By now it should be clear that what we are seeing this winter in the National Electricity Market (NEM) – although unlucky in that international prices and weather are the main drivers – is the predictable outcome of letting a bunch of people with poor track records loose in the system.

Many will be saying “I told you so,” because the need to build new supply has been obvious for many years. Virtually every second week for years we have talked on the Energy Insiders podcast of the need to build new supply ahead of old supply closing, and ways that could be accomplished.

Here at ITK we’d rather be talking about success stories, companies like NexteEra, or a lithium producer like Alkem; companies that have seized the opportunities the transition presents to the benefit of all stakeholders.

But this week I want to go through just some of the roadblocks.

Space does not permit repetition of my own view that the Australian Energy Market Operator (AEMO) should give up some of its functions, like, for instance, Victorian transmission planning, and get back to its core responsibilities – including getting new generation connected efficiently and helping new entrants with their GPS.

Nor do I have space to demonstrate that, in our view, the Queensland government is only a little better than the federal government in that, like the federal government, it has wishful thinking targets but no policies to achieve them.

Nor can I really channel Joe Aston and go through the track records of the chairs of, say, Snowy or Transgrid or APA – and they are not the only ones – to illustrate that overseeing investments that result in a huge loss of shareholder value does not seem to be a problem when being considered for a chairperson’s role at a major corporation.

Roadblock #1 – Angus Taylor

Since this roadblock has been removed, I’ll not waste time, beyond noting that his lack of leadership, inability to read the room – the person that is supposed to be the host of the party inside the tent but would rather be outside the tent trying to burn it to the ground – has set back Australia’s progress by three to five years.

He could learn a lot from Matt Kean about how to be a successful politician. But anyway, he’s yesterdays bad smell.

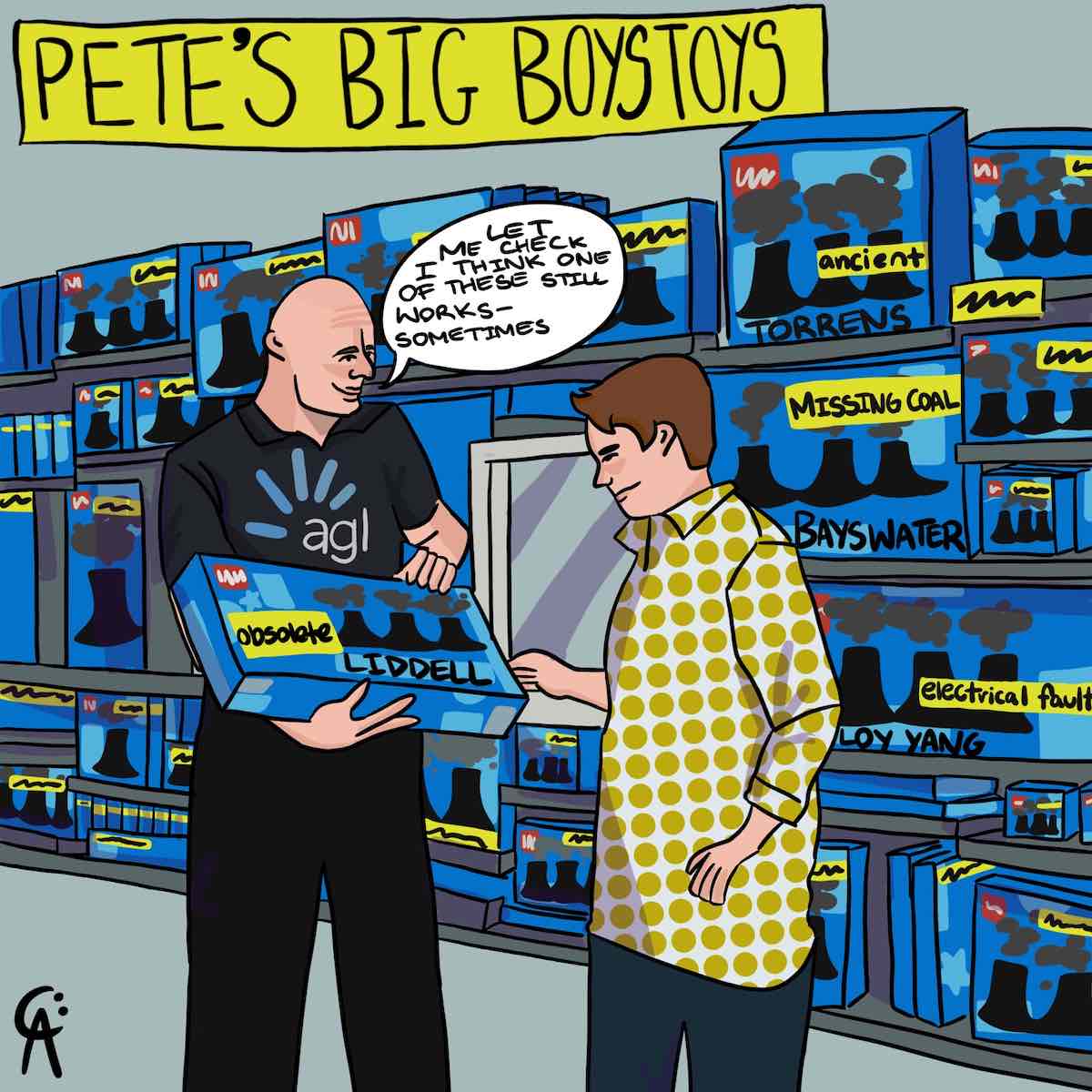

Roadblock #2 – Australia’s Big Three gen-tailers

AGL, Origin and EnergyAustralia are public companies or a subsidiary of a public company and management are responsible to their stakeholder, primarily shareholders. So it’s there that the verdict can be found. And that verdict is negative.

And why is it negative? Its because these three gen-tailers have acted exactly like traditional incumbents in

any industry facing disruption. Namely denial and opposition.

Seventy per cent of Australians want more done about climate change and wind and solar is clearly cheaper than coal or gas generation. But do the Big Three gen-tailers give customers what they want?

Of course they don’t. What they do is announce closures of coal plant (Liddell, Yallourn and Eraring) without doing much to replace the bulk energy these power plants provide. They fiddle around with batteries and pumped hydro, when what we need is lots more bulk energy.

The Big Three gen-tailers sell around 40TWh to 6.7 million mass market customers capturing roughly two-thirds of the total market.

| Majors mass market retail | |||

| 2016 | 2021 | Chg | |

| Mass market Customers (000s) | |||

| AGL | 2,247 | 2,465 | 10% |

| ORG | 2,741 | 2,625 | -4% |

| EA | 1,750 | 1,583 | -10% |

| Total | 6,738 | 6,673 | -1% |

| Consumer volumes (TWh) | |||

| AGL | 14.6 | 14.6 | 0% |

| ORG | 18.4 | 16.3 | -11% |

| EA | 10.8 | 9.2 | -15% |

| Total | 43.8 | 40.1 | -9% |

| Volume per customer (MWh) | |||

| AGL | 6.5 | 5.9 | -9% |

| ORG | 6.7 | 6.2 | -7% |

| EA | 6.2 | 5.8 | -6% |

| Average | 6.5 | 6.0 | -7% |

Figure 1. Just the mass market volumes of big 3, business volumes more than double that. Source: Company

In addition, they sell even more energy to the business market. And yet they sign no new renewable energy contracts and in the past have explicitly said that business customers can be responsible for meeting their own LRET obligation.

The Big Three gen-tailers could have been leaders. AGL was at one time the biggest wind supplier in the

country and its then CEO Michael Fraser, now chair of APA, was chair of the CEC. Fraser abandoned the

wind strategy and Loy Yang A, Bayswater and Liddell were purchased.

Jerry Maycock, now chair of Transgrid, was Chair of AGL at the time. Maycock had previously been CEO of CSR at the time it bought Pilkington glass, resulting in a large destruction of shareholder value. Hopefully Transgrid is more resilient as we need Transgrid to be a success.

Origin had even more opportunity to embrace renewable energy, as it was always a net buyer of power and had gas power stations that could be used for firming. But its various CEOs, and particularly Grant King, never saw the returns in wind and solar and instead went chasing after endless pots of gold at the end of rainbows – in the process destroying shareholder value.

So what happens? King gets appointed by the federal government of the time to come up with an energy strategy and writes “the King report” which has thankfully been largely ignored.

Frank Calabria then compounds the mistake with a strategy that seems to embrace the epigram “the road to hell is paved with good intentions”. Calabria announces the closure of Eraring early. That’s good, except it’s not, because there is no strategy or even obvious intention to replace the Eraring energy with any Origin sourced wind and solar. Totally dumb.

Big energy users like Rio Tinto are going to show AGL and Origin how to do it. Rio is asking for proposals based around 4GW of wind and solar to replace Gladstone power station in supplying energy to Boyne Island aluminium smelter and Gladstone alumina refinery.

Energy Australia is no better, closing Yallourn early but doing nothing to replace its bulk energy supply. It’s fine to fiddle around with batteries and pumped hydro and even a subsidised brownfields gas generator, but the main game right now is building lots of wind and solar.

It’s not just the world’s largest corporate buyer of electricity, Rio Tinto, that is investing in wind and solar; corporates all over Australia are having to invest in people to run their electricity purchasing operations because they want wind and solar for its economics and its ESG credentials, but their traditional suppliers are doing such a piss-poor job of giving it to them.

And, as I say, this just results in a very visible destruction of shareholder value. AGL, though, is a special case. It seems like management has just completely thrown in the towel on maintaining its plants. Rarely in the history of corporate Australia has a large company so clearly demonstrated its basic unfitness.

Take Loy Yang A. The unit that is currently out of operation there and costing shareholders $70 million or more pretax this time, is the same unit that went out of service in 2019. That outage cost close to $70 million, but much was recovered by insurance.

It now seems clear, however, that either the underlying root cause of the problem wasn’t identified or, if it was, it wasn’t fixed because it’s broken again. This time there is no insurance.

Arguably it would be even worse news if the root cause had been found and properly repaired, because it would suggest that the life of each of the units at LYA is less than generally thought. But until someone convince me, otherwise I think it was just a poor repair job.

Now, in NSW, at close to the worst possible time, we have three units at Bayswater out of action and at least two units at Liddell underperforming. There is no shortage of coal for AGL in NSW, it has stockpiles. It seems to be either an outright lack of maintenance or incompetent maintenance.

It’s true that Liddell has always been accident prone, but Bayswater was meant to be better. AGL has had more management change and change of strategy than any other company I have ever analysed and it doesn’t seem that it’s done with change yet.

| AGL’s shameful coal gen performance | |||

| 9-14 June MW | Total | NSW | Victoria |

| Max output | 2982 | 1296 | 1686 |

| Winter capacity | 6250 | 4040 | 2210 |

| Max output /capacity | 48% | 32% | 76% |

Figure 2. AGL recent coal generation performance. Source: NEM Review, AEMO

Maximum output, never mind running all day in NSW, was 1,296MW out of a combined winter capacity for AGL in NSW from the Bayswater and Liddell stations of 4,040MW. AGL supplies Tomago smelter’s 960MW load. After supplying that AGL in NSW had, say, 300MW available for the rest of the state.

It’s very hard to see how AGL in NSW could be short-term profiting from the high generation prices as it’s almost certain to have sales contracts in excess of its capacity to supply. That is, it will have to be buying power from someone else. In that sense, an administered price cap may actually reduce AGL and Origin’s costs.

Similarly Origin Energy has already announced a profit downgrade because it couldn’t get enough coal to run

Eraring as hard as it expected. The coal outage had several causes, including a coal miner fatality, and a

longwall move.

ITK observes that it appears that Energy Australia has brought a unit of Mt Piper back into service that I expected to be out for some months for scheduled maintenance.

In ITK’s opinion one of the biggest winners from the current situation will be Alinta, because the Loy Yang B plant has operated pretty well flawlessly and is unlikely to be fully contracted.

Other winners will be wind and solar projects, either existing or prospective, that are in the process of negotiating PPAs. Notwithstanding the large and still increasing cost of capital, i.e. cashflow discount rate, PPA prices going from sub $50/MWh to possibly over $70/MWh is good news for those project owners.

Grok it!

Telling management of large companies how to run their business is obviously pretty stupid. Even respected management consultants struggle with that, let alone humble keyboard warriors.

Still, as an analyst it’s hard to recommend a company that has a large and diversified load spread over millions of customers big and small and yet doesn’t want to give them power more cheaply than they could get it any other way.

That, in essence. is the true appeal of Grok’s investment in AGL. It offers the prospect that somewhere along the line, one of the big gen-tailers might actually work out that selling only renewable energy to its customers is both attractive and cost effective, allows the gen-tailer to get skilled at owning, maintaining and developing renewable energy and provides a true marketing differentiation.

The alternative is to stand by while all the new entrants eat your lunch, dinner and petit dejeuner.

Clare Savage’s astonishing views on stranded gas asset costs

ITK was a bit surprised to hear AER chair Clare Savage talking at the Quest Australian Energy Week about

“renewable gas” and “hydrogen through the gas network” as alternatives to electrify everything as the strategies for decarbonising household energy consumption.

Who even knows what renewable gas is, very likely I misheard, but I don’t know anyone other than the most optimistic of gas companies that thinks you can put more than 15-20% of hydrogen through the gas pipes without running into showstopper embrittlement issues.

There is pretty much zero chance with current technologies of being able to use hydrogen to replace gas in the average house.

On the other hand there is immediately available technology to replace household gas. And in any case, pretty much every serious study long ago concluded that the way to decarbonise most economies is to decarbonise electricity and then electrify everything.

In my eyes, the failure of Clare Savage to acknowledge that is perhaps emblematic of the way the AER is

approaching its role in decarbonisation. Frankly, to me it’s a worry.

I do want to acknowledge that Savage’s speech about accelerated depreciation for gas networks was interesting, complete with Barry Humphries’ style audience humour. Not so funny was the idea that gas consumers could have to pay to exit the gas network for fear the remaining users would have to pay more.

It’s true that the payment for stranded assets is a vexing issue, but for my part I think the way forward is to incentivise users to switch from gas to electricity and it’s the owners of the gas networks that should pay with uncompensated write downs in the Regulated Asset Base.

I can see no good reason why gas distribution and transmission companies should be paid, even if no one

wants their product. In the very end the owner of an asset must accept the volume, price and cost risks

that come with ownership.

Thank goodness for wind recently

Miraculously, two wind farms, including Moorabool – where output has been restricted for years due to “GPS” and “transmission” issues – suddenly operated at much higher capacity factors:

This has assisted in a very welcome, no doubt temporary and certainly unseasonal, lift in wind production, just when it was most needed.

| Supply by fuel & Renewable Penetration | ||||||||||||

| 13/06/2022 | Latest* | Last year | ||||||||||

| TWh | NEM | NSW | QLD | SA | Vic | Tas | NEM | NSW | QLD | SA | Vic | Tas |

| Coal | 123 | 48 | 42 | 33 | 132 | 56 | 41 | 35 | ||||

| Gas | 20 | 4 | 8 | 5 | 3 | 0 | 17 | 2 | 8 | 6 | 2 | 0 |

| Hydro | 23 | 6 | 1 | 5 | 11 | 19 | 5 | 1 | 3 | 11 | ||

| Wind | 28 | 7 | 2 | 7 | 9 | 2 | 22 | 5 | 2 | 6 | 8 | 2 |

| Solar | 7 | 3 | 3 | 0 | 1 | 6 | 2 | 3 | 0 | 1 | ||

| Rooftop Solar | 11 | 4 | 4 | 1 | 2 | 0 | 11 | 4 | 4 | 1 | 2 | 0 |

| Total | 213 | 72 | 60 | 14 | 53 | 14 | 208 | 73 | 59 | 13 | 50 | 13 |

| Demand | 198 | 74 | 53 | 13 | 48 | 11 | 194 | 74 | 51 | 12 | 46 | 11 |

| Rooftop | 11 | 4 | 4 | 1 | 2 | 0 | 11 | 4 | 4 | 1 | 2 | 0 |

| Total Demand | 210 | 77 | 57 | 14 | 49 | 11 | 205 | 77 | 56 | 13 | 48 | 11 |

| % total | ||||||||||||

| Coal | 58% | 67% | 69% | 0% | 63% | 0% | 63% | 77% | 69% | 0% | 71% | 0% |

| Gas | 9% | 6% | 13% | 38% | 5% | 0% | 8% | 2% | 14% | 43% | 3% | 1% |

| Hydro | 11% | 8% | 2% | 0% | 9% | 83% | 9% | 6% | 2% | 0% | 6% | 82% |

| Wind | 13% | 10% | 3% | 49% | 18% | 16% | 11% | 6% | 3% | 45% | 15% | 17% |

| Solar | 3% | 4% | 5% | 3% | 2% | 0% | 3% | 3% | 5% | 3% | 2% | 0% |

| Rooftop Solar | 5% | 5% | 7% | 10% | 4% | 1% | 5% | 5% | 7% | 9% | 3% | 1% |

| VRE share ** | 21.7% | 19% | 15% | 62% | 23% | 17% | 19% | 14% | 15% | 57% | 20% | 17% |

| * 30 day moving total annualised | ||||||||||||

| ** Wind + solar + rooftop | ||||||||||||

Figure 6. Source: NEM Review