Barely a week after submissions closed on the Turnbull government’s proposed National Energy Guarantee, a “decisions” paper of the controversial policy proposal has been delivered to state and territory governments, ahead of the crucial August 10 COAG Energy Council meeting.

The 39-page Energy Security Board document has been distributed and a copy obtained by RenewEconomy. Bizarrely, the ESB is refusing to even confirm its existence, with a spokesman saying it will make “no comment” on its processes and will not release any details before August 10.

Those that have seen the document – and are prepared to admit its existence – raise many of the same concerns as they did about the draft document released in June, which called for responses to its numerous questions to be delivered in mid July. A week later, it seems decisions have already been made.

The new decisions document, dated July 23 and titled “National Energy Guarantee, COAG Energy Council Decision Paper,” details a number of changes that have been made to the policy since the draft was published in mid-June. Most are considered marginal and not really affecting the overall picture.

However, it also include is what appears to be update modelling which suggests even greater savings to be delivered from the NEG – now $550 a year rather than $400 a year.

Pointedly, most of the savings to households will come from the renewables energy generation brought to the system by the federal renewable energy target, and the Victoria and Queensland state targets.

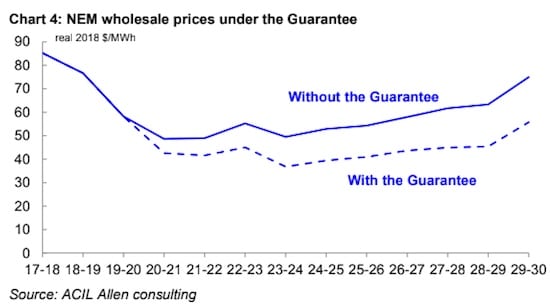

“The continued connection of additional renewable generation projects to the NEM in coming years is projected to see prices fall from today’s elevated levels (Chart 3),” the document says.

“The modelled short-term wholesale price reductions are comparable to those currently implied by futures contracts.”

It says the average NEM-connected household is estimated to save around $550 dollars a year (real $2018) on their retail bill over the 2020s relative to 2017-18. Of this, nearly $150 per year (real $2018) is forecast additional savings as a result of the Guarantee.”

Which means that $400 of the savings come from renewables. In some years, the savings will be $500 a year just from the renewables from the RET – see chart 5 below.

The “decisions document” insists that without the NEG, there will be no new build in any form of generation, apart from Snowy 2.0 and rooftop solar.

It includes this chart above, which seems to ignore the Victoria and Queensland targets too, and seriously undercooks the amount of rooftop solar to be installed, even though it claims to be “in line with AEMO forecasts.”

The “decisions document” does not include expected new build with the NEG in place. The ESB could not comment or clarify because it could not confirm that the document actually exists.

The “decisions document” confirms the use of offsets, and while it says the mechanism can incorporate any further emissions reductions target, the key part of the mechanism that relates to how quickly the targets can be changed is not included. That will come from a special paper from the federal government.

The NEG has been criticised because the emissions reduction target – just 26 per cent for the electricity sector – is too low and will effectively be met by the early 2020s, and the Coalition government is trying to lock this in until at least 2030.

Many different independent analysts say it will result in no new renewables investment, will force prices to rise rather than fall because of the complexity, and will reinforce the power of the incumbents.

Those who have seen the latest document say that despite some cosmetic changes, their fundamental concerns remain, and chief among them is an apparent “premium” for coal, gas and hydro plants, at the expense of wind and solar.

Some of the fine details are still not clear, but the ESB document says the policy is designed to ensure that the owners of existing “firm” generators – i.e. coal and gas – have an incentive to keep them maintained and in production.

Bruce Mountain, from the Victoria Energy Policy Centre says it will result in a “straightforward transfer of wealth” from consumers to incumbent generators.

He says the policy is designed to deliberately obscure pricing of any emissions reduction, and the resulting complexity will flow through to consumers in the form of added costs.

John Grimes, the head of the Smart Energy Council, says the document shows renewable energy – now that it is finally being built – is driving down the wholesale cost of electricity, and yet the policy seeks to put everything in place to ensure power prices go up.

- How will the national emissions reduction target be increased?

- Will national and/or international offsets be included to excluded?

- How can State and Territory Governments realistically go further than the NEG?

The ESB document insists that the “guarantee is specifically designed so that it does not undermine, and may indeed boost, competition through measures that enhance market liquidity and pricing transparency in retail and wholesale electricity markets.”

It says that “under the emissions reduction requirement, smaller retailers are supported through the exemption of the first 50,000MWh of load and with greater flexibility to carry forward any over-achievement.

“Under the reliability requirement, when the reliability obligation is triggered, a Market Liquidity Obligation will require the largest participants to offer to buy and sell contracts with all participants.”

Changes to the reliability mechanism of the policy – designed to incentivise retailers and other liable entities to contract and invest in “dispatchable” resources – include:

– The allowance for large customers to be able to ‘opt-in’ to manage their own reliability obligation, “if they consider this is the most cost-effective and efficient approach.”

– Retailers can adjust their contract position within the compliance year when they take on new commercial and industrial customer sites with historic peak load less than 30MW.

– Large vertically integrated retailers will be covered by a Market Liquidity Obligation when the reliability obligation is triggered. “Obligated entities will be determined based on a size threshold and required to perform a market making function for the duration of the gap period.

– Liable entities found to be non-compliant with their contracting obligations will be charged an amount that contributes to the costs of AEMO exercising its Procurer of Last Resort function. This will be a proportionate cost contribution commensurate with the non-compliance, determined after the event and capped at $100 million.

Analysts are also concerned about potential windfall gains to long-standing hydro power plants, with those built before 1997 now being able to sell allocations, unlike in the RET. This will benefit the federal government-owned Snowy Hydro, and the Tasmania government Hydro Tasmania.

Other changes to the emissions component include:

• The approach to over-allocations of generation has been revised. Market customers have an incentive to reallocate generation in advance of the reporting deadline. Over-allocation will not attract a civil penalty.

• The carry forward limit increases, to up to 10 per cent of the first year’s electricity emissions intensity target per MWh of load plus a fixed amount of 60,000 tCO2-e.

• In the first year, market customers can defer their full compliance obligation, but any deferral must be made up in the following years.

[pdf-embedder url=”https://reneweconomy.wpengine.com/wp-content/uploads/2018/07/COAG-NEG-Decision-Paper-final.pdf” title=”COAG NEG Decision Paper – final”]