Last week an updated Business Case for Snowy 2.0 was released. Like every aspect of this hapless, over-hyped project it is late, inadequate, and unrealistically optimistic.

For some inexplicable reason the public release of the Business Case has been delayed nine months after it was adopted for the project ‘reset’ last August, following a “comprehensive and robust review”.

However, it hasn’t been worth the wait as the document is little more than a rehash of the August 2023 Media Release with a few photos and diagrams.

The complete Business Case, assuming there is one, remains locked away and it seems will never be released. A Senate request last year failed to elicit any more than heavily redacted papers with no substantive information.

This secrecy is at odds with the commitment made last August by the shareholding Ministers, Bowen and Gallagher, to “provide full and transparent updates to the Australian people, unlike the previous government”.

And it needs to be remembered that the project ‘reset’ was extensive, coming after seven years of cost blowouts, delays and construction debacles – resulting in a doubling of Snowy 2.0’s cost to $12 billion (its fifth increase, though this does not represent the total cost), adjusting the completion date to December 2028 (sixth change), and replacing the $5.1 billion fixed-price main works contract with a cost-plus contact.

Despite these massive financial impacts the updated Business Case paints a rosy picture. Its key claim is that the net present value of Snowy 2.0 is now $3 billion, slightly more than the estimate of $2.8 billion at the time of the Final Investment Decision (FID) in December 2018.

As an aside, the net value at FID was actually a range from $2.8bn to minus $0.2bn, based on an estimated gross value of $4.3 billion to $6.6 billion and cost of $3.8 billion to $4.5 billion. Critics at the time disputed Snowy 2.0 having any net value.

Putting that clarification aside, the updated Business Case claims that whilst the cost of Snowy 2.0 has blown out three-fold (by $8 billion) in five years, its value has risen even more! But no analysis or explanation is provided.

Once again the Federal Government has meekly accepted Snowy 2.0’s updated estimates and dutifully kicked in $7.1bn in the 2024-25 budget, on top of $1.4bn previously provided.

To spur the government to have a proper look at the latest Business Case let’s identify a few obvious flaws and unrealistic estimates.

The Case states that Snowy 2.0’s revenue “is based on a diverse and robust earnings profile, derived from four revenue streams” – storage value (60%), wholesale firming/ capacity sales (34%), retail diversification (5%) and ancillary services (1%).

No information is provided on the latter three revenue streams, so no comment can be made. But some limited information is provided on the storage value, which comes from ”time-shifting energy … by purchasing energy at low prices for pumping, then selling the energy when prices are higher”.

Two core factors determine storage value – the generation production volume and the price differential between purchases for pumping and sales from generating.

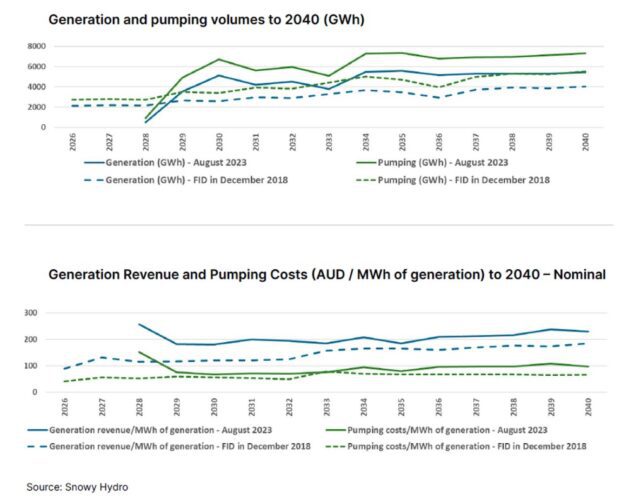

The Business Case assumes average generation production of 5,300 gigawatt-hours per year, up 50% from the 3,500 GWh cited in the FID, and an average price differential of $100 per mega-watt hour, up 18% from $85/MWh in the FID (see Figure 1). No explanation or justification is provided for these boosted assumptions.

Figure 1 – Storage Value assumptions (‘Snowy 2.0 Updated Business Case’, 24 May 2024’)

However, even the most cursory look shows the updated generation production assumption is unrealistically optimistic, as was the initial (lower) FID assumption in the first place.

To produce 5,300 GWh annually would require Snowy 2.0 to generate at its full capacity of 2200 megawatts (MW) for almost seven hours on average every day of every year [5300/(2.2×365)].

Additionally, Snowy 2.0 would need to consume 7,100 GWh of pumping power annually [5300/0.75 efficiency] to replenish the upper reservoir, pumping for nine hours every day on average at full capacity.

That adds up to a minimum of sixteen hours a day of pumping, and longer when generating or pumping at less than full capacity. For example, at 1,400 MW Snowy 2.0 would need to generate or pump all day.

More inconceivable still, the actual hours of operation would need to be even longer due to the drop in round-trip efficiency at such elevated levels of operation.

Snowy 2.0’s Feasibility Study states that whilst the efficiency target is 75.5% at 1000 MW, this drops to 67% at 2000 MW due to higher frictional losses, and to 63% over the design life.

Presumably, the efficiency will be even lower at Snowy 2.0’s updated capacity of 2200 MW. Also, the Feasibility Study warned “that prolonged operation at such high velocities may lead to a deterioration by scouring of the power waterway’s concrete surfaces due to high local turbulence at surface irregularities”.

To emphasise the flaw in this generation production assumption, if Snowy 2.0 is continuously operating at such elevated levels, then so too would every other pumped hydro station, including the Tumut3 1800 MW station, and chemical batteries, as they are all more efficient than Snowy 2.0 with its (unprecedented) twenty-seven kilometres of tunnels between reservoirs.

To further illustrate the impracticality of the 5300 GWh production assumption, allowance needs to be made for reduced or no operation during faults, maintenance outages, transmission constraints and storage limitations.

HumeLink, the transmission connection for Snowy 2.0, has exactly the same capacity (2200 MW) and hence would need to be reserved most of the time for Snowy 2.0’s exclusive use.

This is not going to happen as HumeLink is also expected to transmit over 4000 MW of southwest REZ generation, 800 MW from South Australia (via EnergyConnect), and 1900 MW from Victoria (via VNI West). Simply, there is insufficient transmission capacity for Snowy 2.0 to operate at such high levels for such extended periods.

And finally, extended generation will be restricted whenever the upper reservoir is near empty (it will be around 15% during winter according to the Business Case), or the lower reservoir is near full (during wet periods). Similarly, pumping will be restricted when the upper reservoir is near full (it will be around 95% during spring and summer) or the lower reservoir is near empty.

Not only is the assumed production of Snowy 2.0 impossible from a practical perspective, so too is the assumed $100/MWh price differential from a commercial perspective, as the upper and lower prices would need to line up with the exact times needed for generation and pumping over the daily cycle. Cheap prices for pumping just won’t be available for over nine hours every day of the year.

The implausibility of these base assumptions for Snowy 2.0’s major revenue stream means that it is scarcely believable that Snowy 2.0 could earn the revenue forecast in the Business Case nor have a net benefit.

The ‘value’ of Snowy 2.0 is even more negative when all costs are included, such as financing, exploratory works, and transmission connections, resulting in a total cost of more like $25 billion.

The project has never stacked up, and the economics keep getting worse, not better as claimed in the updated Business Case, with the likelihood of further delays (Florence is ‘paused’ again) and cost blowouts.

As experts have been urging for years, the government must stop relying on Snowy Hydro’s flawed advice and optimistic guesstimates, seek independent expert advice and provide full and transparent information to the Australian people, as promised, before further billions of taxpayer dollars are squandered.