The instantaneous share of renewable energy in Australia’s main grid has reached new highs for the second day in a row, steadily nudging out fossil fuels in preparation for the day that coal generation might be switched off completely, as occurred in the UK earlier today.

As Joshua Hill writes here, the last coal-fired power generator in the UK shut down at 9am AEST on Tuesday, bringing to an end nearly 143 years of coal power. The UK was the first to adopt the technology and the first major economy to shut it down.

In Australia, coal remains stubbornly strong, courtesy of its historical dominance and the failure – unlike the UK – of having bipartisan agreement that it should be closed down. Over the last 12 months it has accounted for 54 per cent of the generation on the main grid, but on Monday it was pushed to a new intantaneous low of 26.4 per cent.

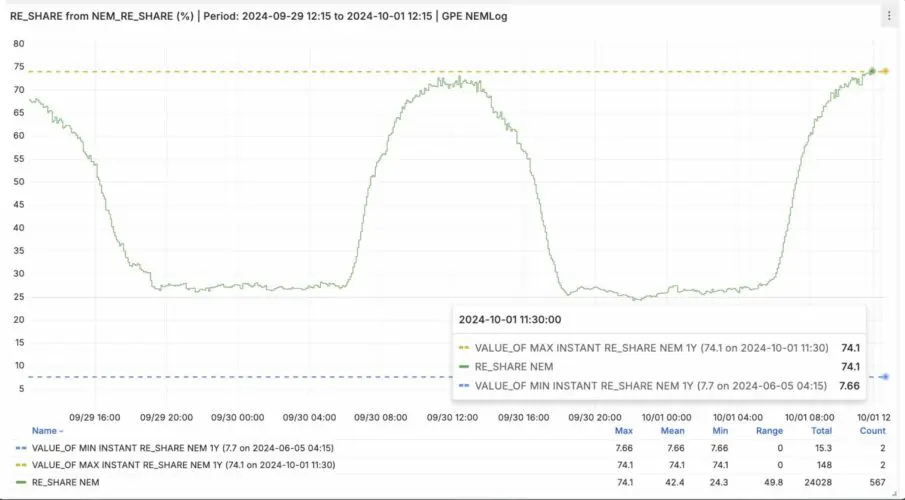

That’s because the share of renewables posted a new instantaneous high of 73.1 per cent – a record that was broken on Tuesday morning at 11.30 when renewables grabbed a 74.1 per cent share.

Wind and solar alone accounted for 72.6 per cent of total demand on the main grid, also a new record that beat the previous high set in November last year by nearly one per cent.

Almost all of it, just over 64 per cent, came from solar – a mix of rooftop (44.4 per cent) and large scale solar (19.7 per cent. Just eight per cent came from wind power.

The new instantaneous renewable share record was later confirmed by the market operator. GPE NEMLog’s records focus on five minute trading periods, while AEMO focuses on 30 minute settlement intervals.

It said that on a 30-m minute peak, a new peak renewable generation record of 73.87 per cent was set for the period ending at 11:30am on Tuesday. It noted that rooftop solar provided 43.7 per cent, grid-scale solar 19.7 per cent, wind 8.5 per cent, hydro 1.6 per cent, other 0.4 per cent and non-renewables 26.1 per cent.

Spring is usually the season for new records because of the good conditions for generation and mild temperatures and low demand.

Australia’s main grid on accessions has enough “potential” renewables to reach a 100 per cent share of generation, but that does not occur for one of two reasons.

Firstly, it’s because a lot of wind and solar is curtailed as wholesale electricity prices plunge below zero, particularly when rooftop solar is holding court in the middle of the day. The wholesale prices go negative because coal fired power generators are keen to keep at least some of their capacity online, because it is cheaper than switching them off.

A second reason is that the Australian Energy Market Operator is not yet ready to allow all synchronous or spinning machines to be turned off, as it is still working through the engineering challenges and complexity of having all the power needs and system services delivered by inverter-based technologies.

Because “grid forming” inverters are relatively new, the market operator is taking a conservative approach while assessing their ability to provide all the system services traditionally supplied by coal and gas generators, particularly in relation to system strength and fault current.

In a recent episode of Renew Economy’s Energy Insiders podcast, AEMO boss Daniel Westerman said the operator still favours having at least some spinning machines – even synchronous condensers which don’t burn fuel – to ensure that the system needs can be met.

The switch from fossil fuels to renewables, from baseload and peaking power to a combination of low cost wind and solar backed by battery storage and other flexible capacity is contested enough without risking having the lights go out.

Some states have much higher levels of instantaneous wind and solar – South Australia reached a record of more than 150 per cent of demand over the weekend – but that’s because those state grids are able to export surplus capacity when needed, and import too.

That option is not available for the main grid, although it will be able to soak up more excess capacity as it installs more storage – both in batteries and pumped hydro and other emerging storage technologies.