The International Energy Agency is expecting another record-breaking year for global renewable energy in 2022, as Russia’s invasion of Ukraine makes a strong case for locally generated power. But the outlook to 2023 is not as robust.

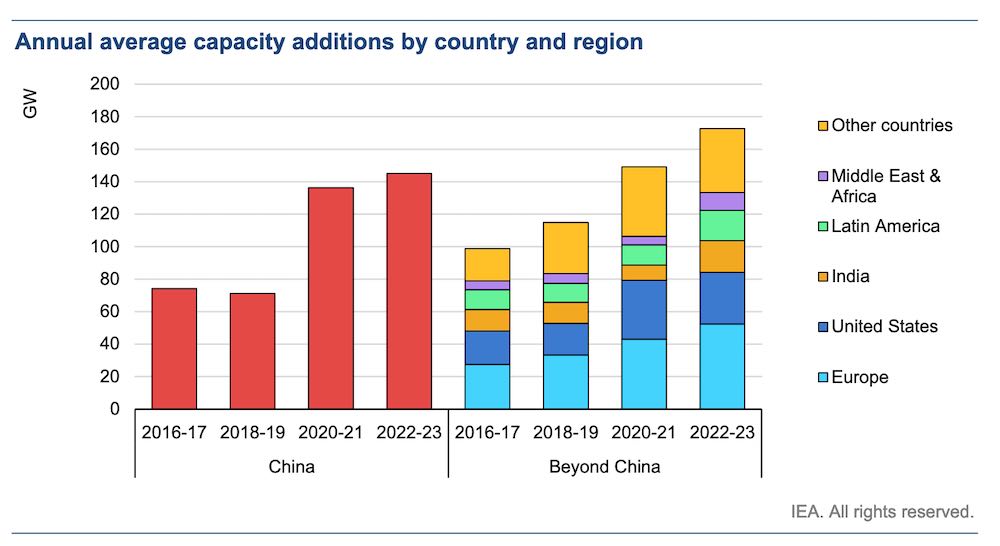

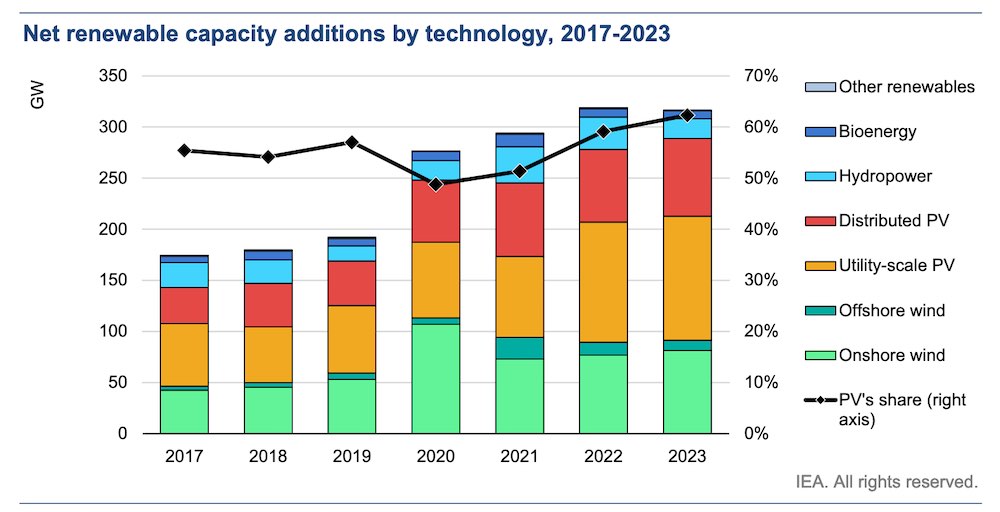

The IEA’s 2022-23 Renewable Energy Market Update, published on Thursday, says global renewable energy capacity is expected to grow by another 8% over the course of 2022, adding a total of almost 320GW for the year, compared to the record 295GW added in 2021.

The report says that for the year so far, renewable energy growth has been much faster than initially expected, particularly with Covid-19 still making its presence known and with the onset of war between Russia and Ukraine.

Indeed, the now months-long eastern European conflict and the impact it has had on fossil fuel supplies and prices has served to underscore the key role renewables can play in global energy security and affordability.

“Notably, wind and solar PV have the potential to reduce the European Union’s power sector dependence on Russian Federation natural gas by 2023,” the report says.

“The high fossil fuel price environment has improved the cost competitiveness of renewable electricity technologies against coal and natural gas-fuelled power plants.

“Meanwhile, residential and commercial solar PV applications are helping consumers reduce their electricity bills.”

Ultimately, however, the IEA says that the outlook for renewable markets in 2023 and beyond will depend on what happens in the coming six months – not with Covid or the war, but at the hands of policy makers.

If policy settings stay as they are now, the IEA says it expects renewable growth to lose momentum and plateau in 2023, dragged down by a possible 40% decline in hydropower expansion and little growth in wind markets.

Conditions are forecast to be particularly tough for onshore wind, with the report citing policy uncertainties, as well as long and complex permitting regulations, as stunting growth for the sector.

New additions of offshore wind are on track to drop by 40% globally in 2022, but this still puts the market on course to wind up 80% up on 2020 numbers.

“Despite their potential, an acceleration in new renewables capacity is highly dependent upon a stable policy environment providing long-term revenue certainty and faster permitting,” it says.

“Ultimately, the forecast of renewable markets for 2023 and beyond will depend on whether new and stronger policies will be introduced and implemented in the next six months.”

This could be an especially apt prediction for the Australian market, which is headed to the polls in less than two weeks to chose who will lead the country in what will be a crucial term for climate action and renewable growth.

Whoever takes the reins will have to step up and guide Australia’s renewable energy industry through a number of challenging global headwinds.

“Geopolitical and macroeconomic challenges increase uncertainties over renewable electricity forecasts beyond 2023,” the IEA says.

“Higher wind and solar PV investment costs due to elevated commodity prices in the wake of Russia’s invasion and permitting delays resulted in the lowest first-quarter auction volumes globally in 2022 since 2016.

“In addition, volatility in electricity markets due to sharply higher gas prices has complicated contract negotiations for corporate power purchase agreements (PPA), especially in the European Union, while rising interest rates are compounding challenges for renewable developers.”

The strong hope from the IEA is that amidst the ongoing geo-political difficulties and looming market uncertainties, the “sharpened new focus on energy security” will trigger “unprecedented policy momentum towards accelerating energy efficiency and renewables.”