A new report from Bloomberg New Energy Finance has highlighted how wind and solar technologies paired with battery storage are already beating new coal and gas fired generators on cost.

This should not be a surprise to anyone paying attention to the debate around the closure of AGL Energy’s Liddell coal generator in NSW, where the company has calculated that even the cost of extending the ageing plant’s life is significantly higher than replacing it with renewables and storage.

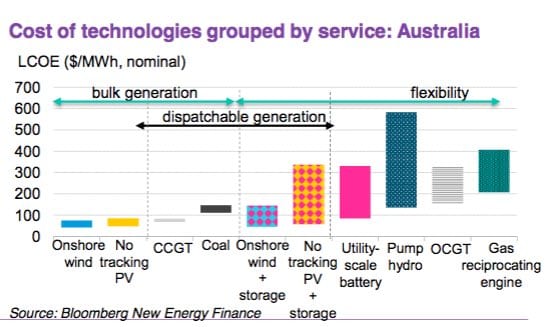

Still, the BNEF chart above provides an interesting snap-shot that shows the basic metrics that will influence the financiers of new projects, and specifically the choice of new coal and gas projects over new wind and solar plus battery storage.

BNF puts the average combined cost of onshore wind and PV plants paired with small batteries at between $US32-$US110/MWh ($A41-$A143/MWh).

And this cost will fall dramatically in coming years as wind and solar costs continue to fall – solar by another 62 per cent and wind by another 48 per cent by 2040 – making them the cheapest form of bulk generation almost everywhere in the world by 2023.

“Adding a battery to a solar or wind plant can make some of its output ‘dispatchable’, and give it access to high-value hours when it might otherwise be offline,” the report says.

“The degree of dispatchability of a paired system, as well as its LCOE (levellised cost of energy), depends on the size of the battery relative to the renewable asset and how long it can run before needing to recharge.

“Today, in countries like Australia, the U.S. and India, new solar- and wind-plus-battery systems with a low degree of dispatchability – say, 25% generating capacity to storage ratio, and one-hour batteries – can already compete with new coal and gas plants.”

Australia was a particular highlight. The graph at the top shows the range in costs of storage from one hour to four hours, so for short period durations the cost is below the cost of comparable fossil fuel technologies, but for longer duration it is not.

The second graph just above shows a broader range of technologies, including the stand-alone storage. All beat their comparable fossil fuel competitors.

For those longer duration storage needs, technologies like pumped hydro and solar thermal are likely to be better options than battery storage, unless the cost of grid scale battery storage continues to plunge as it has in the last two years.

The other advantage of battery storage is that it is modular – meaning it can be built in 1MW to 100MW and above, and – as the Tesla big battery in South Australia ably demonstrated – it is quick to install and connect

And on judging the worthiness of battery storage investment, it is not just the costs that count, but the value.

The cost estimates here are based on only its ability to store power – there is no value placed on its numerous other services, such as providing grid security, network support, frequency control and inertia, “black-starts”, and reducing the need for new infrastructure.

Still, recent bids in Colorado have suggested that battery storage combined with wind and solar easily beat new gas generators, despite the low cost of gas in that country.

The BNEF report also looks at stand-along battery storage system, noting that these can also be competitive with gas peaker plants, depending on the capital and operational costs of the battery and the gas plants, and the duration of the demand peak.

The wider the peak, the longer the battery has to discharge, and the more expensive it becomes. This graph above is taking Germany as an example. In California and elsewhere, battery storage systems are beating out gas plants – and it would not surprise to see the same in Australia too.

“While standalone batteries are competitive today for hitting narrow peaks, we expect them to be able to cover wider and wider peak periods as their costs decline,” the BNEF report says.

“By 2025, four-hour energy storage begins to compete with peaker gas plants even in countries with cheap gas generation like the US.