A number of people, including myself, had expected that the Small-scale Technology Certificate (STC) Clearing House might come into play by third quarter surrender this year (28 October). Alas, no certificates were cleared through the Clearing House and it is worth exploring why this was the case, and to also consider what has been happening in the STC market more broadly.

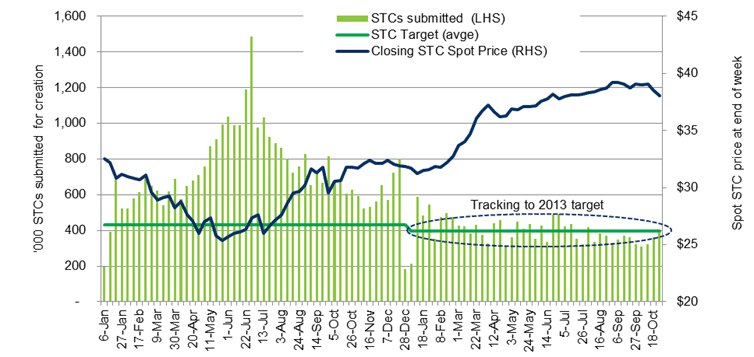

The first thing that has occurred is that the level of solar systems being installed and creating certificates has fallen. This is demonstrated in Figure 1, where we can see weekly certificate creation throughout 2013, tracking closely to the required average weekly target. Weekly creation in 2012 by comparison, was consistently above the weekly target.

Secondly, the STC spot price has progressively increased through 2013 as the level of certificate creation has fallen and come into line with the target for the year (Figure 1). The spot price reached a high of $39.40 in early September, just below the Clearing House Price of $40. As liable parties completed their purchasing for third quarter surrender the STC price started to fall reaching $38 in late October.

Figure 1. Weekly STC creation and STC spot price since 1 January 2012

The third observation is that the number of STCs queued in the Clearing House has fallen dramatically over the course of 2013. There were around 5.5 million STCs in the Clearing House at the beginning of 2013 and this has dropped to 1.3 million by late October (Figure 2). As the STC price has increased it has become financially attractive to remove certificates from the Clearing House and sell them on the market now rather than wait for a slightly higher price later.

Figure 2. STCs in Clearing House and STC spot price since 1 January 2012

So where does this leave us and when might the Clearing House operate?

After the third quarter surrender there were a total of 5.1 million registered STCs available in the market of which 1.3 million were in the Clearing House. The STC surplus at the beginning of 2013 was 16.5 million certificates which comprised 15 million surplus that was carried forward into the 2013 target and 1.5 million that was not surrendered for 2012 due to lower than expected electricity sales. The 16.5 million surplus is slowly being absorbed, and if it had not been for the 1.5 million under-surrender for 2012, the surplus may well have been fully absorbed by the fourth quarter surrender on 14 February 2014.

Whether or not any certificates are sold through the Clearing House at the next surrender depends on a couple of factors:

(i) The level of weekly certificate creation. If we continue at the rate we have been creating certificates to date then the Clearing House might well come into play.

(ii) The level of the STC price. If the STC price reaches a point where people are indifferent to selling on the market or waiting for the Clearing House price then they may remove certificates from the Clearing House and it might not come into play until we have a deficit of certificates (this could happen by end April 2014).

Finally the Clean Energy Regulator is required to release the target for 2014 by the end of December 2013. It appears that there will be only a modest level of surplus certificates carried forward into next year’s target. This will mean that the first quarter surrender for 2014 of 35 per cent of the total target becomes much more challenging and we might have a deficit of certificates which will mean that the Clearing House will be well and truly operational by end April 2014.

While the Clearing House has not come into play in any meaningful way to date, the STC scheme is starting to work as expected. The surplus of certificates that has hung over the market has slowly been absorbed and the market price for certificates has become less volatile and has moved towards the $40 Clearing House price. In the final analysis, it may not matter that much to the solar industry whether $40 is obtained through the Clearing House or slightly less than $40 is obtained through the market a little earlier.