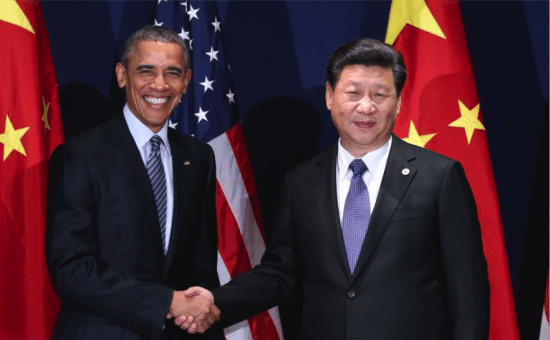

It was vaguely wonderful watching Presidents Obama and Xi cement their bids for a place in history, via climate change, by announcing American and Chinese ratification of the Paris Agreement on September 3. These two nations, so far apart on so many issues, have erected glass walls around the shared climate threat and worked hard together for four years to fight it.

They do so now buoyed by the strengthening momentum of climate-survival technologies, and aware of the increasing catalogue of problems faced by the energy incumbency notwithstanding climate considerations.

Meanwhile, the increasingly alarming warnings they hear about the unfolding pace of global overheating from their respective scientific establishments is undoubtedly a major motivator. The great global race against time has very much begun now, and they are the undisputed leaders on the first lap.

All the above was manifestly clear, for those with time to watch the flow of the Carbon War, during August.

The figures for US electricity generation from renewables came out: 16.9% of the national electricity mix, up from 13.7% in 2015. A new front opened, as the first offshore wind turbine was installed. There will be hosts more. Sixteen cities have now targeted 100% of their power from renewables, and four have achieved it already: Aspen, Colorado; Burlington, Vermont; Columbia, Maryland; Greensburg, Kansas. In the cloudy UK, renewables set a new quarterly generation record of 25.1% of the national mix on the back of solar growth. The new government approved the world’s largest offshore windfarm, the $7.8bn 1.8 gigawatt Hornsea 2 project. It will be installed by a former oil and gas company, now a mostly-renewables company, Dong Energy.

The pace of development in storage, that vital partner for renewables, continued to amaze. Notable this month was an exhuberant survey of growth and technical advances in both batteries and renewables by the international business editor at the Telegraph, the UK Conservative government’s newspaper of choice.

“Holy Grail of energy policy in sight as battery technology smashes the old order”, read the headline. And the bottom line: “This country can achieve total self-sufficiency in power at viable cost from our own sun, wind, and waters within a generation. Once we shift to electric vehicles as well, we will no longer need to import much oil either. Rejoice.”

Within a generation. In the Telegraph!

Government ministers currently seemingly obsessed with pushing nuclear and shale gas and oil at the clear expense of renewables and energy efficiency will have read this.

On the point about EVs and oil displacement, Nissan announced that charging points will outnumber petrol stations in the UK by 2020, at current rates of growth and decline, respectively. Meanwhile, the Dutch are so enthusiastic about EV prospects that the government seems to be on the brink of completely banning new petrol-powered cars by 2025. The deciding vote will be held on October 13th.

Imagine being an oil and gas industry strategist surveying news like this. There has been much more such in 2016. My monthly blog digests are highlights only.

The rapid emergence of driverless cars also plays into the energy transition. The auto makers envisage autonomous vehicles as being EVs, for the most part. This month Uber and Volvo announced that they will start the first autonomous taxi fleet within weeks, in Pittsburgh, and develop self-driving cars themselves.

This would put them ahead of both Ford and Google in the race. Ford plans a mass-market self-driving car by 2021 targeting the driverless taxi market. CEO Mark Fields had an interesting thought to offer on this: “Vehicle autonomy could have as big an impact on society as the Ford mass assembly line had over 100 years ago.”

Everywhere in the theatre of the Carbon War we see evidence of incumbency players rethinking. This includes grid operators. In August, National Grid slashed its forecasts for big new UK power plants. In 2012, it had thought 33 gigawatts would be needed by 2021. Now it says 12.

Its new Executive Director, Nicola Shaw, waxed lyrical about the scope for a smart energy revolution to help to avoid UK blackouts. Energy-hungry devices in households and businesses, hooked up on the coming “internet of things”, could smooth 30-50% of grid demand at peak times, she said.

Among the utilities U-turning away from incumbency business models is RWE, and this month the German giant joined the list of peers acquiring renewables companies, buying one of Europe’s biggest downstream solar companies, Belectric Solar and Battery. Those utilities endeavouring to defend the status quo and resist change are finding life increasingly difficult. In Hawaii, for example, solar advocates report increasing ease of grid disconnection in fighting utility pushback.

Investors continue to awaken to the smell of energy-transition coffee, albeit not fast enough. The evidence might be clearer to them, were they not so steeped in short-termism. A new index, the“Clean 200”, contains giants on the frontiers of the energy transion. Its top 20 performers include Toyota (1st), Siemens (2nd), Vestas (7th), Dong (11th), and First Solar (19th). It has grown in value by 22% in the last 10 years. An index of fossil-fuel companies, the “Underground 200”, has grown only 8% in that time.

Lansdowne Partners, one of the largest hedge funds in London, became one of the very few hedge funds and private equity funds to set up a dedicated fund for renewables. Many institutions will have to follow. Barclays calculates that £200bn+ will be needed for UK energy investment by 2030, and concludes that nearly all of it should go to clean disruptive technologies. Governments could do a lot to help here, and the UK’s clearly isn’t.

Meanwhile, on the other side of the energy-investment coin, those quitting fossil fuels were joined by a £500 million UK fund, Liontrust Macro Equity Income fund. Stephen Bailey, co-manager, described his motivations graphically to the Telegraph, in a reference to the Saudi Arabia’s “Post Oil Era” investment strategy: “Even the Saudis appear to know the fossil fuels game is up.”

The big oil companies evidently disagree. They continue to “binge on debt”, as the Wall Street Journal put it on 24th August, hoping against hope that the oil price will rise to just the right level. Their combined debt is now $184 billion, double their 2014 level. In 2015, they spent more than 100% of their profits on dividends. In the US shale belt, bottom feeding private equity has begun to move in on debt-distressed oil assets. Bankruptcies among oil and gas companies have risen to 90 and counting.

And still, as the Saudis and Russians pump full tilt, the oil price remains too low for most companies to do anything but keep haemorrhaging cash. Saudi oil production rose to a record level of 10.67 million barrels per day in July, a distressingly large amount of it being required to to satisfy air conditioning loads in power plants. This is surely a candidate for the most dysfunctional use of fossil fuels in the world today.

Meanwhile, investment in exploration has plummeted, unsurprisingly, since the oil price began its fall in mid 2014. And so to the inevitable: oil discoveries hit a 70 year low this month. Oil demand in 2016 so far has been 94.8 million barrels a day on average. That is 34.6 billion barrels per year. Oil discovered last year: 2.7 billion barrels.

The industry is not even replacing 1 in 10 of the barrels that the world burns.

How long can that go on for, even if demand is falling? Bloomberg was one of the few to warn of a supply shortfall ahead. At which point, the oil price would likely soar to levels that make oil essentially unaffordable for many – and hence renewables, storage and EVs even more attractive.

The oil industry loses on the low side and the high side both.

As for their hopes for gas from shale, the problem with leakage was in the news once again. In a study of a US methane hot spot, researchers pinpointed the sources of 250 leaks using airborne sensors. 600,000 metric tons of gas was escaping in all: 6 times the loss from the Aliso Canyon disaster every year. The largest emissions measured in one flight were from a gas processing plant. More than half the emissions came from 10% of the leaks.

It looks increasingly certain that the gas industry has a systemic problem with leakage, right across its infrastructure value chain.

Another door shut for the industry as a result of public protest. Victoria became the first Australian state to permanently ban fracking and coal seam gas.

As for the UK’s government’s increasingly incomprehensible ambitions for shale, in the face of all this, officials told the press that all households near fracking sites are set to get money paid straight into bank accounts.

Bad as the distress was in the oil industry in August, the nuclear industry suffered worse. The dire economics of the Hinkley Point C plant, on which so many nuclear hopes hinge, has reached the point where even the conservative British news organ The Economist, long a champion of nuclear power, withdrew support. “Hinkley Pointless”, raged its headline. “Britain should cancel its nuclear white elephant and spend the billions on making renewables work.” The article majored on National Audit Office figures showing both solar and onshore wind cheaper than nuclear and gas. As for offshore wind, Bloomberg New Energy Finance calculated that it could replace Hinkley nuclear at the same cost today.

It became clear in August that there had been a substantial reversal in opinion on nuclear versus renewables among UK business leaders. A huge majority of the Institute of Directors’ members were for new nuclear 12 months ago. Now only 9% “strongly agree” with going ahead. 75% strongly support solar and wind.

EDF continues to behave as though it is trying to dig its own grave. It emerged that CEO & Chairman Jean-Bernard Levy knew about the new British Prime Minister’s decision in July to defer a decision on Hinkley Point, but did not tell his board at the meeting where they voted narrowly to go ahead. Five EDF board members then sued to block the decision, arguing that Levy’s withholding of information rendered any outcome of the board meeting invalid.

How will all this affect the Chinese involvement in Hinkley C? As things stand, they are contributing a third of the £18 billion capital cost of the plant. They have taken a dim view of the UK dithering. But little noticed during August, a mass protest in China against a Sino-French nuclear waste plant – in Lianyungang, Jiangsu province – caused an about-turn by Beijing that must be a threat to the Chinese nuclear industry’s plans. The government cancelled the plant. This is the third nuclear project to attract significant public opposition in the past 10 years, and all have been called off. It looks as though Beijing tends to listen to its people on issues like this.

Which is interesting, because an opinion poll in August showed that the Chinese public overwhelmingly back their government’s renewables push: 92% profess themselves willing to pay more for green power. Equivalent polls in US and UK recently showed 50% and 48% respectively.

Encouraging as much of this is, it becomes ever clearer that the pace of the transition must pick up. July 2016 was Earth’s hottest month in recorded history, Nasa reported in August: the 10th hottest month in a row. Speaking of the NOAA-led annual State of The Climate Report 2015, climatologist Michael Mann said: “The impacts of climate change are no longer subtle. They are playing out before us, in real time.”

2015 was the warmest year ever. Total warming is now 1˚C since pre-industrial times. The oceans are now 70 mm above 1993 average, rising 3.3 mm every year. Arctic ice was at its lower ever maximum in February 2015. The Greenland ice sheet experienced melting over 50% of its surface.

Back to President’s Obama and Xi. Their ratification of the Paris Agreement means it is now probably set to become international law this year. 57 countries have now ratified or signalled intent so to do, entailing 57.88% of global emissions. The treaty comes into force after a minimum of 55 countries representing a minimum of 55% of emissions have ratified.

The rare dissidents are being encouraged back into the fold. After a meeting with John Kerry, the Philippine President is now likely to back the Paris Agreement.

A year on from his climate encyclical, Pope Francis reinforced his appeal to Christians to act. “It is up to citizens to insist that this (Paris Agreement in force) happen, and indeed to advocate for even more ambitious goals,” he said.

Amen to that.

Source: Jeremy Leggett. Reproduced with permission.