Rooftop solar has continued its massive incursions into the business case for coal fired power generation over the weekend, smashing all sorts on consecutive days as it continued to reshape the grid and highlight how more power now now shifted to the consumer.

The records started tumbling on Saturday when a number of data providers, including GPE NEMLog2, noted that the share of rooftop solar on the National Electricity Market reached a record 46.74 per cent at 12.25pm (AEST).

That easily shattered the previous benchmark of 44.26 per cent set nearly a year ago. Rooftop solar was generating 11,000 MW at the time.

And on Sunday, rooftop solar grabbed an even bigger share, jumping to 47.3 per cent of the NEM, at the same time sending operational demand to a new record low of 11,953 MW, according to the Australian Energy Market Operator, beating the new low of 12,393 MW set just a day earlier.

On both occasions, rooftop solar was eating into the output of coal fired generators, sending black coal to a record low output, although it was also causing significant amount of curtailment of large scale wind and solar, due to the lack of adequate storage.

More than 1.2 GW was being sucked up by pumped hydro and battery storage, attracted by the wholesale market prices of minus $64/MWh at the time. The wholesale prices were negative for most of the daylight hours.

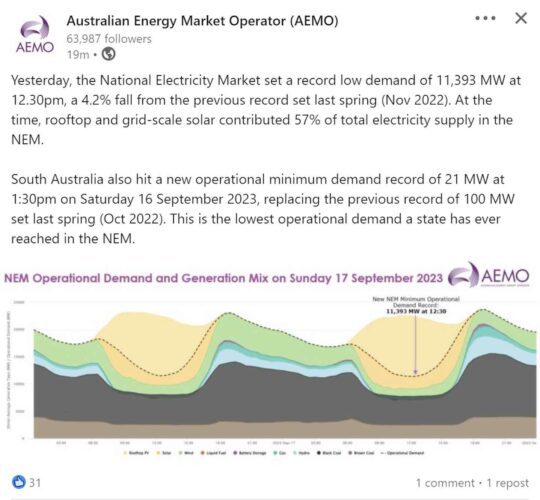

The numbers were confirmed on Monday by AEMO in this tweet above, which noted that the combined output of rooftop and grid scale solar was 57 per cent of total demand at the time. As the graph illustrates, solar dominated more than half of grid demand for most of the day.

Indeed, rooftop solar continued to eat into market demand in such a way that it sent the output of black coal generators (in NSW and Queensland) to a record low of 5221 MW, well below the previous minimum of 5332 MW set just a week ago.

The rise of rooftop solar – installed across households and businesses across the country – is one of the most profound changes in the grid.

It is shielding many households and businesses from rising electricity prices, but is also becoming a major influence on the operations of large scale generation – coal in particular – and in the way the grid is managed.

Until recently, the biggest concern of the market operator was ensuring enough capacity to meet demand spikes on hot summer evenings. Now it is equally concerned with maintaining operational control of the grid as rooftop solar sends demand to lows where it could become difficult to secure the grid in the event of any disruption.

The market operator has rolled out a program to ensure that all new rooftop capacity in some states – such as South Australia – have inverter settings that allow the facilities to be “orchestrated”, or even switched off if needed.

Federal and state governments have also rolled out a major program to install neighbourhood batteries to soak up solar in the middle of the day.

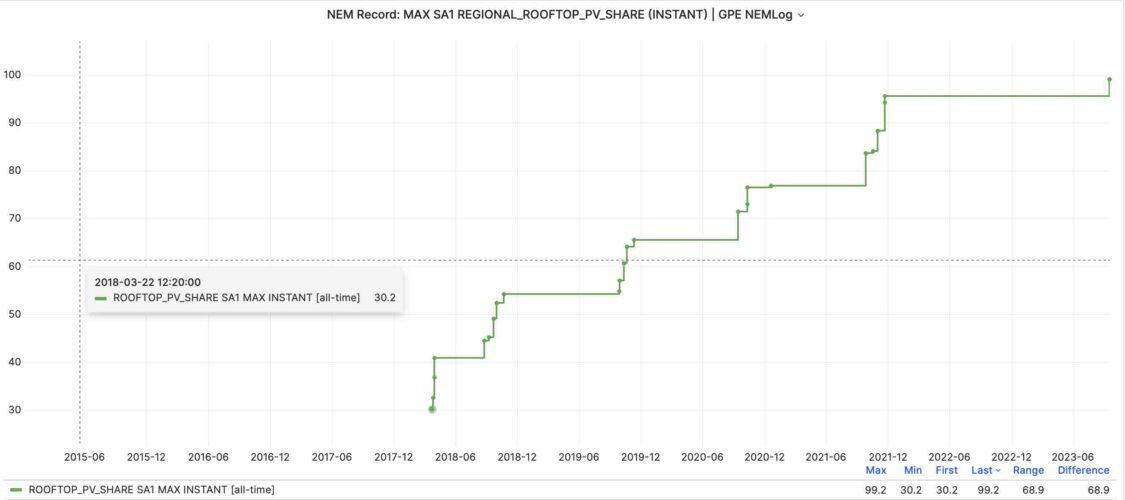

On Saturday, rooftop solar reached a record 99.2 per cent of state demand in South Australia – beating the 95 per cent record set two years ago, according to GPE NEMLog2, and meant that the local distributed network was actually exporting power back into the transmission network, instead of vice-versa.

AEMO also confirmed that operational demand in South Australia had fallen to just 21 MW, the lowest in any state on record, and well below the previous minimum in that state of 100MW.

See more on that story: Rooftop solar eats up all demand in South Australia, world’s most renewable grid

In Western Australia, a grid that has no links with other states and is the world’s biggest standalone network, rooftop solar has hit a record share of 77 per cent, and it has also required new systems to have controllable inverter settings.

It is also contracting a series of giant four-hour batteries to soak up rooftop solar during the middle of the day and transfer the output to the evening peak.

But over the medium term, it expects new industrial demand – looking for zero emissions power, along with more household batteries and the growing uptake of electric vehicles – to soften the impact of low operational demand.