Ground zero in the race to renewables in Australia has suddenly moved across the Nullabor.

Western Australia is a state that has long chosen to go its own way on electricity generation, driven by its isolation, huge land mass, small population, unique resources and the power of local industry. It has its own grid, its own rules and regulations, and it is not connected to the rest of Australia.

But W.A. now finds itself thrust from back-marker to front-runner in the transition to green energy. And some of those unique qualities – isolation, huge land mass, and massive industrial projects – make it one of the most fascinating and challenging case studies in the world.

South Australia gets much of the limelight in Australia because it is a global pacesetter, having already reached more than 70 per cent wind and solar in its end-of-grid market, and it is rapidly heading to “net” 100 per cent renewables share within a few years.

W.A. is a long way behind in terms of renewable share, but in the past 12 months it appears to have had a collective dawning – or maybe just a collective “oh-shit” moment – that is going to propel it to the cutting edge of this green energy transition.

In May, the state government produced a remarkable report – a 30 year demand forecast – that highlighted the potential need for more than 50GW of wind, solar and storage to tap deeper into its renewable energy resources and use this to propel a new era of green manufacturing – hydrogen, mineral processing, refining and manufacturing.

Supply and demand

If that seemed like a bit of a long term plan, the reality of it has struck this week with the release of the Australian Energy Market Operator’s 10-year demand and supply forecast, a document known as the Electricity Statement of Opportunities.

The ESOO is an important but usually dull annual planning document, even if it has been thrust into centre stage in recent years as mainstream media seized on its forecasts of potential supply shortfalls as proof that the switch to green energy could send us back to cave-life and bring an end to civilisation as we know it.

This year’s WA ESOO is sensational – there is really no other way to describe it – because it shows that its main assumptions have been turned on their head in just 12 months. A year ago, the ESOO forecast a decline in energy consumption (an average fall of 0.4 per cent) for the next 10 years.

Now, it is telling us consumption is likely to grow by more than 5.6 per cent a year. In one scenario, demand growth could be as much as 12.6 per cent a year, leading to a near quadrupling of electricity demand in just 10 years. And those that want to buy that power, do not want it to be dirty. They want only green energy.

In statistical terms, this is a huge deal, And because we are talking about the electricity grid and supplies, and the fate of big industry, this is about as dramatic and complicated as it gets.

Switch to green energy

So what’s going on here? In summary, the government, the market operators, households and big industry have woken up to the reality of emissions, clean energy technologies, and the extraordinary opportunities it presents.

The switch to electric cars and households plays a reasonably significant role in the increased demand forecasts, but the big ticket items reflect the desire by big business and big industry for clean energy.

They see huge opportunities from the state’s vast mineral resources to cash in on the global switch to EVs and electrification. They see opportunities in more mining, more processing, more refining and even manufacturing.

But they are also very clear on another matter: They don’t want this powered by fossil fuels. It has to be green energy, or the market opportunities and the buyers of their products will simply melt away.

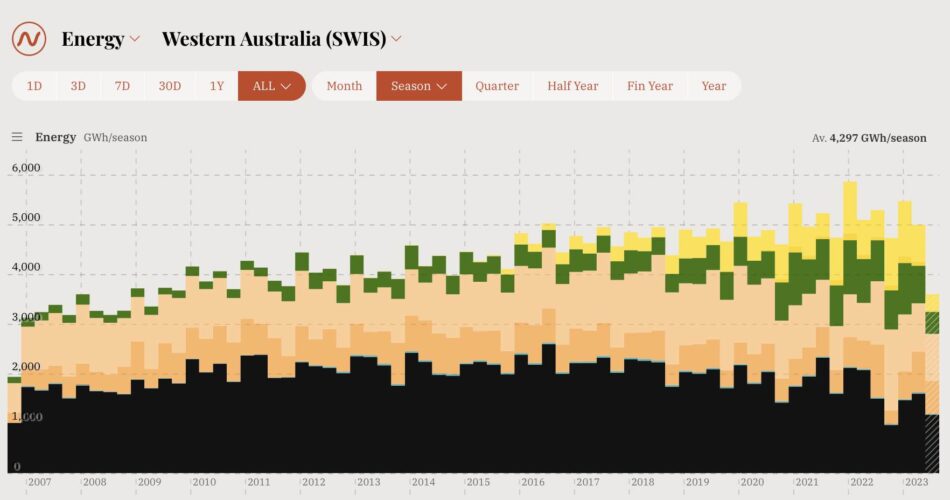

WA has traditionally sourced around half of its grid power from coal generation, mostly around the town of Collie. Most of the rest came from gas.

But the coal generation, apart from being dirty, is now also expensive, and it’s getting hard to find enough supply. The state even had to ship in coal last summer from the eastern states, at great cost and embarrassment.

One by one coal units have been closed, and as renewables have grown – particularly rooftop solar – the state energy mix is now roughly one third coal, one third gas, and one third wind and solar.

The state government last year made the decision to close the last of the state owned generators – nearly a gigawatt of capacity in a grid with a peak of more than 4GW – by the end of the decade.

Coal exits

The remaining privately owned coal plant at Bluewaters is facing financial problems and will likely close by around that time too, and possibly as early as 2025, according to AEMO. And it is the potential supply crunch in the next couple of years – due to be rebooting of demand forecasts – that is causing frowns.

A big part of the solution is the dramatic push to battery storage. Until a few weeks ago, there was not a single big battery in the state’s main grid, the role of “firming” had been left to the gas industry. All of a sudden, there are battery projects everywhere.

Synergy has just completed its first 100MW/200MWh battery at Kwinana and is already building a second stage four times that size – 200MW and 800MWh.

AEMO has been busy conducting tenders and signing contracts for a unique role of squashing the solar duck – using battery storage to suck up excess solar in the middle of the day and storing it for the evening peak.

Neoen has secured one contract and is building its first four hour battery, a 219MW/877MWh battery at Collie, which could grow into a 1GW battery with fours hours storage.

Synergy has another two battery plans at similar scale at Collie and nearby and this week Alinta announced it too had landed a contract with AEMO and has started building its own 100MW/200MWh battery at Wagerup, next to the alumina refinery.

More big batteries

Another 1GW of battery capacity – with between two and four hours storage – could be contracted in coming months.

But to ensure that there is enough capacity to deal with the first anticipated supply crunch in the summer of 2025, the state government has decided to keep one of the 200MW coal units at Muja open, or at least in reserve, for another six months.

State energy minister Bill Johnston says the six month extension is simply a matter of insurance. The coal plant can be fired up with three days notice if needed, and it will have no impact to the state tovernment’s phased transition to cleaner, reliable and affordable energy.

“Putting Unit 6 at Muja in reserve outage mode will allow us to call on the unit, if needed, during periods of high demand,” he said. “Western Australia has the most remote stand-alone energy system in the world and the supply of reliable electricity to residents is the highest priority.”

It will be fascinating to see what the NSW state government makes of this as it assesses the recommendations of the O’Reilly report into the health of its grid, and the status of the planned transition of the country’s biggest coal generation state to renewables, possibly within a decade.

The main focus is on the fate of the country’s biggest coal fired power station at Eraring, a 2.8GW monolith that owners Origin Energy want to close as early as August, 2025.

A government divided

It’s thought that the state government is divided over this, with premier Minns – who proposed a buyout in the state election campaign last year – not wanting to rock the boat on supplies and prices.

Others, such as state energy minister Penny Sharpe, appear keen to get on with the green energy transition – knowing the cost of delays, the potential impact on new green energy investment, price of keeping some of the Eraring units on for longer, and the threat to clean energy opportunities in the state.

NSW and W.A. share one thing in common when assessing their coal closure timetables – both are Labor governments facing elections soon after the planned coal closures.

In W.A. the planned closure of Muja 6 has been pushed back from October, 2024, to after the scheduled state election in March, 2025.

There is speculation that NSW will want to push the closure of at least some units at Eraring beyond August 2025 to after the next state election in early 2027. And there is also speculation that the contents of the O’Reilly report will give them the ammunition to push for that.

The difference between the two, of course, is that WA owns most of its coal fired power stations, so it can do as it pleases. NSW does not own any of them, although it clearly wishes it did.

Public versus private

If that was the case, then you could lock in a delay to the Eraring closure. In private hands, and with the soaring cost of coal, an extension will be costly, and Origin went out of its way to point that out in its results presentation this week.

NSW is also accelerating the roll out of battery storage, trebling the size of the tender for short-duration “firming” capacity to more than 930MW. The purpose is to provide additional back-up at times of peak demand, particularly in the summer heat when the ageing fossil fuel generators come under most pressure.

What both states also need is a lot of new wind and solar capacity. Storage is useful for transferring the output of wind and solar from times of low demand to times of peak demand, but both states need significant increases in bulk renewables to provide the majority of electricity demand.

To do that, both states need a lot of new transmission. NSW is well down that road through the creation of at least five renewable energy zones, although some of these proposals are running into opposition flamed by the Nationals keen to protect the business interests of their fossil fuel benefactors.

WA is also developing its own transmission plan, sorely needed given the limits and difficulties for new wind and solar projects on the existing infrastructure.

Big renewable hubs

And it is interesting to see how the big mining companies are looking to connect their privately owned grids in the north-west to achieve the same outcome in the rest of the state: Big renewable energy hubs that can power existing and new industries.

Despite the bulk of generation, and the main transmission and energy retailing groups being state-owned in W.A, Johnston is leaning heavily on private interests to lead the investment in new wind and solar. And he says that was the purpose of the AEMO report and the recent demand forecasts.

“What it says is that if there is no new investment, then there would be a shortfall,” Johnston said of the supply and demand forecasts.

“But that’s in the future. That’s not today. I have absolutely no doubt that there’ll be a whole range of new wind and solar projects coming forward in response to this.”

In NSW, there is no shortage of project proposals – more than 100GW according to the various market soundings conducted by the NSW government in recent years, in preparation for the renewable zones.

To close coal or not

But the reality of actual deployment is less clear. A basket of issues – connections, market signals, transmission and social licence – are piling up in front of them. Some coal plant owners like Vales Point are already extending their closure dates in anticipation of filling in any supply gaps.

Unless NSW manages the process properly – and that includes the Eraring closure timing – then the state might end up having a lot of coal capacity hanging around for longer than anyone can afford.

An unmanaged delay to Eraring will likely have a cascading effect, with Vales Point hanging around till 2032, AGL and EnergyAustralia stubbornly holding on until 2035 for Bayswater and Mt Piper.

And the risk of that will to rob the states of the opportunity of making the green energy transition that most big businesses should be craving, and to leave customers exposed to dirty, expensive and unreliable fossil fuel power.