Solar and wind power are on track to become the new baseload electricity supply for global energy markets as early as 2030, and to relegate thermal generation from coal and gas to the role of back-up, a major new report has found.

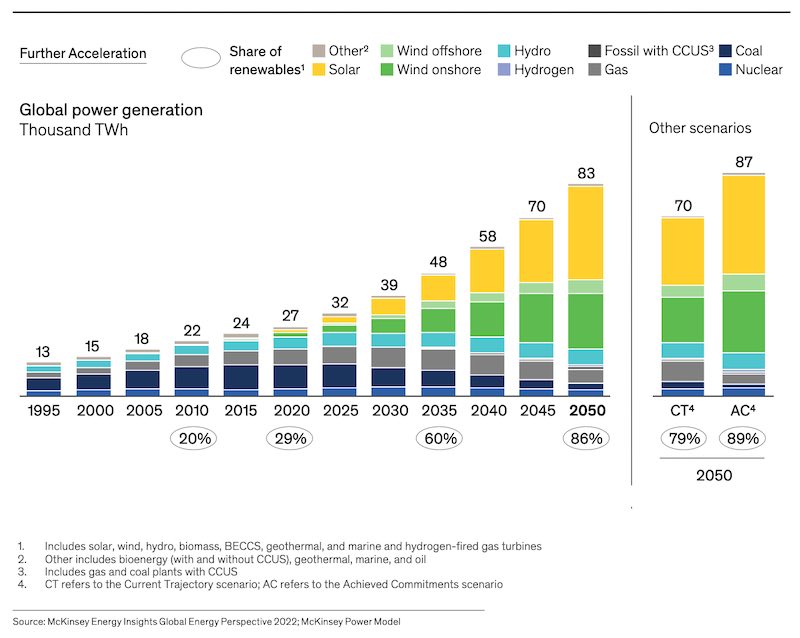

In its 2022 Global Energy Perspective, leading global consultancy McKinsey & Company says renewable energy is on track to account for 50% of the world’s power mix by 2030, and around 85% by 2050, thanks to the increasing cost competitiveness of new solar and wind capacity.

McKinsey says that even despite the conflict in Ukraine – and bizarre declarations from certain Australian politicians that net-zero is “dead” – the long-term transition to low-carbon energy systems continues to see strong momentum, and even acceleration.

The report projects a rapid shift in the global energy mix, with the share of renewables in global power generation expected to double in the next 15 years while total fossil fuel demand is projected to peak before 2030, depending on the scenario.

In all of its scenarios, however, renewables are projected to grow by a factor of three by 2050, accounting for 50% of power generation globally by 2030 and 80-90% by 2050.

“Renewables become the new baseload,” it says, supported by significant additions of “flexible” capacity, including battery storage, electric vehicles, and green hydrogen.

Thermal generation is projected to shift to a role of back-up flexibility provider to support grid stability, with load factors declining by one third globally from 2019 to 2050 (from 40% to 28%).

Hydrogen demand is expected to grow four to six times by 2050, driven by road transport, maritime, and aviation. Hydrogen and hydrogen-derived synfuels are expected to account for 10% of global final energy consumption by 2050.

In the report’s Further Acceleration scenario, clean hydrogen supply totals around ~110 Mt (~60% of total supply) by 2035 and ~510 Mt (~95%) by 2050. McKinsey reports that announcements of new clean hydrogen production projects tripled year-on-year in 2021.

To date, the report calculates that around 22 Mt of clean hydrogen capacity has been announced globally, which is impressive, but also only about 15–20% of what is needed by 2035.

And, in just the middle scenario assumptions of the McKinsey report, peak oil is projected to arrive as early as within the next three to five years, driven in no small part by the rapid increase in electric vehicle adoption.

McKinsey notes that, next to the urgent global imperative to stem the tide of dangerous climate change, the shift to away from fossil fuels and towards renewables is being driven by pure economics, including significant decreases in the costs for battery storage.

“Technological developments and supply chain optimisation have collectively halved the cost of solar, while wind costs have also fallen by almost one-third,” the report says.

“As a result, 61% of new renewable capacity installation is already priced lower than fossil fuel alternatives. Battery costs have also fallen by nearly half in the past four years.”

On the less positive side, the report concludes that despite all this momentum behind decarbonisation, global warming is projected to exceed 1.7°C by 2100, and reaching a 1.5°C pathway is increasingly challenging. Much more must be done. Much faster.

“In the past few years, we have certainly seen the energy transition pick up pace,” said Christer Tryggestad, a senior partner at McKinsey.

“Every year we’ve published this report, peak oil demand has moved closer. Under our middle scenario assumptions, oil demand could even peak in the next three to five years, primarily driven by electric-vehicle adoption.

“However, even if all countries with net zero commitments deliver on their aspirations, global warming is still expected to reach 1.7°C. To keep the 1.5°C pathway in sight, even more ambitious acceleration is needed.”