Mark July 7th as a red letter day in Australia’s tortuous path to decarbonisation – a day of special significance and opportunity.

The causes and consequences of the wild gyrations on the South Australian electricity wholesale market that day will be scrutinised for months, worrying regulators, politicians, businesses and commentators alike. The events, and how we interpret them, will have ongoing implications for future business investment decisions, for the survival of struggling businesses such as Arrium, and for how we meet the challenge of decarbonisation.

The events of July 7th will, no doubt, sharpen the minds of our energy ministers who are meeting Friday (19th August) in Canberra at the COAG Energy Council. Thankfully, recent statements by the Federal Minister Josh Frydenberg lend hope to the idea that rationality will trump ideology in any COAG outcome. However recent history suggests it will take some time before the bipartisanship emerges essential to realising the opportunity of our red letter day. Ever the optimist, I remain hopeful.

And in that hope, Dylan McConnell and I have prepared a rather lengthy analysis of those events in a report titled Winds of Change – An analysis of recent changes in the South Australian electricity market, available at this link. Here I summarise some key points we consider in that analysis.

What happened July 7th

July 7th was a calm, cold winter day across South Australia, as it was exactly one year before.

Demand for electricity reached a high of over 2183 megawatts in the early evening well above the typical South Australian average of around 1300-1400 megawatts. The calm conditions meant the output of the 1575 megawatts of installed wind capacity fell to almost zero by mid afternoon and contributed no more than 23 megawatts throughout the high demand evening period. With upgrades on the Heywood interconnecter into Victoria severely limiting the ability to import power, gas generators and a little bit of diesel were all that were available. With Engie’s gas (CCGT) Pelican Point station effectively mothballed (having earlier on-sold its gas supply into the gas market), AGL (Torrens A and Torrens B stations) and, to a lesser extent, Origin (Osborne and Quarantine stations) were in a pivotal supplier positions at various stages across the day, meaning they were needed to meet demand. The capacity bid into the market topped out at 2413 megawatts.

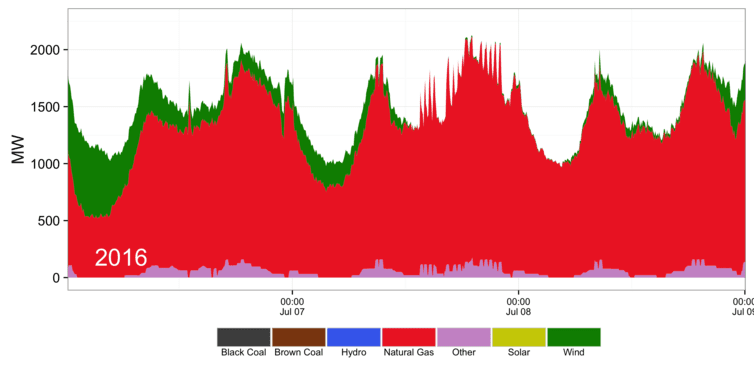

The relevant data is captured in the images below. The first shows the dispatch by fuel type over the period 6th July through to 8th July. The second shows the dispatch by generator/wind farm averaged across 7th July. The third shows the contributions made by interconnector, and different fuels, along with wholesale prices for the period midday through to 11 pm on 7th July.

Dispatch by power station and fuel type averaged across the day for July 7th 2016 in South Australia. Stations dispatching less that 10 megawatts are not shown. Other is distillate.

Time series for South Australia on July 7th 2016 from midday onwards.

The top panel shows shows the 5-minute dispatch price (note logarithmic scale). Panel b show interconnector flows, with V-SA representing Heywood and V-S-MNSP1 representing Murraylink. The dark line and shaded region shows the net imports, which averaged 151 MW over the period. Panels c, d and e show the output of gas-fired generators, wind and distillate generation during this period. In all panels, vertical tick marks at the top of each panel show period where the 5-minute price exceeded $9,000/MWh

Across the day, SA dispatch prices (that are resolved at the 5-minute interval) exceeded $10,000 per megawatt hour (MWh) on 24 occasions, and the volume weighted price for the day was just above $1400/MWh. The peak settlement price (resolved at the 30-minute interval) of just below $9,000/MWh occurred between 7:00pm and 7:30pm, with 19 settlement periods across the day exceeding $1000/MWh. For reference, the average wholesale price in South Australia is about $60/MWh and normally there are only around 40 settlement periods exceeding $1000/MWh each year (a total of 53 were recorded in July 2016 alone).

Settlement prices were above $2000/MWh for most of the afternoon and evening.

In the extreme trading interval between 7:00pm and 7:30pm wind was dispatching only 13.5 megawatts and other generators displayed erratic dispatch patterns. For example, the output from the AGL Torrens Island plants reduced by 90 megawatts soon after 7:00 pm while the prices remained near the price cap of $14,000/MWh.

To provide a reference frame, it is useful to compare the events of July 7th this year with the same period of last year, as shown below. The comparison is made all the more useful because in both years July 7th weather conditions were similarly calm, with low to negligible wind generation in the critical early evening period, and a very similar demand profile (peak demand on July 7th 2015 of 2133 megawatts). However, in 2015, Alinta’s brown coal Northern Power Station in Point Augusta was still operating, contributing around 350 megawatts, and the Heywood interconnect was fully operational allowing imports to average around 530 megawatts, and up to 620 megawatts at peak. Together, that meant for what were essentially equivalent conditions, some 700 megawatts less gas was being dispatched on July 7th in 2015, compared to the same day a year later.

For the period midday through 11:00pm prices on July 7th 2015 averaged only $112/Mwh, with only one 5 minute price interval spiking above $500/MWh.

Time series for South Australia on July 7th 2015 from midday onwards.

The top panel shows shows the 5-minute dispatch price (note logarithmic scale). Panel b show interconnector flows, with V-SA representing Heywood and V-S-MNSP1 representing Murraylink. The dark line and shaded region shows the net imports, which averaged 536 MW over the period, 385 megawatts more than the same period in 2016. Panels c, d and e show the output of gas-fired generators, wind and brown coal generation during this period.

A key notable difference between the winters of 2015 and 2016 was the price of gas, which had literally gone through the roof, by 375% for the day of July 7th (335% for the week).

But that was nothing compared to the wholesale electricity price outcomes which had gone stratospheric, rising some 2000% over the midday to 11:00 pm intervals considered here.

Concentrating market power

Our wholesale energy-only market is deliberately structured with a very high market cap price ($14,000/MWh). Scarcity events are valued way above the cost of fuel, which typically would amount to only a few $‘00/MWh for even the most expensive diesel or gas generator, to ensure that enough generation capacity is available to meet rare high demand periods. For example, a gas peaking generator that may be needed only a few days a year, needs to recoup prices in the $’000’s/MWh for the times it is dispatching in an energy only market in order to cover long run costs.

To avert risks and ensure supply, participants normally engage via the contract market, rather than directly through the wholesale market. A variety of standard contracting arrangements are available. Cap contracts reduce exposure to extreme price spikes by setting a strike price typically at $300/MWh. The cap contract provides a form of insurance to mitigate exposure to high price events, where the buyer pays a contract price to the supplier independent of the wholesale price outcome, and in return gets recompensed for any wholesale price events above the strike price.

The importance is that it has been rumoured that some large energy users in South Australia were either uncontracted or under-contracted on their supply this year. Any energy intensive business exposed to the wholesale market on July 7th would have been in for one almighty shock. And for those that do make sure they are fully contracted, they will face the consequences as the higher wholesale prices are passed through to the futures markets, as Andrew Stock indicates they inevitably will.

The Australian Energy regulator reports that the extent of contracting varies across the regions that make up the National Electricity Market (NEM), with South Australia reportedly with lower liquidity than other regions. That is consistent with issues to do with market power, or perceptions thereof, and there are certainly strong indications that market power has become excessively concentrated in South Australia.

As noted above, on July 7th key generators were in the positions of pivotal supply, by our estimates, AGL for around 87% of the day and Origin for 11%.

There are very good reasons for prices to rise during scarcity events, but how much they rise is dependent on competition. Pivotal suppliers are able to exercise market power to extract so called monopoly rents, and there is certainly some circumstantial evidence that suggests as much, perhaps partly motivated by a desire to force buyers back onto the contract market. Who knows?

A useful index for market concentration is the Herfindahl-Hirschman index (HHI). As the sum of the squares of the market percentage shares, it can rise to 10,000 for 100% concentration. The ACCC sets an HHI index at 2000 to flag competition concerns. The UK’s Office of Gas and Electricity Markets (OFGEM) regards an HHI exceeding 1000 in an electricity market as concentrated and above 2000 as very concentrated. With a current HHI value of 1243, the OFGEM considers the UK wholesale electricity market somewhat concentrated. According to the Australian Energy Regulator, the regional NEM markets had HHI indices in the range 1700-2000 in 2015. With the closure of Alinta’s Northern and the mothballing of Engie’s Pelican Point station, the effective HHI index in South Australia in July this year was probably around 3300-3400, making it exceedingly concentrated.

Market concentration in South Australia is a consequence of events dating as far back as 2000 when the state government put its generation assets up for sale. Then minister Rob Lucas refused a request from Origin to split the two gas fired generating stations at Torrens Island (Torrens A and Torrens B), on advice from Morgan Stanley deciding to sell them as a bundle to TXU. One can only surmise the combination was worth more than the sum of the parts, presumably because it would give its new owner greater power. South Australians may now be paying the dues owed on that decision.

But other factors have also conspired. AGL, who acquired Torrens island from TXU in 2007, was not responsible for Alinta’s decision to close Northern in May, or Engie’s mothballing of Pelican Point earlier in the year.

However, by virtue of these events AGL has found itself in a position of unprecedented market power. How it and other participants responded will no doubt be examined in excruciating detail in coming months, not in the least because AGL could find itself in a similar position if Hazelwood or Yallourn were to exit Victoria.

What we know is that margins on South Australian gas generation units have increased dramatically in recent times rising from about $20/MWhr to many times that, in a measure known as the spark spread. As the figure below shows, despite the gas market price rises affecting all regions, South Australia is the only region to show any significant rise in the margins of gas generators. Given that volumes have also risen, such a dramatic rise in margins is hardly the trade off one expects for an efficient competitive market.

Top panel – illustrates the spark spread for gas generation in South Australia. The margins for Queensland, New South Wales and South Australia are compared in the bottom panel, since February 2015. Prior to June 2016, the spark spread was relative constant and broadly consistent across the three regions, with the exception of the late summer and early autumn period when Queensland spark spread was elevated by a factor of about four. Prior to June 2016, the South Australian spark spread averaged $17/MWhr. That value is comparable to the spark spread in other, completely unrelated jurisdictions such as the United Kingdom. We assume a typical Combined Cycle Gas Turbine with an assumed thermal efficiency of 50%, analysis by Dylan McConnell.

So what should we make of this?

A number of interdependent factors are playing out in the evolving South Australian electricity sector. The aggregate effect manifest dramatically on July 7th reflects a complex interplay between legacy issues (including existing asset ownership), the increasing penetration of wind generation, competing developments in the gas market, and the absence of coordination of transitional arrangements.

The rise in wind generation in South Australia since 2006 has impacted in several ways. It has contributed downward pressure on wholesale prices, which declined in real terms in the period 2008 through 2015 (while also generating net Large-scale Renewable Energy Target certificates to the annual value of about $120 million). It is of note that over the five years prior to the winter of 2016, the wholesale market prices in South Australia have been pretty much on par with those in Queensland, which has no wind assets.

However, in suppressing wholesale prices, wind generation has contributed to decisions to close brown coal generators, and increased South Australian dependence on imports and, in times of low wind output, gas. As one of the largest stations on the NEM in terms of capacity relative to regional demand, the closure of Northern Power Station in May, 2016, has tightened the demand-supply settings, and that has reset the wholesale price clock upwards – a dynamic that is part of the ordinary capacity cycle in energy only markets.

The dramatic increases in gas prices in the winter of 2016, largely driven by dynamics in the export market (which have seen an 3-fold expansion of production in recent years) have added at least $140-$200 million to the annual cost of South Australian electricity supply. Due to its historic reliance on gas generation, South Australia has always been exposed to movements in gas prices even without the investment in wind. In pure energy terms, gas generation in South Australia has been declining over the last decade, due in significant part to the addition of wind to the generation mix.

Despite the closure of the Northern Power Station, South Australia gas dispatch has remained at near record low levels in seasonally-adjusted terms. What has changed dramatically since Northern’s closure is the concentration of market power. While there are legitimate reasons for power station owners to increase prices to reflect scarcity value, our analysis suggests that recent increases in wholesale prices have been well in excess of the reasonable market response, and reflect the extraction of monopoly rents. Such ‘opportunism’ has been encouraged by poor coordination of the system adjustments, such as mid-winter upgrades to Heywood interconnector.

Multiple options exist that address both of these issues to greater or lesser extent. OCGT is a cheap option to increase capacity and supply in peak periods, but does not improve competition or supply outside these periods and is still partially dependent on gas prices. Storage options can both increase capacity in peak periods, and increase competition through daily arbitrage opportunities. Concentrating solar thermal (CST) further reduces the consumption and reliance on gas, while providing capacity. Additional interconnection (above and beyond the current 190 megawatt expansion of Heywood) may also prove to be a viable solution. Adding a robust demand-side market to the existing supply-side market would add significant impetus to achieving energy productivity gains.

In the longer term, South Australian experience points to the need to diversify low emission generation and storage portfolios. As we necessarily decarbonise the national electricity system, large-scale storage including CST with storage will become increasingly necessary to provide for both peak capacity and reliability of supply.

Finally, the South Australian experience provides a salutary forewarning of the havoc that can ensue from lack of coordinated system planning in times of transition. It bears on the question of disorderly exit that will be faced in all markets requiring substantial decarbonisation, in part because of the scale of the fossil power stations that are displaced. South Australia highlights the potential benefits for system wide oversight of transitional arrangements to avoid market power issues. The recent price rises in South Australia would have been much less extreme had Northern’s closure not occurred prior to completion of the upgrade to the Heywood interconnect at a time when Pelican Point was effectively mothballed (reflecting the opportunity cost of the gas export market), and demand was rising to meet the winter peak. As it transpired, the coincidence of all these factors contributed to a rapid and unprecedented concentration of market power.

And for the COAG meeting need we emphasize that the benefits of market competition can only be realised if markets are competitive?

For the full details see our report “Winds of Change – An analysis of recent changes in the South Australian electricity market” available here, for which any credit should go to coauthor Dylan McConnell.

Source: The Conversation. Reproduced with permission.![]()