the federal government, as we map in our new ‘The Lights will Stay On’ report released this week.

This gives us even more confidence than in our previous analysis of July 2023 that with continued improvements and delivery on projects under development, the lights will stay on in NSW as the hyper-expensive, high-emissions, end-of-life Eraring closes on time – and that retail power prices will reverse some of the hyper-inflation seen in July 2022 and July 2023 20% pa regulated price increases.

Consistent with both AEMO’s analysis and our July 2023 report, our new analysis reconfirms that there is no material reliability gap.

On utility-scale renewables and storage, we find that NSW is on track to deliver on the commitments AEMO has assumed in its analysis – Figure 1.

The Round 2 tender for new wind, solar and storage of November 2023, conducted under the NSW government’s Electricity Infrastructure Roadmap, is set to deliver 1,070MW of battery energy storage system (BESS) firming capacity by end 2025, building on the 1,445MW of new firmed renewables capacity awarded in the Round 1 tender in May 2023.

The December 2023 Round 3 tender underwrites another 1,274MW of firmed renewable capacity. June 2024 will see Round 4 awarded.

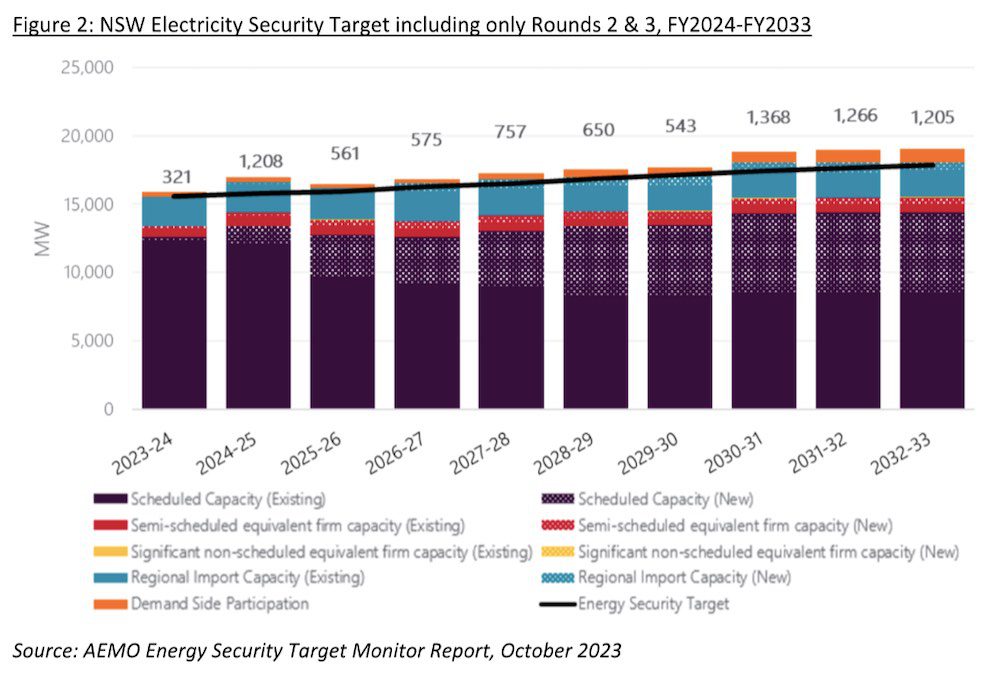

With these Round 2 and 3 projects, alone, NSW is already set to meet its Energy Security Target needs around the Eraring closure, according to AEMO’s analysis, see Figure 2:

The deflation of costs for renewables and storage is a key factor underpinning acceleration of their deployment.

BloombergNEF estimates global battery system costs fell 80% in the last decade and another 14% in 2023, and solar module prices declined 45% yoy in calendar year 2023. BNEF forecasts BESS prices will halve again by 2030. As such, the relative capital cost of BESS improved dramatically, as did the technology. The rise and rise of solar continues, lifting the likely arbitrage value of time-shifting solar generation into the evening peak.

As our new report details, NSW is leading the world in the financing, approval and construction of new BESS projects, with the 850 megawatt (MW)/1,680megawatt hour (MWh) Waratah Super Battery under construction, while AGL reached a final investment decision (FID) in December 2023 on its $750m 500MW/ 1,000MWh Liddell BESS. Origin Energy has commenced construction of phase 1 of its 700MW/2,800MWh Eraring BESS. The list of project proposals is enormous, and growing weekly.

After a growing industry clamour for an end to very substantive and costly new project approval delays in the state, NSW finished 2023 with a range of critically important wins in terms of new renewable infrastructure awards, approvals, FIDs and commencements of construction, and the long overdue promise of accelerated approval efforts in 2024.

December 2023 saw approvals by the Department of Planning and Environment (DPE) of ENGIE’s 290MW Hill of Gold wind farm ( still subject to an Independent Planning Commission review), and Virya Energy’s Yanco Delta 1.5GW wind farm, along with a 800MW/800MWh BESS.

In December 2023 the IPC approved the Oxley 215MW solar farm and Trina Solar’s 200MW Glennellen solar farm. January 2024 saw Squadron Energy commence construction of the 414MW Uungula Wind Farm after winning the December Round 3 tender.

On transmission, ElectraNet has successfully completed the 900km South Australian stage 1 of the $2.3bn Project EnergyConnect, the new high-voltage line between South Australia and NSW.

There remains a very strong proposed pipeline of projects of some 50GW of firmed renewables in NSW, many already in the approval process. We look forward to wholesale permanent improvements in project approval delays with the restructure of the DPE effective 1 January 2024, which we presume now sees energy planning approvals sit under the Climate and Energy Minister.

As firmed renewables burgeon, consumer energy resources (CER) uptake remains robust, with 3.17GW of rooftop solar installed nationally in calendar 2023, the second highest on record.

We have urged the NSW government to prioritise collaboration with the federal government to introduce policies to accelerate CER deployments, along with behind the meter storage, vehicle to grid (V2G), building and energy efficiency, as well as the rollout of smart meters and CER orchestration.

The January 2024 $206m social housing energy savings initiative for 30,000 disadvantaged households, announced jointly by the NSW and federal governments, is laudable. These measures are much faster and lower cost to deploy than utility scale infrastructure, and complement the longer timeframe work the NSW government is doing on utility scale infrastructure and Renewable Energy Zones.

As an example of ‘electrification of everything’ taking off, the market for air source heat pumps in Australia grew a staggering 71% yoy in the first nine months of calendar 2023, with NSW leading the uptake with a 58% share nationally to-date in 2023 (up from just a 13% share in the previous corresponding period).

Australia now needs electricity price tariff reform to change consumer behaviour and ensure that V2G becomes a smart grid enabler, rather than a new demand problem. Our electricity retailers are not waiting, with both Origin Energy and AGL Energy leveraging and modernising their IT and consumer platforms to enable this, putting a major focus on grid orchestration’s growing role to maximise customer service and value.

Our new analysis includes NSW electricity demand and supply modelling out to 2030.

A key issue is that demand growth of +0.6% year on year in calendar year 2023 was well below AEMO’s +2.7% annual compound growth rate forecast through to 2030 and beyond.

Extrapolating AEMO’s overly high demand growth assumptions out to 2030 means the grid reliability gap risks are potentially overstated. We note over the last two decades, electricity demand in NSW has been flat. This lower observed demand growth provides additional insurance, guaranteeing NSW electricity supply reliability, even if some projects are delayed during delivery.

The NSW government’s Peak Demand Reduction Scheme, which provides financial incentives to households and businesses to reduce energy consumption during hours of high peak demand, is also an important initiative that is lowering the cost in improving grid reliability.

Notably, on supply, renewables share (utility scale wind and solar, rooftop solar and hydro) was a record high 31.3% in calendar 2023, up from 28.9% in 2022, having more than doubled in the last five years.

We know that firmed renewables are the cheapest source of energy. Over time, wholesale prices and retail total costs are likely to fall as renewable energy share rises.

NSW saw wholesale electricity prices drop 47% year to average $105/MWh in 2023, with the fourth quarter of 2023 averaging -40% yoy to $72/MWh.

After two years where the hyperinflation of fossil fuel prices has driven 20% per annum retail electricity price increases, CEF expects the Australian Energy Regulator’s Default Market Offer (DMO) to drop double digits come 1 July 2024, bringing much overdue energy bill relief for NSW citizens.

The delivery of significant new low cost firmed renewables capacity will help cement this trend in the longer term, even as it concurrently helps deliver on the NSW Climate Change (Net Zero Future) Act 2023 with its excellent 70% emissions reduction interim target for 2035, which passed NSW parliament with multiparty support in November 2023 – a key achievement of the NSW Energy Minister and Government.

NSW is moving to systemically address the energy, climate and cost of living crises that have smashed Australia and the world in the last two years. Renewables and firming capacity additions to offset the on-time closure of Eraring and ensure reliability of supply and reduce prices are a key part of this.

This progress is in the context of federal climate and energy minister Chris Bowen’s game-changing upgrade of the federal government’s policy commitment to 82% renewables by 2030 with the 32GW Capacity Investment Scheme (CIS) announced in late 2023, and Australia’s pledge at COP26 to treble renewables and double energy efficiency by 2030.

For all the mis- and disinformation peddled by climate luddites and fossil fuel vested interests about the purported intermittency of renewables, the rise and rise of ever-lower cost variable renewable energy firmed by BESS is far exceeding even the most bullish forecasts. Together with the policy certainty and cooperative federalism noted above, this makes the decarbonisation of the electricity grid and ‘electrification of everything’ a key enabler of NSW’ and Australia’s energy transition and Net Zero Emissions objectives.

There is a global race to develop zero emissions industries of the future, and NSW is stepping up to take advantage of these investment and employment opportunities, and to deliver a more sustainable, lower-cost energy system.

Tim Buckley is director of Climate Energy Finance. Annemarie Jonson is chief of staff at Climate Energy Finance.