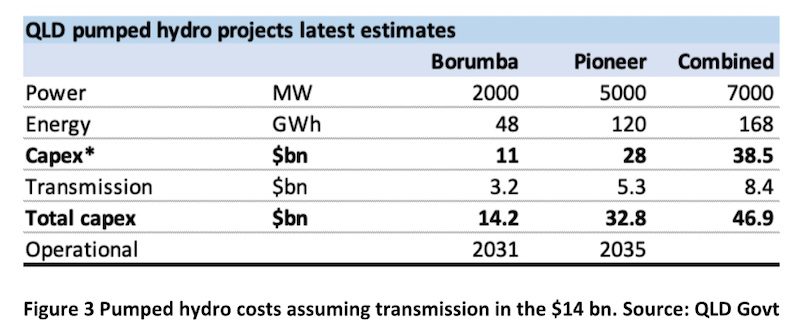

The Queensland government has announced that the cost of the 2GW, 24 hour (48GWh) Borumba pumped hydro station, located 80km west of Noosa, will be around $14 billion.

That is still an early cost estimate given that work hasn’t really started. So it’s still reasonable to assume that no matter how conservative the state government thinks it’s been in estimating the cost, it could end up higher.

Nevertheless the cost is high enough. It’s double what AEMO estimated and if financed by the private sector would require higher electricity prices than those estimated when the Queensland Energy and Jobs plan was released.

The Queensland government has been quite open about the plan and the costs and this is to be applauded.

At the same time it would help us observers to understand (1) why so much focus is on 24 hour pumped hydro when this didn’t seem necessary under the Integrated System Plan, and (2) why costs are 100% higher than what AEMO was estimating.

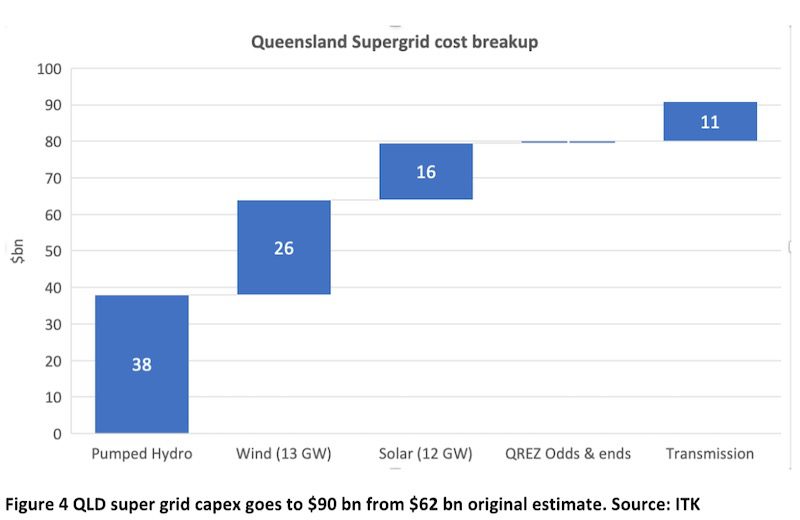

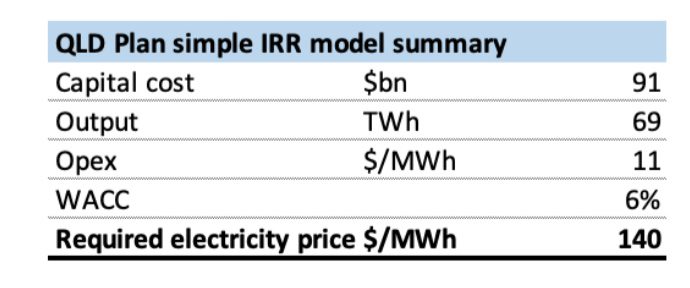

I estimate the Queensland plan now costs say $90 billion compared to the initial $62 billion estimate, and will require electricity prices maybe as much as $140/MWh to earn a commercial return.

Maybe I’m an optimist but I think the lights could be kept on for a lower cost if there was less focus on such expensive firming and a more balanced approach. I guess this is one of the outcomes of a government-owned approach.

Here is an extract from AEMO’s gencost file used in the 2022 ISP.

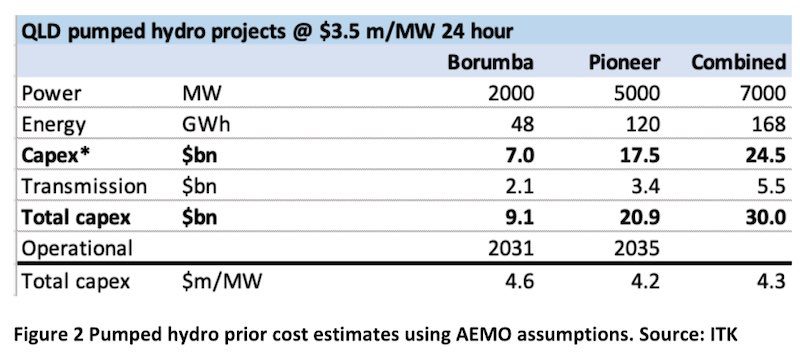

AEMO used an estimate of $3,500 /KWh for a 24 hour pumped hydro plant.

AEMO also used an estimate of $2,500 /KWh for an 8 hour plant. A pumped hydro plant typically divides in two components the cost of the power equipment and the cost of the dams and tunnels that store the water at each end and circulate it.

Using a tiny bit of high school algebra, we can work out that AEMO was using around $2m/MW for the power and about $62,500 for a MWh of storage (footnote).

If we applied those numbers to Borumba, and the larger mooted Pioneer/Burdekin proposal inland from Townsville, the result would be:

I’ve included transmission at the costs mentioned in the Energy and Jobs plan blue print of September 2022.

It’s unclear whether the $14 billion now quoted includes the associated transmission spending or not, but what is for sure is that transmission cost will be higher than shown in the original plan. If I take the most negative view and say that the Borumba cost is now $14 billion plus transmission then the cost has doubled.

The combined cost of Borumba and Pioneer would then be $48 billion plus transmission, but I ignore transmission and make the combined Borumba and Pioneer $38 billion, albeit still in the spreadsheet.

If I generously assume the $14 billion includes the transmission then the cost has risen in 12 months about 55%. Increasing the transmission cost by 55% from its Sep 22 estimate of $7 billion, I now estimate the Queensland plan has about $90 billion of capex.

The total cost in the figure below, and used in the NPV model is the 55% increase rather than $7m/MW if I excluded transmission in the Borumba announcement.

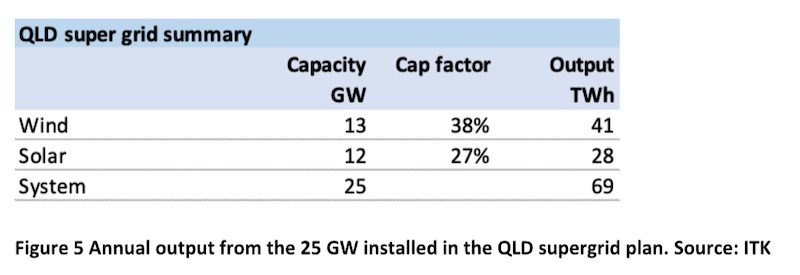

That excludes the behind-the-meter contribution. In this system which has 13GW of wind and 12GW of utility solar I estimate the output at something like 69TWh per year. The 13GW of wind and 12GW of solar are also taken from the Supergrid document.

It’s important to note that the 69TWh of output is a lot higher than current Queensland operational annual supply in past 12 months of 53TWh. So growth is built in.

Plugging these numbers into a very simple model produces a required electricity price of something like $140/MWh.

Figure 6 QLD plan electricity price implications. Source: ITK

Or course the government doesn’t have to earn a commercial IRR and so I am not suggesting that the electricity price will be $140/MWh. It’s just the number required to get the IRR target I’ve pulled out of the air.

I don’t show the IRR model here, but it’s no different to what I would use for a wind or solar farm or a brick kiln or an LNG plant.

Models and actual outcomes can always be manipulated by financing and tax structures and various other things. All my model does is provide a rough estimate of where the compass points. For instance this model does include some tax. It also starts in 2035 when the system is assumed to be built.

Discussion: Why 24 hour pumped hydro?

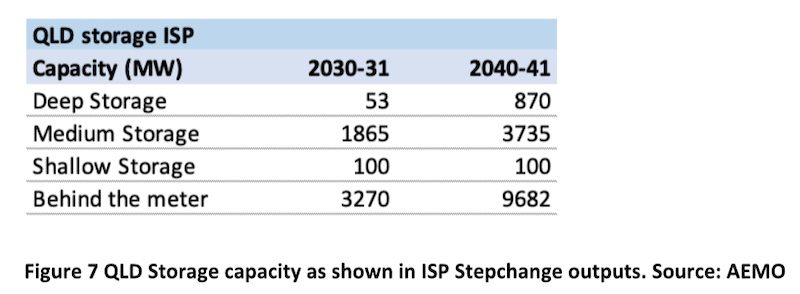

The Queensland Supergrid has broadly similar wind and solar outcomes to the 2022 ISP but its emphasis on large-scale pumped hydro is very different. Also, in the ISP coal was ramped down more slowly, only exiting around 2040 as compared to 2035 in the Supergrid timetable.

So if I look at the storage capacity that the ISP modelling process produced for 2040 it has less than 1GW of Deep Storage (greater than, say, 10 hours) and even by 2050 in the ISP there is less than 2GW.

By contrast, the Queensland government has gone with a plan that focuses virtually entirely on deep storage. In my opinion this raises costs to consumers and on the positive side there is probably a lower risk of edge case outcomes (prolonged NEM wide wind and solar droughts).

So for a commercial operator building 24 hour storage would likely be completely unviable. We can see in the battery market that investors prefer two-hour batteries to four hours. That’s because even though four-hour batteries have lower unit costs compared to two hours, the revenue opportunity drops off even faster.

That is, the revenue you can on average earn from the fourth hour of storage is a lot less than from the first hour.

For 24 hour storage there is zero opportunity to earn revenue on an average day from the last 14 hours of storage (a pumped hydro plant that fully recharges every day can generate for 10 hours at the most).

So the operator is restricted to either getting capacity (that is insurance) payments or waiting for wind and solar droughts when all the shorter duration storage is exhausted.

In the next part of this note, I firstly compare the pumped hydro storage to some other storage costs and secondly look at the opportunity to earn returns outside of the normal daily re-balance – that is, pumping when solar operates and discharging when it does not.

Pumped hydro vs batteries

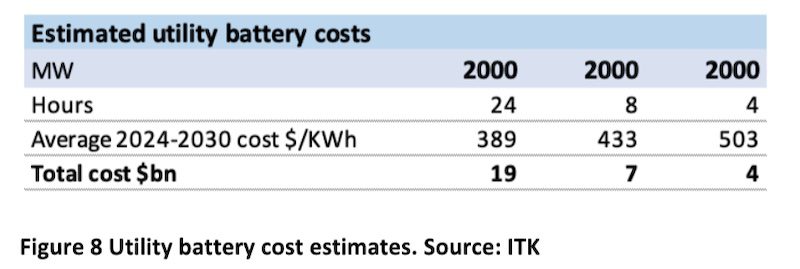

First up batteries. The starting point for the battery numbers is what I estimate as $650/kwh for a two hour battery installed in 2022. I assume that there the longer the duration the lower the unit cost (you only need 1 inverter no matter how many hours and there are other savings on enclosures, fire protection, cooling, maintenance, and so on).

Secondly I assume that costs do come down steadily based on standard learning rates. Of course, costs went up 30-40% in 2022, and yes I expect lithium and other raw materials to remain expensive. Nevertheless I still expect overall battery costs to come down for a given duration. So using my perhaps rose coloured glasses I get:

On this basis you could get 2GW of batteries with 24 hour storage for just about the same price as Borumba plus transmission. You could plan for 24 hours but install for 8 hours and save billions and billions. Also distributing the batteries round the grid might well open up more transmission capacity from the existing network.

You would also have infinitely less social license issues and I can imagine other benefits. You would also get all the system control services where batteries are clearly the superior technology

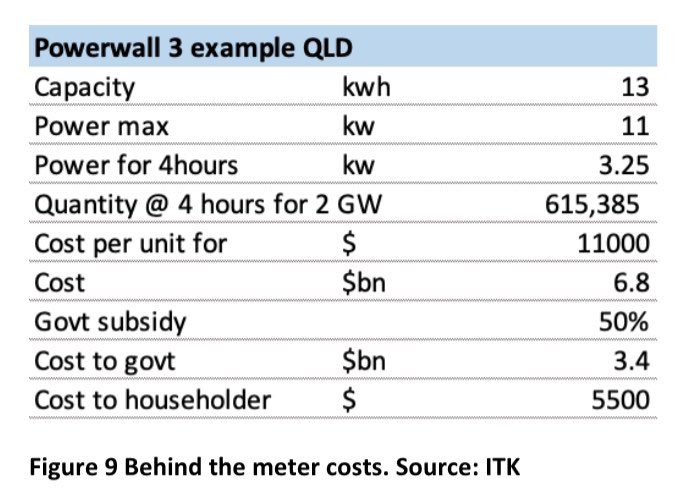

Then there are household batteries. To avoid an argument let’s assume that these are all managed under a VPP. I personally don’t think it’s necessary, but let’s assume it and assume that the software for the VPP costs, say, $1 billion.

Plus the VPP cost. Are there 615,000 Queensland households that would pay $5,500 for a Powerwall or equivalent? Could you get the cost down to $11k per unit for a bulk order of that size? I think the answer might be yes. Of course you still only have four hour storage or a 615MW of 12 hour storage but…..

Let’s not talk about gas, but clearly it’s more competitive when compared against pumped hydro that costs $7 million a MW.

Borumba usage just looking at the duration requirements

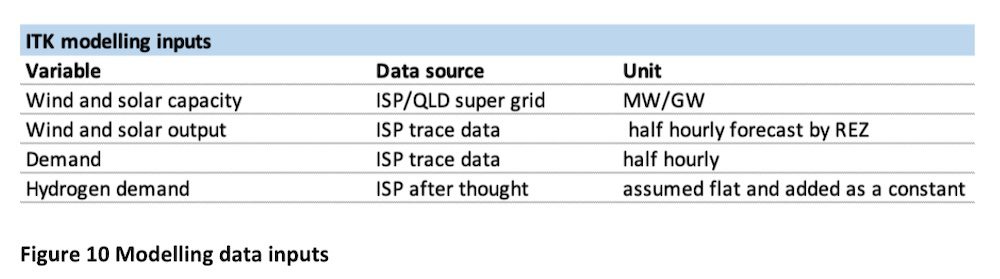

For various purposes I’ve spent much of the past 12 months analysing Queensland electricity. The data used in my analysis is sourced:

Rooftop solar is also sourced from the ISP.

Using this data you can estimate for each half-hour whether there will be a surplus of deficit of energy produced by wind and solar compared to demand.

For instance, the following figure shows the minimum, average and maximum amount of firming needed in Queensland as the amount of wind and solar increases.

The figure shows that by the time coal is gone in 2040 the average amount of firming required is close to zero but the maximum amount remains a relatively constant 10GW because, no matter how much wind and solar capacity, there will still be nights with little or no wind.

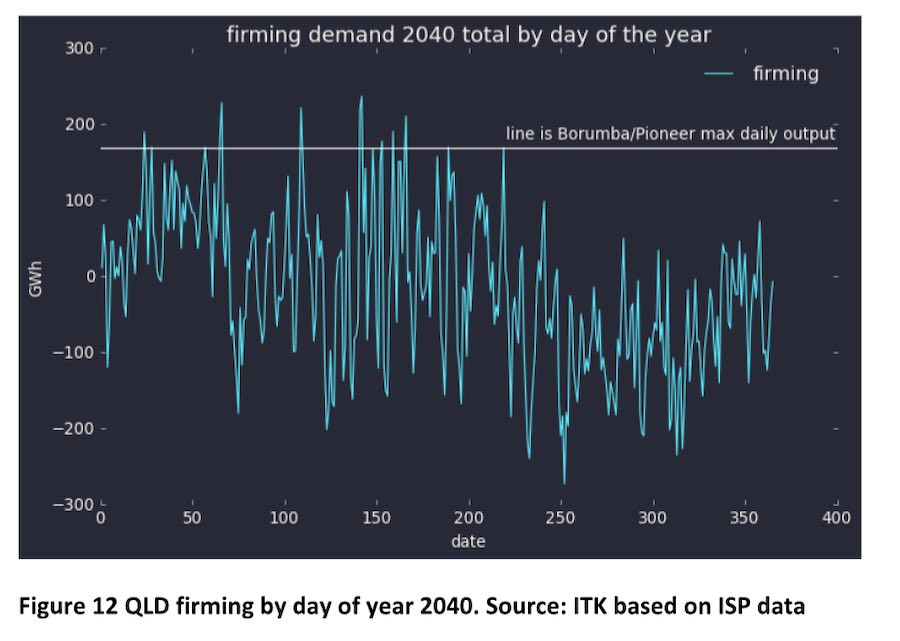

Or we can look at the firming requirement in GWh by day in, say, 2040.

Really, 2040 is a tough test because in the ISP numbers there is still only just enough VRE to cover demand over the year. Secondly the graph only considers Queensland in isolation.

We know that NSW and Queensland wind complement each other and it’s likely that NSW could assist Queensland when the latter has a low wind day.

And then of course there will be multiple forms of other firming supply in Queensland from household to utility batteries to gas, to existing pumped hydro and even conventional hydro.

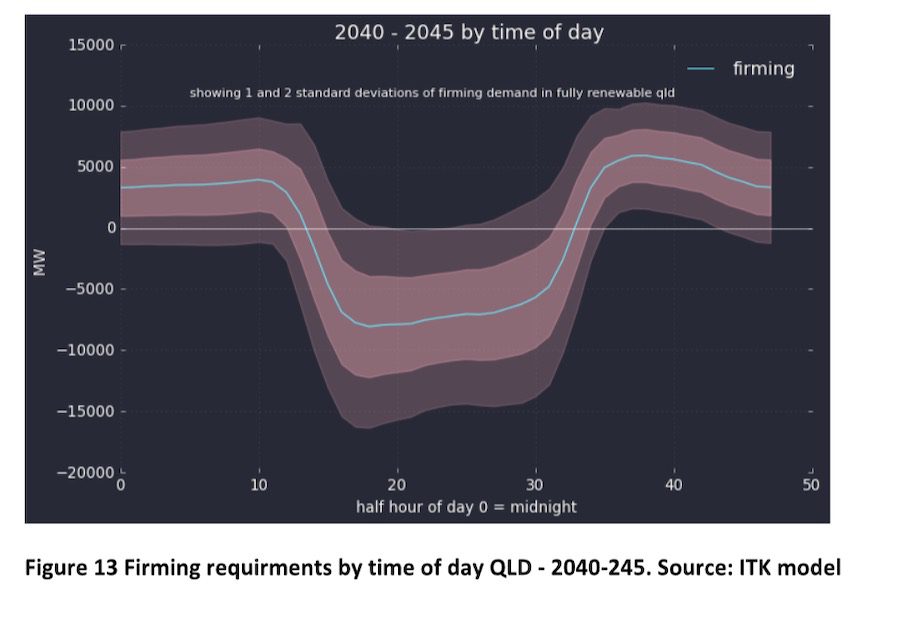

In considering how much of the job four hour batteries could do, we can look at the firming demand in power (MW) by time of day over the 2040-2045 period.

I only show two standard deviations and that covers, say, 95% of the half hours. About one-third of the time close to 10GW of firming will be needed for a couple of hours in the evening.